Germany may soon face a challenging financial landscape marked by increased taxes and escalating debt as NATO allies prepare to adopt a higher defense spending target.

In 2024, Germany’s defense expenditure is projected to be around 2% of its gross domestic product (GDP), exceeding 90 billion euros (approximately $104 billion), as per a NATO estimate. While this aligns with the current NATO target, it falls short of the newly conceived 5% spending goal reportedly agreed upon by member nations of the military alliance.

Under these updated guidelines, NATO members would be expected to allocate 3.5% of GDP to traditional defense and an additional 1.5% to broader security areas, such as infrastructure and cyber defense.

The push for increased defense spending, led by the United States, has faced mixed reactions. Some NATO countries have expressed concerns about their ability to increase funding, while others are more supportive. Germany has shown backing for the proposal initiated by former U.S. President Donald Trump, but skepticism remains regarding the feasibility of achieving a 5% target for the continent’s largest economy.

Financial Considerations

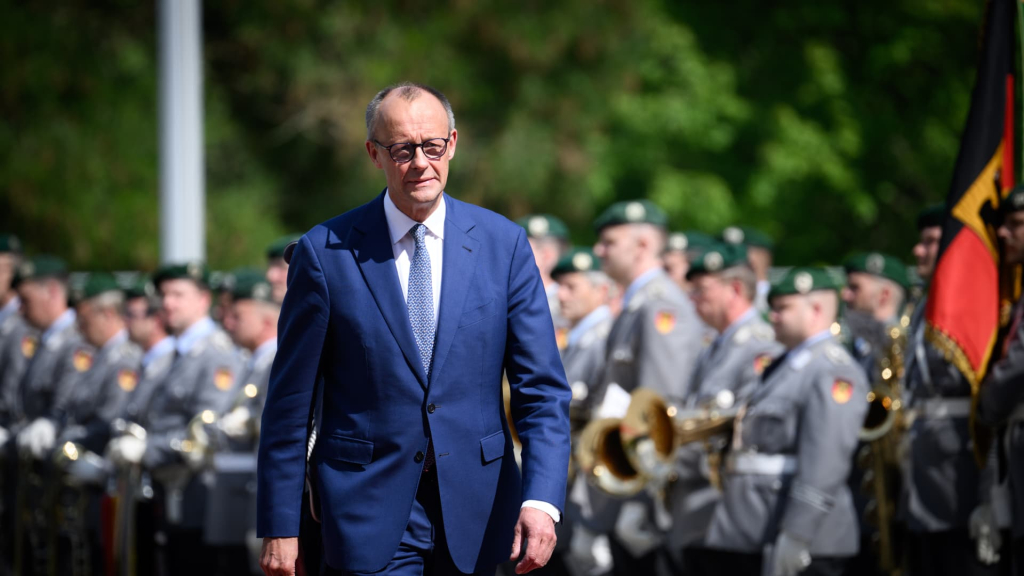

Raising Germany’s defense spending from 2% to 5% of GDP would necessitate tens of billions of euros in additional funding each year. Chancellor Friedrich Merz noted earlier that achieving the additional 1% of GDP equates to about 45 billion euros.

Experts suggest that these increased costs will likely need to be financed through loans. Hubertus Bardt, managing director of the IW Koeln economic institute, informed Finance Newso that while this could provide short-term flexibility, it might lead to significant budgetary conflicts within the annual fiscal plan.

“This increase will likely force the administration to consider budget cuts in other areas alongside potential tax hikes,” he remarked, as per a Finance Newso translation.

Emilie Hoeslinger, a researcher at the ifo Institute, highlighted Germany’s recent shift in fiscal policy. New rules allow for exemptions from Germany’s so-called debt brake—regulations designed to limit government borrowing—for defense expenditures over a specified limit. Furthermore, Germany has established a special 500 billion euro infrastructure fund.

“Securing defense expenditures through additional borrowing grants the government more flexibility in the short run,” she stated, though she cautioned that heightened debt levels would lead to increased interest expenses in the medium term, placing further strain on the federal budget.

Bardt reiterated these concerns, asserting the long-term impracticality of relying entirely on loans for financing.

Experts have also pointed out that the European Union’s fiscal rules could hinder member states from incurring more debt. However, these regulations can be temporarily suspended in exceptional situations, and some nations, including Germany, have requested such a reprieve on defense and security grounds.

Assessing Feasibility of the 5% Target

According to Jens Boysen-Hogrefe, a senior economist at the Kiel Institute for the World Economy, Germany could feasibly implement a 5% defense target in the short term, but faces challenges in sustaining it over the long haul.

“Meeting the 5% goal could present hurdles in the medium term, while long-term achievement would demand a significant restructuring of public budgets,” he indicated, in a Finance Newso translation. He added that the EU is unlikely to resist the adjustment, and the German government should be able to manage budgetary pressures as necessary.

Nevertheless, urgency remains. “It will be challenging to initiate such spending quickly. Even reaching the 3.5% target seems unrealistic for the coming year and possibly by 2027,” Boysen-Hogrefe noted.

“Historically, these figures are remarkably high, though they could be attainable with sufficient time and planning, despite the inherent difficulties,” Bardt observed, emphasizing that much will depend on whether the 1.5% allocation for security-related expenses will incur new costs.