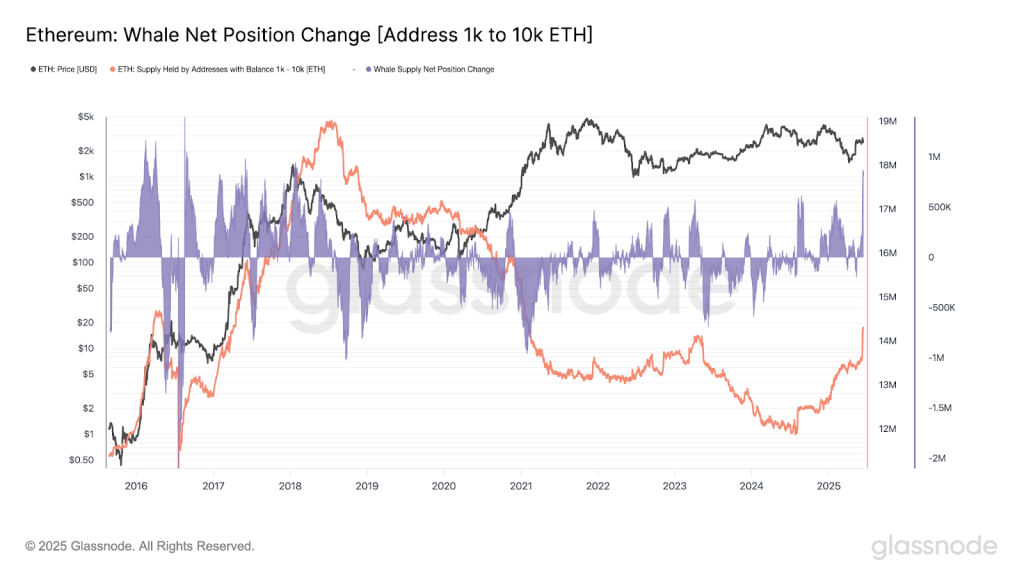

Ethereum whales have launched an aggressive accumulation effort, marking their most significant activity since 2018. On June 15, wallets containing between 1,000 and 10,000 ETH acquired an astonishing 818,410 ETH, valued at approximately $2.5 billion, according to GlassNode data.

This influx reflects the highest daily accumulation for this group in over six years, boosting their total holdings from approximately 11.87 million ETH a year ago to over 16 million ETH.

The timing of this accumulation aligns with a robust performance in digital asset investment products, which have seen $1.9 billion in inflows for nine consecutive weeks. Ethereum alone attracted $583 million, marking its best weekly performance since February.

Whale Accumulation Meets Strong Institutional Belief

This surge in whale accumulation correlates with increased institutional confidence, as spot-based Ether ETFs recently completed an impressive 19-day inflow streak, accumulating $1.37 billion prior to a minor outflow of $2.1 million.

Additionally, the Ethereum Name Service has seen a 313.5% increase in whale transactions, while Ethereum-based lending protocols reported a 203.8% uptick in activity from large holders in recent weeks.

Wallets containing between 1,000 and 100,000 ETH have collectively added 1.49 million ETH, worth around $3.79 billion, over the past month, according to blockchain analytics firm Santiment.

Currently, there are 6,392 wallets in this range, and these significant investor wallets have increased their holdings while retail traders have been cashing in on profits, indicating a transfer of wealth from weaker to stronger hands, often a precursor to major price movements in cryptocurrency.

Currently, there are 6,392 wallets in this range, and these significant investor wallets have increased their holdings while retail traders have been cashing in on profits, indicating a transfer of wealth from weaker to stronger hands, often a precursor to major price movements in cryptocurrency.

This particular group of investors has expanded its holdings by 3.72%, now controlling 41.61 million ETH, nearly 27% of the total supply.

Digital Asset Resilience Defies Global Market Turbulence

This significant accumulation of Ethereum comes amidst global market volatility, particularly influenced by ongoing geopolitical tensions, such as the Israeli-Iran conflict, which have affected traditional risk assets.

Despite this uncertainty, digital assets have shown remarkable resilience. The recent inflow of $1.9 billion is part of a record year-to-date total of $13.2 billion in investment product inflows, positioning digital assets alongside gold as a refuge for capital amid geopolitical strife.

Regionally, the United States has been the leading contributor with $1.9 billion in inflows, supplemented by Switzerland ($20.7 million), Germany ($39.2 million), and Canada ($12.1 million), among others.

Ethereum’s recent $2 billion in cumulative inflows represents an impressive 14% of the total assets under management, underscoring its strong position in the market.

Technical Analysis Reveals Critical Breakout Setup

From a technical standpoint, Ethereum’s current price action suggests a complex but potentially bullish arrangement across various timeframes. Currently trading at $2,617, the asset is consolidating near pivotal resistance levels.

Analysis of the 4-hour chart reveals Ethereum is locked within a broad sideways range after recovering from a significant low at $1,400. The presence of multiple Doji candlestick patterns indicates indecision, often preceding substantial directional shifts.

The development of a triangle pattern suggests a potential breakout is on the horizon, with prices coiling for a potentially significant surge above the resistance zone between $2,800 and $2,900.

Daily timeframe analysis highlights Ethereum’s journey of recovery, successfully reclaiming the 50% Fibonacci retracement level at $2,130, while currently addressing challenges at the 38.2% retracement level around $2,307.

Key levels to watch include initial resistance at $2,816 and crucial support at $2,092, while current consolidation is just shy of the pivotal mark at $2,407.

The technical structure indicative of continued whale accumulation could propel Ethereum towards the 0% retracement level near $2,879, which signifies the previous critical high preceding a major correction phase.

However, the long-term outlook presents a more complicated scenario, revealing a rising wedge pattern that has been forming over a considerable period.

While rising wedges are typically viewed as bearish reversal patterns, Ethereum’s position near the apex of the wedge at $2,607 highlights a critical moment where a breakout in either direction could yield significant price movements.

The ongoing whale accumulation strongly advocates for a bullish outcome, especially if Ethereum can break decisively above the upper wedge boundary around $2,850 to $2,900, ideally with robust trading volume.

In the coming days, if buying pressure from whales pushes Ethereum past the $2,800 resistance, targets could extend towards $3,000 to $3,200, with even loftier goals reaching between $3,500 and $4,000 should the rising wedge be invalidated upward.

Monitoring the $2,570 support level is crucial, as failing to maintain this threshold might prompt further declines and delay the expected breakout.

The post Ethereum Whales Stage Massive $2.5B Accumulation, Biggest Since 2018 – Will This Trigger ETH Breakout? appeared first on Finance Newso.