The traditional 60/40 investment strategy, which allocates 60% to stocks and 40% to bonds, has long served as a foundational approach for retirement saving, offering a safety net through diversification. However, BlackRock’s CEO, Larry Fink, is calling for a reevaluation of this investment paradigm.

In his 2025 Letter to Investors, Fink stated, “While generations of investors have successfully adhered to this approach, possessing a broad market mix instead of concentrating on specific securities, the dynamic nature of the global financial landscape suggests that the conventional 60/40 portfolio might fail to capture genuine diversification. The portfolio of the future may rather resemble a 50/30/20 allocation, consisting of stocks, bonds, and alternative investments like real estate, infrastructure, and private credit.”

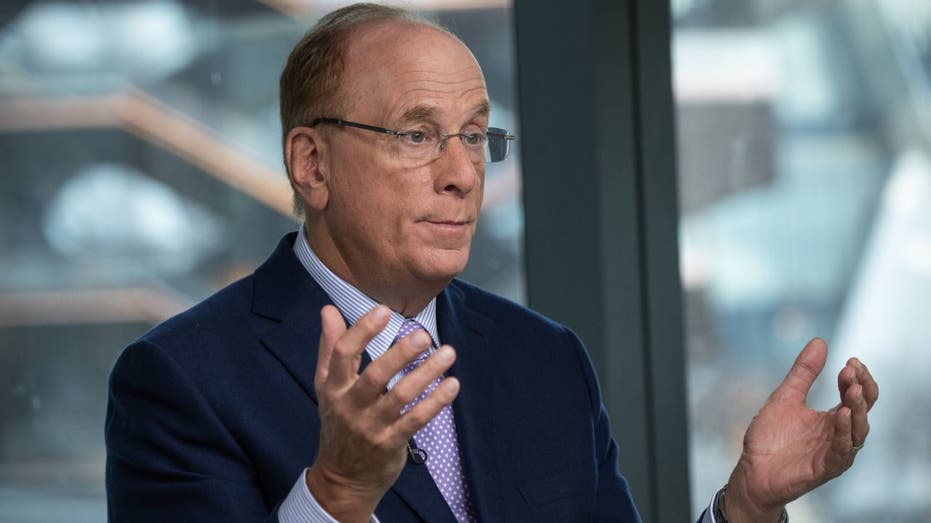

BLACKROCK CEO LARRY FINK’S ANNUAL LETTER TO INVESTORS

Regarding infrastructure investments, Fink emphasized their potential as a hedge against inflation, their capacity for revenue generation through user fees, and their relative stability compared to more volatile public markets. He noted that even a modest allocation of 10% to infrastructure could yield significant returns.

BlackRock has made headlines recently with its acquisition of ports in the Panama Canal for $23 billion. This investment underscores the opportunities for revenue through the charging of transit fees for shipping vessels.

BLACKROCK PAYS $23 BILLION FOR PANAMA CANAL PORTS

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 875.75 | +9.64 | +1.11% |

Despite BlackRock’s position as the world’s largest asset manager with over $11 trillion in assets, Fink’s proposed 50/30/20 strategy—or other configurations incorporating alternative assets—could also be advantageous for smaller retail investors.

“For individuals with a significant time horizon and assets that warrant an allocation to private markets, we believe this approach offers an exciting opportunity for diversification within their portfolios,” stated Katie Klingensmith, Chief Investment Strategist at Edelman Financial Engines, in remarks to Finance Newso Business.

MORTGAGE RATES SPIKE AMID MARKET VOLATILITY

As it stands, the S&P 500, the primary indicator of the U.S. stock market, has seen a 10% decline this year.

GET Finance Newso BUSINESS ON THE GO BY CLICKING HERE

In contrast, Morningstar’s US Core Bond Index has recorded an increase of approximately 2% this year, encompassing fixed-rate, investment-grade U.S. dollar-denominated securities with maturities exceeding one year, according to the respective firm.