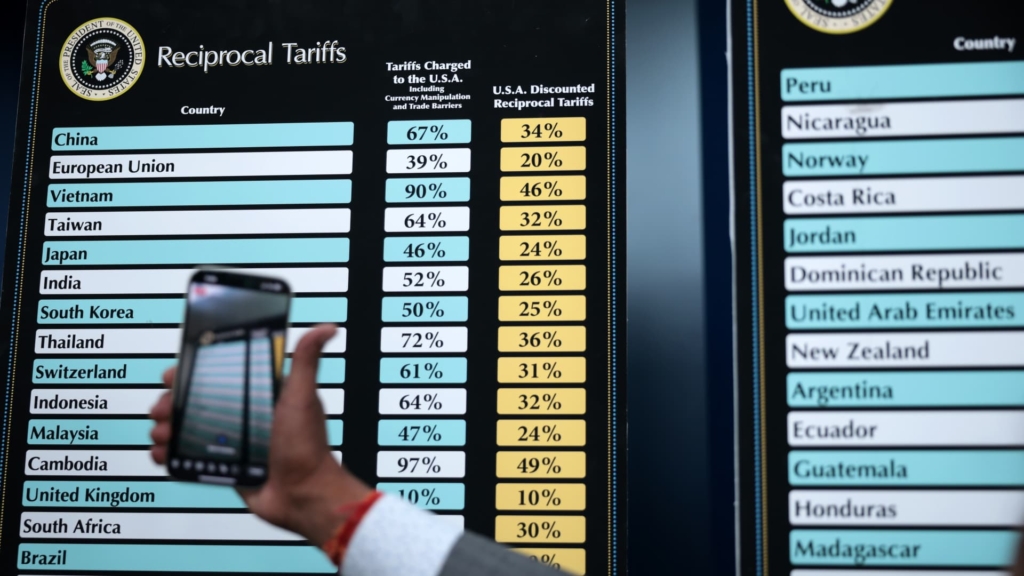

On Wednesday, U.S. President Donald Trump unveiled the new “reciprocal tariff” rates that will affect over 180 countries and territories as part of his comprehensive trade policy strategy.

The announcement triggered a sharp decline in stock markets, with investors flocking to assets deemed safe as uncertainty loomed.

Market analysts expressed concerns, with many predicting a heightened risk of recession for the United States in the wake of this announcement.

Prominent voices in the financial community weighed in on the news:

Tai Hui, APAC Chief Market Strategist at J.P. Morgan Asset Management

“The tariff levels foreshadow a potential rise to average rates not seen since the early 1900s. If these tariffs endure, they could significantly influence inflation, especially as U.S. factories struggle to scale up production and pass increased costs onto consumers. Advanced semiconductor producers in Taiwan may face challenges in absorbing these tariff expenses without alternative solutions.”

“The gravity of these tariffs raises significant growth apprehensions. With import prices escalating, U.S. consumers may curtail spending, and businesses could postpone investments due to the prevailing uncertainty regarding tariff implications and possible retaliatory actions by trade partners.”

David Rosenberg, President and Founder of Rosenberg Research

“A global trade war offers no benefits to anyone involved. It is naïve to believe that U.S. consumers will be shielded from the effects, as these tariffs will ultimately be borne by the importing businesses, rather than the foreign producers. This will likely translate into considerable price increases for American households in the coming months.”

Anthony Raza, Head of Multi-Asset Strategy at UOB Asset Management

“The figures being proposed are astonishing and almost beyond comprehension. It was hoped that the rollout of such measures would be gradual, allowing time for potential negotiations. However, the immediate timing of these tariffs appears more severe and less flexible than anyone had anticipated.”

David Roche, Strategist at Quantum Strategy

“These tariffs are not just transient measures; they represent a fundamental shift in President Trump’s policy approach from globalization toward isolationism and nationalism, which will have lasting effects for years to come. We should anticipate retaliation from the EU, particularly targeting U.S. services, and from China, which may focus on U.S. strategic interests. The repercussions of these tariffs will likely contribute to a bear market and signal a period of global stagflation alongside potential recessions in both the U.S. and the EU.”

Shane Oliver, Head of Investment Strategy and Chief Economist at AMP

“Our calculations indicate that the recent announcement could elevate the U.S. average tariff rate beyond levels observed during the 1930s, following the Smoot-Hawley tariffs. This escalation is expected to further undermine confidence and disrupt supply chains, subsequently raising the likelihood of a U.S. recession to approximately 40% and potentially pushing global growth down to 2% from the current 3%, influenced by the response from countries like China.”

Tom Kenny, Senior International Economist at ANZ

“The reciprocal tariffs announced today are more severe than anticipated. The effective tariff rate on imports into the U.S. could surge to the 20-25% range, the highest level recorded since the early 1900s. Following this announcement, yields on inflation-indexed bonds rose, and equities experienced a sell-off, suggesting that the market anticipates adverse effects on growth and higher inflation. Current market conditions imply a likelihood of sooner-than-expected interest rate cuts by the Federal Reserve.”