In response to Israel’s military operations targeting Iran’s nuclear facilities, investors have shifted their focus towards safer havens such as gold, moving away from U.S. equities.

On Friday, all three major U.S. stock indices experienced declines, erasing earlier weekly gains. The Dow Jones Industrial Average dropped by over 500 points, marking a 1% decrease, while the Nasdaq Composite and S&P 500 indices saw losses of 0.6% as trading progressed.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 42309.26 | -658.36 | -1.53% |

| SP500 | S&P 500 | 5999.32 | -45.94 | -0.76% |

| I:COMP | NASDAQ COMPOSITE INDEX | 19512.043399 | -150.44 | -0.77% |

The military actions, which began late Thursday, prompted a significant spike in oil prices, with an increase as high as 11% reaching the mid-$70s per barrel, although those gains were later reduced. Companies such as ExxonMobil, Chevron, and ConocoPhillips saw their stocks climb, while the United States Oil Fund ETF made a notable advance, poised for its most substantial percentage increase since April.

OIL & ENERGY

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XOM | EXXON MOBIL CORP. | 112.14 | +2.40 | +2.19% |

| CVX | CHEVRON CORP. | 145.90 | +0.93 | +0.64% |

| COP | CONOCOPHILLIPS | 96.29 | +1.60 | +1.69% |

Investor Louis Navellier remarked that these developments could negatively impact inflation metrics if the situation does not stabilize quickly. A recent report on consumer inflation revealed that prices remain elevated above the Federal Reserve’s target of 2%, although it also hinted at a degree of easing.

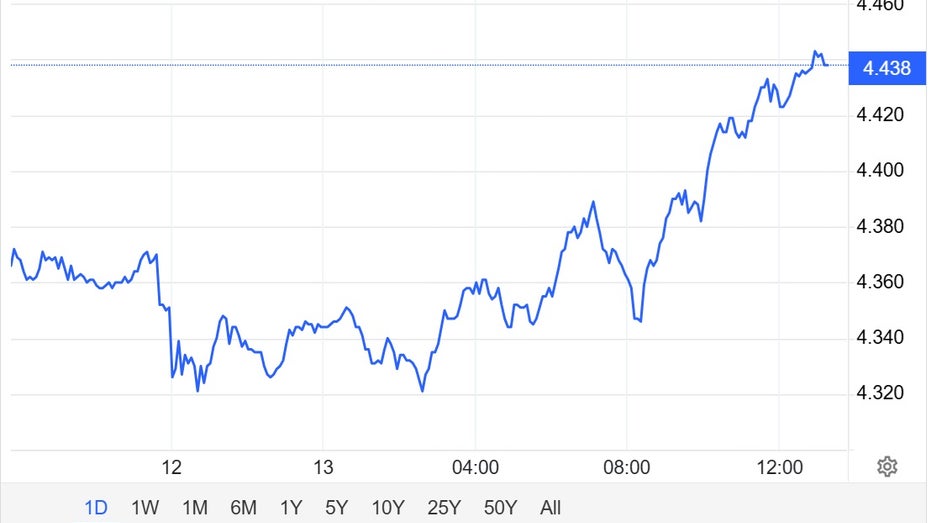

RISING BOND YIELDS

Bond yields observed an upward trend, with the yield on the 10-year Treasury crossing the 4.4% mark, mainly due to resurfacing inflation worries.

Frank Ros, a senior market strategist at Angel Oak Capital Advisors, commented on the market’s behavior, stating, “This is a classic flight to safety, and you’re seeing that reflected in treasury yields.” He noted the prevailing investor concerns amid rising geopolitical tensions.

GOLD HITS NEW RECORD

Gold prices soared to a new high, peaking at $3,500 per ounce, marking the third consecutive day of increased trading activity. The SPDR Gold Trust, which is the largest exchange-traded fund backed by physical gold, is on track for a weekly gain of 3%.

FED WATCH

Upcoming Federal Reserve meetings are not anticipated to yield changes to interest rates in the near term, with the CME FedWatch Tool indicating little chance of rate movement in the coming weeks. There is increasing speculation that a potential rate cut could happen in September.

TRUMP CRITICIZES FED CHAIR POWELL

Former President Trump has publicly criticized Federal Reserve Chairman Jerome Powell, pushing for a one-percentage-point rate cut while labeling Powell as a “numskull” and “Mr. Too Late” for maintaining current rates amid reductions by international counterparts like the European Central Bank.

CRYPTOCURRENCY

Bitcoin has maintained its position near the $105,000 mark, slightly below its all-time high of $111,986.44.