Key Takeaways:

The recent legal ruling against Genius Group underscores a mounting friction between decentralized financial approaches and centralized legal frameworks.

The mandated liquidation of Bitcoin assets reveals the inherent weaknesses in corporate cryptocurrency reserves, raising questions about the sustainability of Bitcoin-centric treasury strategies amid evolving regulatory pressures.

This situation further illustrates the perilous nature of cross-jurisdictional legal battles, where U.S. court rulings can hinder foreign entities’ ability to adhere to their local laws and governance frameworks.

On April 3, a New York court issued an order prohibiting Genius Group from selling shares, raising capital, or utilizing investor funds for Bitcoin purchases, compelling the company to liquidate portions of its Bitcoin Treasury to keep its operations afloat.

The ruling was handed down by the United States District Court for the Southern District of New York (SDNY) amidst a protracted legal conflict involving the education and AI-oriented firm.

Court Injunction Applies Pressure on Genius Group

Genius Group, listed on the NYSE American under the ticker GNS, has found itself embroiled in disputes as it seeks to terminate an asset acquisition agreement with Fatbrain AI (LZGI).

The tension escalated when LZGI shareholders initiated lawsuits alleging fraud against the firm’s executives, Michael Moe and Peter Ritz. Concurrently, the SEC has opened its own investigation into allegations of shareholder fraud.

On February 14, 2025, Moe and Ritz requested a temporary restraining order and a preliminary injunction to halt Genius’s plans to sell shares or utilize proceeds from its $150 million at-the-market (ATM) offering for Bitcoin investments.

Genius Group has been restricted by the US District Court Southern District of New York from executing share sales or raising funds, including a specific ban on Bitcoin purchases, directly contradicting the board and shareholders’ approvals. We will keep fighting… pic.twitter.com/Lk6uXzfCx6

— Roger James Hamilton (@rogerhamilton) April 3, 2025

The court granted the injunction on March 13, effectively crippling the company’s capacity to issue new shares or secure additional funding.

In reaction to the ruling, Genius Group has filed several motions to contest the injunction, claiming it disrupts their business operations and was obtained based on misleading assertions.

The company has also submitted a transcript from a meeting with Ritz, recorded in New York on February 27, where he allegedly mentioned strategies to manipulate the legal system for financial gain from Genius. This transcript is also a part of a separate lawsuit against LZGI and its executives in Florida.

Consequently, the court’s order has forced Genius Group to decrease its Bitcoin holdings from 440 BTC to 430 BTC.

Genius has cautioned that if the injunction persists, further asset sales might be required. The restrictions have simultaneously hindered their ability to issue share-based compensation, creating conflicts with Singaporean labor laws.

The company has lodged an emergency appeal with the United States Court of Appeals for the Second Circuit, aiming to overturn the injunction.

In parallel, Genius is undertaking a restructuring of its operations, reducing marketing expenditures, closing divisions, and canceling sponsorship agreements to preserve resources.

CEO Roger James Hamilton has decried the court’s actions, stating, “We never imagined that a U.S. court could prevent the company from issuing shares, raising funds, or purchasing Bitcoin—decisions best left to shareholders or the board, not the judiciary.”

Genius Group Faces Market Downturn Amid Legal Issues

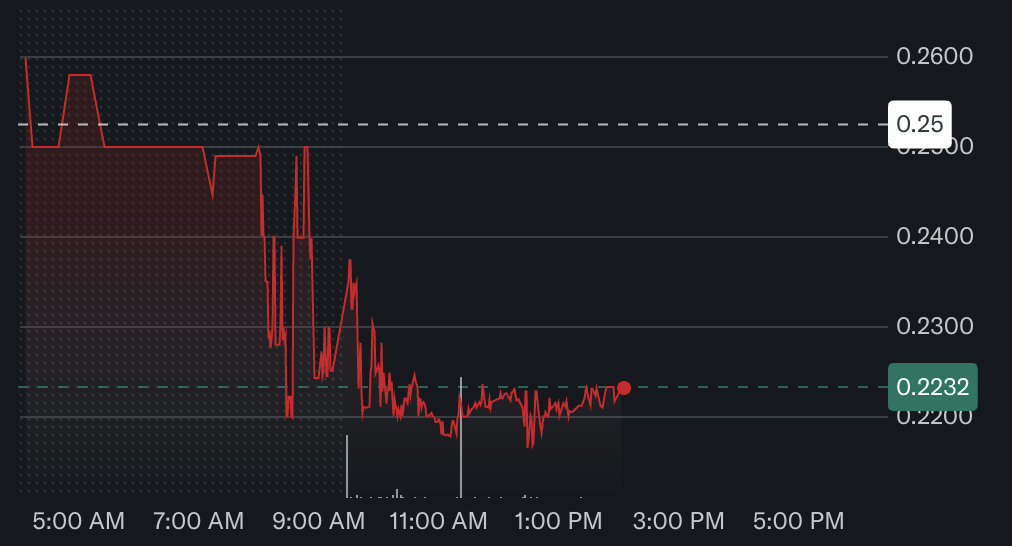

Since the issuance of the temporary restraining order in February, Genius Group’s stock has plummeted by 53%, falling from $0.47 to $0.22. The company’s market capitalization now sits at a mere 40% of its Bitcoin holdings, escalating concerns regarding its operational continuity.

Source: YahooFinance

Amid these challenges, Hamilton reaffirmed the company’s commitment to Bitcoin, asserting, “We will continue to support Bitcoin, even in the face of legal barriers preventing us from expanding our Bitcoin Treasury.”

Despite being barred from trading shares and acquiring Bitcoin, the Singapore-based firm has persistently worked to increase its BTC holdings.

Currently, the company possesses 430 BTC, approximately valued at $46 million, while its market capitalization stands at $33.1 million. Genius has invested $42 million in Bitcoin acquisitions, mirroring strategies similar to those of MicroStrategy. Over just four months, the company has allocated $40 million towards BTC and aims to boost that investment to $120 million through reserves, loans, and ATM facilities.

As regulatory pressures heighten, the future of Genius Group’s Bitcoin-first strategy remains uncertain.

Frequently Asked Questions (FAQs)

How does the court ruling highlight risks for foreign companies listed in the U.S.?

It illustrates the susceptibility of international businesses to U.S. legal actions, where judicial decisions can significantly disrupt operations, independent of local governance structures.

Could this case transform corporate treasury strategies?

Yes, it may catalyze a shift in how companies manage reserves, prompting them to look beyond Bitcoin to balance liquidity and compliance risks, thereby safeguarding their operational stability.

What does this mean for Bitcoin’s role in corporate finance?

The forced liquidation underscores the impact that external legal pressures can have on Bitcoin-centric strategies, raising doubts about its reliability as a primary reserve asset.

What lessons can other crypto-focused firms learn from this situation?

They should prioritize establishing strong legal frameworks and contingency plans to mitigate risks resulting from regulatory and judicial interferences.

The post New York Court Bans Genius Group from Trading Stocks and Holding Bitcoin appeared first on Cryptonews.