On Thursday, Apple Inc. announced fiscal results that slightly surpassed Wall Street forecasts, driven by a surge in iPhone purchases as consumers reacted to potential import taxes on the popular device proposed by former President Donald Trump.

The technology giant, based in Cupertino, California, reported sales of $95.36 billion and earnings of $1.65 per share for the fiscal second quarter ending March 29. These figures eclipsed analyst projections of $94.68 billion in sales and $1.63 per share in profits, according to data from LSEG. iPhone revenues totaled $46.84 billion, surpassing estimates of $46.17 billion.

APPLE UNVEILS HISTORIC $500B INVESTMENT IN US MANUFACTURING, INNOVATION: ‘BULLISH ON THE FUTURE’

Following the announcements, Apple shares fell by 1.5% in after-hours trading.

Despite beating expectations, investor anxiety remains centered on the tariff implications for the upcoming quarter. Apple executives are expected to provide more detailed forecasts during a conference call with investors set to commence at 5 p.m. EDT.

While the Trump administration has so far exempted electronics from tariffs, indications from Washington suggest that some levies could be announced in the coming weeks. This uncertainty has contributed to a 15% drop in Apple’s stock this year, erasing over $600 billion from its market capitalization.

In contrast, Microsoft recently reported promising projections, propelling its market value to $3.2 trillion, surpassing Apple for the leading position.

To counteract potential tariffs, Apple is reportedly planning to shift production of iPhones destined for the U.S. to India, as reported by Reuters. Analysts predict that the company may absorb certain tariff costs through its supply chain while limiting price hikes to maintain market share amid intense competition and delays in deploying essential artificial intelligence features, including enhancements to the Siri voice assistant.

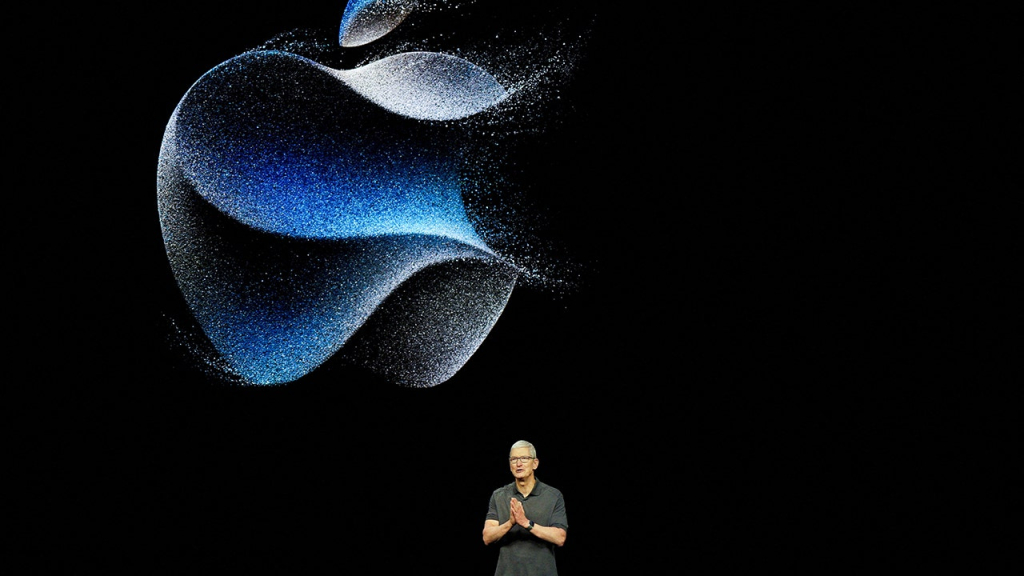

Tim Cook, Apple’s CEO, shared with Reuters that inventory levels for iPhones were stable at both the beginning and end of the fiscal second quarter, indicating no substantial inventory accumulation. Cook credited sales growth to the iPhone 16e, a new mid-market model priced at $599, featuring Apple’s first custom modem chip.

APPLE IPO ANNIVERSARY: HOW MUCH WOULD A $1,000 INVESTMENT BE WORTH TODAY?

The iPhone 16 is noted for being Apple’s most affordable model, yet it is equipped with a capable processor that supports the latest AI functionalities.

“The active (iPhone) installed base has reached a new high, with growth across all geographic regions,” Cook stated during his conversation with Reuters.

Apple’s sales in the Greater China region declined to $16 billion, which was slightly above the $15.9 billion anticipated by analysts, according to Visible Alpha data. The company faces significant competition in China from domestic brands like Huawei and Xiaomi, while also grappling with the delayed launch of crucial AI features first announced nearly a year ago.

Reports from Reuters indicate that Apple is collaborating with Alibaba to introduce AI functionalities in China, but no timeline has been provided for the rollout of these features.

In its services sector, Apple reported revenues of $26.65 billion, just short of the $26.69 billion forecast by analysts, according to LSEG data. Over 1 billion paid subscriptions are now on Apple’s platform, Cook confirmed.

In terms of accessories and wearables, which include popular items like AirPods, the company registered $7.52 billion in revenue, falling short of the $7.85 billion forecasted by analysts.

GET Finance Newso BUSINESS ON THE GO BY CLICKING HERE

Sales from iPads and Macs amounted to $6.40 billion and $7.95 billion, respectively, exceeding analyst expectations of $6.07 billion and $7.92 billion. Cook noted that entry-level iPads performed particularly well during the quarter.

The company also announced a 4% increase in its cash dividend, raising it to 26 cents per share, and has authorized an additional $100 billion for its stock buyback program.