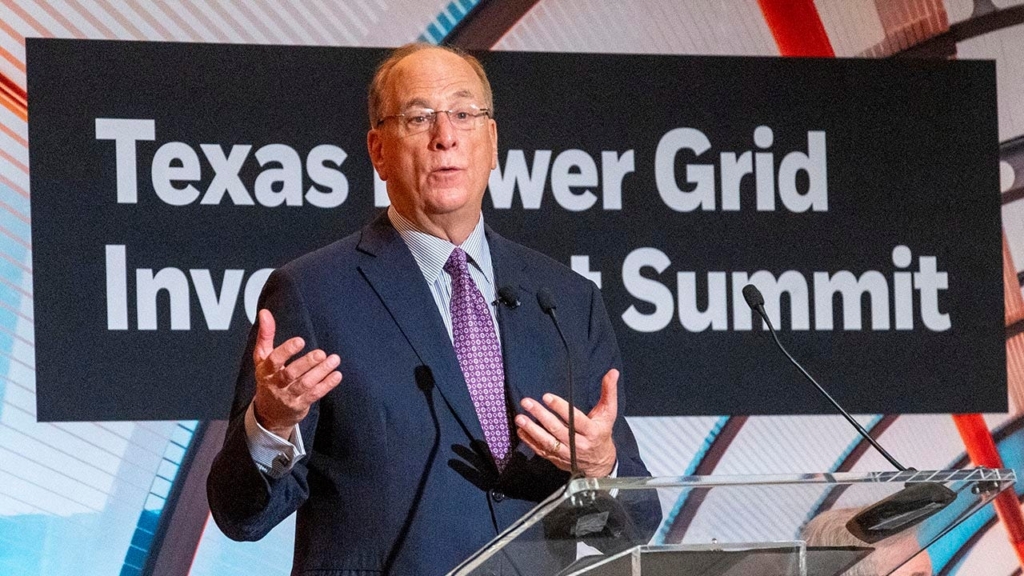

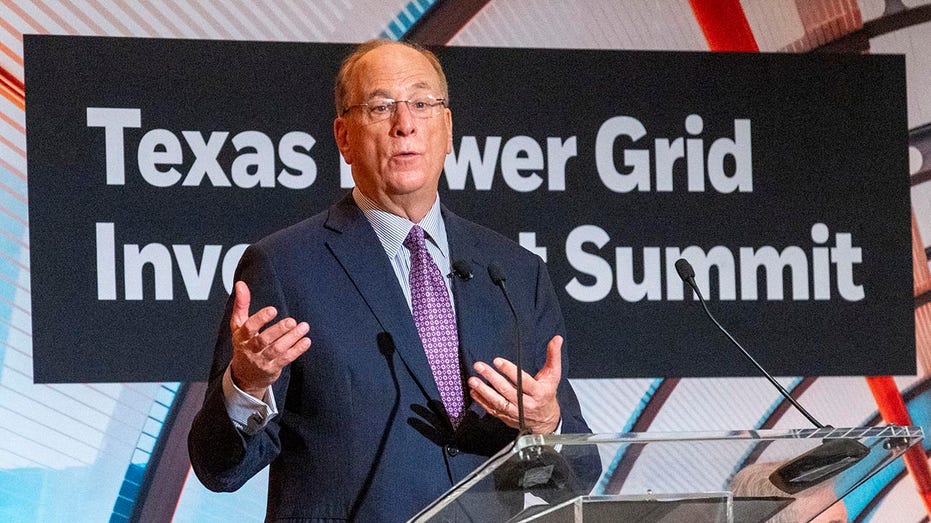

Larry Fink, CEO of BlackRock, has announced a significant shift in the investment firm’s focus in his annual letter to investors, moving away from politically charged issues like diversity, equity, and inclusion (DEI), along with environment, social, and governance (ESG) strategies.

The chairman’s letter for 2025, released on Monday, notably excludes references to DEI, ESG, and climate change. This change follows BlackRock’s February decision to pivot away from internal DEI policies and remove related mentions from its annual report, opting instead to emphasize connectivity and inclusivity.

Upon the release of the annual report, BlackRock reiterated its commitment to fostering an environment that attracts top talent and encourages diverse viewpoints to mitigate groupthink, as reported to Finance Newso Business.

In his investor letter, Fink praised the potential of financial markets, advocating for enhanced access to market segments that many investors currently find restricted, thereby encouraging broader participation in these markets.

BLACKROCK FLIPS SCRIPT ON DEI POLICIES IN COMPANY-WIDE EMAIL: ‘ANNOUNCING SEVERAL CHANGES’

Fink pointed out the growing divide in the economy, stating, “Today, many countries have twin, inverted economies: one where wealth builds on wealth; another where hardship builds on hardship. The divide has reshaped our politics, our policies, even our sense of what’s possible. Protectionism has returned with force. The unspoken assumption is that capitalism didn’t work and it’s time to try something new.” He reassured investors that capitalism has worked, albeit for a select few.

“Markets, like everything humans build, aren’t perfect. They reflect us – unfinished, sometimes flawed, but always improvable. The solution isn’t to abandon markets; it’s to expand them, to finish the market democratization that began 400 years ago and let more people own a meaningful stake in the growth happening around them,” he articulated.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 817.50 | -5.12 | -0.62% |

Fink emphasized that BlackRock aims to democratize investing by helping current investors access financial markets that have previously been off-limits, and enabling more individuals to embark on their investment journeys. He specifically noted private markets, which remain largely inaccessible to most investors.

BLACKROCK DROPS DEI REFERENCES FROM ANNUAL REPORT

Fink elaborated that many associate ‘markets’ only with publicly traded assets like stocks and bonds. However, he pointed out that opportunities in infrastructure projects, including high-speed rail and next-generation power grids, are typically confined to private markets, inaccessible through exchanges like the NYSE or LSE.

“The assets that will define the future – data centers, ports, power grids, and the fastest-growing private companies – are locked behind high walls, primarily open only to the wealthiest investors,” he remarked.

Fink addressed the reason for this exclusivity, citing factors like risk, illiquidity, and complexity. However, he maintained that financial landscapes can evolve, and private markets do not necessarily have to uphold these barriers.

BLACKROCK INKS $23B DEAL FOR PANAMA CANAL PORTS

Over the past 14 months, BlackRock has expanded its footprint in private markets by acquiring two firms specializing in infrastructure and private credit, as well as another company focused on data and analytics to enhance risk assessment and identify opportunities.

Fink argued that greater access to private markets could enhance investors’ portfolios through diversification. He proposed that a more diversified portfolio could shift from the traditional 60/40 mix of stocks and bonds to a new framework of 50/30/20, incorporating private assets like real estate and infrastructure alongside traditional investments.

GET Finance Newso BUSINESS ON THE GO BY CLICKING HERE

He concluded by asserting that improved data availability would enable indexing private markets akin to current practices with public markets such as the S&P 500. This shift would democratize investment opportunities, facilitating easier access and tracking, which, in turn, would stimulate broader capital flows within the economy and expedite growth for investors of all sizes globally.