Recent findings from the on-chain analytics firm CryptoQuant suggest that Ethereum (ETH) might be poised for a significant resurgence against Bitcoin (BTC).

New data indicates that Ethereum may have reached a trough in its value relative to Bitcoin, as the ETH/BTC trading ratio recently experienced a remarkable 38% increase from a five-year low. This rise in demand comes amid a decrease in selling pressure and increased accumulation by ETFs, potentially indicating the onset of an “alt season.” pic.twitter.com/dosAgvW6UE

— CryptoQuant.com (@cryptoquant_com) May 16, 2025

Several factors—historical trends, an uptick in investor interest, and diminished selling activity—appear to suggest that ETH is on the verge of outpacing Bitcoin, a trend often referred to in the crypto community as the commencement of an alt season.

According to CryptoQuant, the ETH/BTC price ratio, a critical metric for comparing Ethereum’s performance to Bitcoin’s, has surged by 38% this past week after hitting its lowest point since January 2020.

Historically, reaching this level has often indicated a bottom for Ethereum and has been a precursor to significant rallies among altcoins. CryptoQuant also highlights that Ethereum has entered a zone of extreme undervaluation relative to Bitcoin, as evidenced by the ETH/BTC MVRV metric—marking the first occurrence of this condition since 2019.

Similar circumstances in previous years—2017, 2018, and 2019—were followed by strong mean-reversion movements favoring ETH.

Surge in ETH-to-BTC Spot Trading Volume Ratio

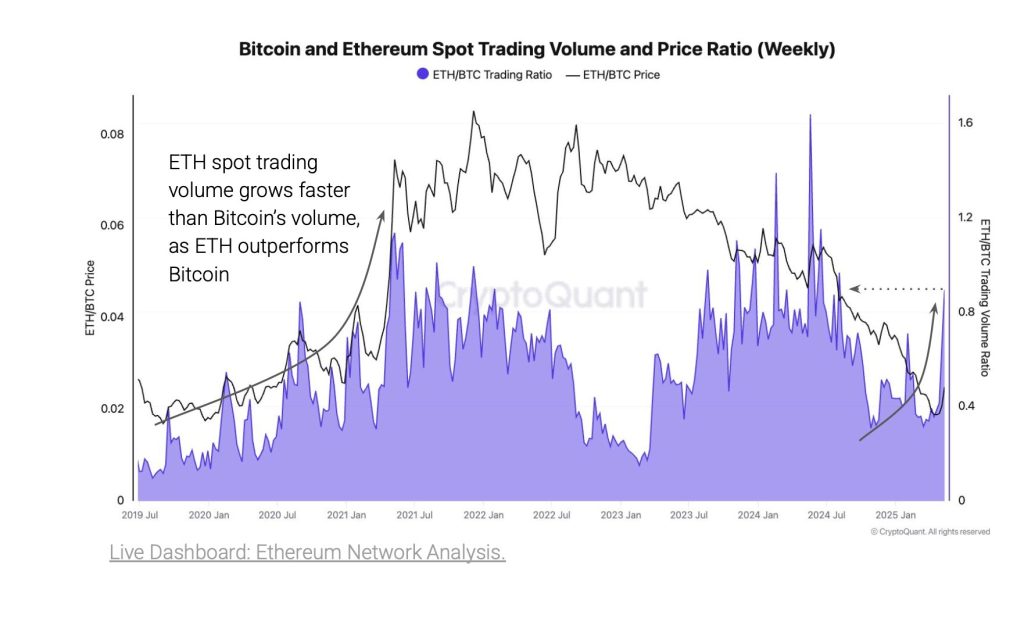

The ETH-to-BTC spot trading volume has reached a ratio of 0.89, its highest level since August 2024. This surge mirrors a trend noted between 2019 and 2021, during which Ethereum outperformed Bitcoin by a factor of four.

Furthermore, institutional flows appear to be favoring Ethereum as well. CryptoQuant observes a notable increase in the ETF holdings ratio of ETH in comparison to BTC since late April.

This suggests that fund managers are shifting their allocations toward Ethereum, likely in anticipation of favorable market movements, including recent scaling advancements or a more conducive macroeconomic environment for ETH.

Positive Inflow Data for Ethereum

CryptoQuant’s analysis of exchange inflow data reveals another optimistic sign for ETH. The ETH/BTC exchange inflow ratio has fallen to its lowest level since 2020, indicating that fewer Ethereum holders are sending their assets to exchanges for sale. In contrast, Bitcoin appears to be experiencing relatively higher selling pressure.

The data from CryptoQuant illustrates a landscape of increasing demand for Ethereum amid a backdrop of reduced selling pressure and relative undervaluation. If these historical trends continue, Ethereum could reclaim its influence over Bitcoin and potentially drive the broader altcoin market into a new growth phase.

The post Ethereum Flashes Extreme Undervaluation – CryptoQuant Eyes 38% ETH/BTC Rally Soon appeared first on Finance Newso.