The opening quarter of 2025 has significantly reshaped the landscape of the cryptocurrency sector, standing as a pivotal moment despite the downward price trends observed during the period.

A recent report from Bitwise Investment, titled “Crypto Market Review #Q1.25,” characterizes this period as “The Best Worst Quarter in Crypto’s History.” This statement reflects the underlying advancements and trends that have emerged alongside falling prices.

Although Ethereum has faced a 45% decline this quarter, its foundational infrastructure is integral to a burgeoning trend within the financial sphere: the rise of stablecoins.

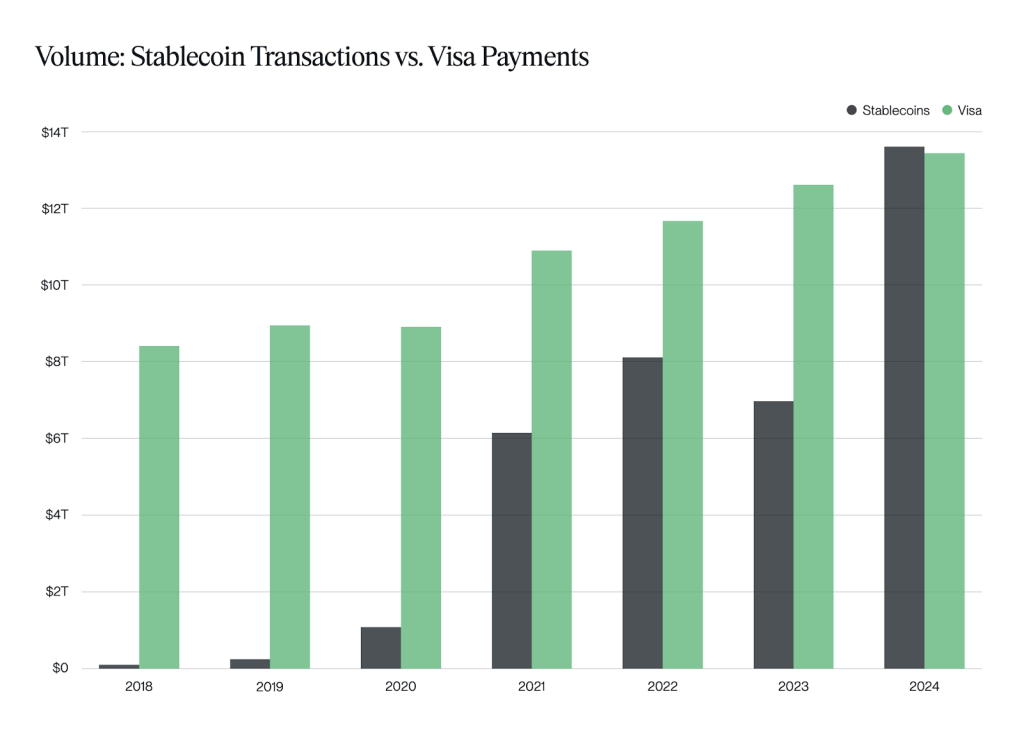

In the first quarter alone, stablecoins have facilitated an astounding $27.6 trillion in on-chain settlements, surpassing Visa’s entire 2023 settlement volume, which stood at $12 trillion, more than doubling it.

Source: Bitwise

With a 13.5% quarter-over-quarter increase, the assets under management for stablecoins have reached $218 billion, showcasing their solid standing in the market.

Ethereum stands at the forefront of this transformation. Despite median transaction fees lingering around $0.66, the network’s capacity has been significantly enhanced by cost-effective and scalable rollups like Base, Arbitrum, and Optimism, where fees are often only a few cents.

Source: Bitwise

Looking ahead, anticipated stablecoin legislation by July 2025, coupled with the support of traditional financial institutions, suggests that a new era—termed “Stablecoin Summer”—may be on the horizon.

From Crisis to Catalyst: Regulation, Institutional Moves, and a National Crypto Pivot

While price movements may not have told the full story, the developments seen in Q1 2025 have indicated a fundamental shift in the crypto narrative, driven by regulatory and institutional influences.

The Bitwise report reveals that the quarter began with the introduction of the first U.S. president with a clear pro-crypto stance, who promptly established digital assets as a national priority through an executive order.

This initiative initiated a series of significant events, including the formation of a Strategic Bitcoin Reserve, the nullification of restrictive guidance such as SAB 121, and the cessation of major lawsuits by the SEC against cryptocurrency firms.

Additionally, banks were authorized to hold digital assets, effectively dismantling the regulatory overreach previously symbolized by Operation Choke Point 2.0.

@coinbase has uncovered @FDICgov documents revealing efforts to halt crypto banking activities, exposing a systematic push against the industry.#Coinbase #FDIChttps://t.co/Wr6DByXffC

@coinbase has uncovered @FDICgov documents revealing efforts to halt crypto banking activities, exposing a systematic push against the industry.#Coinbase #FDIChttps://t.co/Wr6DByXffC

— Finance Newso.com (@Finance Newso) January 3, 2025

These enablement measures have created a favorable environment for renewed investment in the crypto space.

A noteworthy development was the Financial Accounting Standards Board’s revision of how digital assets are managed in accounting, providing clearer guidance for companies holding Bitcoin and other cryptocurrencies.

Following a trend set by MicroStrategy, GameStop secured $1.5 billion funding to invest in Bitcoin, while Abu Dhabi’s sovereign wealth fund allocated $437 million to BTC, illustrating an upsurge in institutional interest globally.

The fundamentals surrounding stablecoins also displayed notable strength, as expectations of forthcoming U.S. regulatory clarity prompted stronger institutional alignment.

Similarly, Ethereum’s fundamentals remained robust, with transaction volumes and layer-2 growth witnessing significant increases as protocols like Base, Arbitrum, and Optimism attracted numerous new users and activities.

Source: Bitwise

Developer engagement remains highest within the Ethereum ecosystem. Although Solana briefly outperformed Ethereum in revenue generation, Ethereum retains dominance in DeFi and overall infrastructure.

Source: Bitwise

The data indicate that while investors in the crypto market faced substantial losses during the first quarter, the groundwork is being laid for a potential rebound in the latter half of 2025.

The convergence of regulatory clarity, national consensus, and the integration of stablecoins might prove more influential in determining the industry’s future trajectory than any fleeting price surges.

Ethereum’s Quiet Triumph: The Infrastructure Behind Trillions

Often criticized for its transaction costs and sluggish speeds, Ethereum has evolved into the essential infrastructure for a new global financial system.

Not only does it serve as the main settlement platform for stablecoins, but its layer-2 ecosystems are accommodating an increasing volume of global cryptocurrency transactions with remarkable speed and minimal fees.

Bitwise’s findings indicate that Ethereum maintains the highest average developer engagement in the industry.

Source: Bitwise

The blockchain also supports several high-revenue DeFi protocols, such as Uniswap ($1.03 billion) and Lido ($972.1 million), which either directly integrate with Ethereum or utilize its scaling solutions.

Source: Bitwise

Transaction volumes are rising on Base, Arbitrum, and Optimism, while Ethereum’s Layer 1 continues to serve as a secure foundation for decentralized computation.

With the acceptance of stablecoins by the mainstream public and favorable shifts in global regulation, Ethereum’s role as a foundational element in the industry is likely to grow.

Currently, it represents the largest portion of the $2.5 trillion cryptocurrency market, with its market capitalization at $217.78 billion.

Source: Bitwise

While it may be easy to equate success solely with rising token prices, Bitwise’s findings highlight that the fundamental aspects of cryptocurrency are strengthening, regardless of market fluctuations.

As the competition for dominance in global payment systems intensifies, Visa has, for now, fallen behind with the explosive growth of stablecoins, while it prepares to launch its own stablecoin initiative later this year.

The post Visa Dethroned: Stablecoins Settle $27.6 Trillion — Ethereum’s Big Win? appeared first on Finance Newso.