Retirees ‘stunned’ as tariff-driven market rout shrinks their 401(k)s

Many Americans approaching retirement, along with recent retirees, voiced their concerns and dissatisfaction as a market downturn, attributed to new tariffs, significantly affected their 401(k) accounts. This sentiment was reported by NBC News.

In light of the ongoing financial instability, some individuals mentioned that they are delaying major purchases and reassessing home renovation projects, while others expressed fear over potential long-term impacts on their standard of living.

“I’m just kind of stunned, and with so much money in the market, we have to hope we have enough time to recover,” stated Paula, a 68-year-old former occupational health professional from New Jersey who retired three years ago.

Paula, who requested anonymity due to concerns over possible backlash against her views on the administration’s policies, expressed her worries about the future. “What we’ve been doing is trying to enjoy the time we have, but you want to be able to make it last. I have no confidence here,” she shared on Friday.

— Daniella Silva of NBC News

Trump tariffs could cut France’s GDP growth by 0.5 percentage points, prime minister says

French Prime Minister Francois Bayrou warned that the U.S. President’s tariff strategies might lead to a 0.5 percentage point reduction in the country’s gross domestic product growth. In an interview published on Saturday, Bayrou stated, “Trump’s policies could cost us more than 0.5% of our GDP” according to excerpts shared with Le Parisien.

He added that “the imposition of these outrageous tariffs will lead to a global crisis,” stressing the significant risk of job losses and economic downturns. Under Trump’s recently announced plans, France, along with other EU nations, will face a blanket tariff of 20%.

Following a conversation with British Prime Minister Keir Starmer, President Emmanuel Macron indicated that both nations are committed to closely coordinating their approach in tariff negotiations with Trump. Macron stated on social media, “A trade war is in no one’s interest. We must stand united and resolute to protect our citizens and our businesses.”

— Reuters

Experts say tariffs won’t accelerate reshoring that easily

While President Trump may anticipate that his tariffs will catalyze a resurgence in American manufacturing, experts argue that the situation is more complex. Morgan Stanley analyst Chris Snyder described tariffs as a “positive catalyst” for reshoring but noted that a large influx of production returning to the U.S. isn’t expected in the near future. He foresees only minor investments that could increase output by around 2%.

According to Manish Kabra, head of U.S. equity strategy at Societe Generale, consumer confidence has significantly plummeted, which will affect firms’ determination on whether or when to reshore operations. Additionally, experts argue that a substantial investment is necessary to enhance the skills of the American workforce.

— Michelle Finance Newso

Tech industry hit particularly hard by tariffs

The technology sector is facing significant challenges as stock valuations tumble and initial public offerings get delayed due to the recent market turmoil following Trump’s policies. Major tech firms like Alphabet, Amazon, Meta, Microsoft, and Uber contributed sizable donations—whether individually or through corporate channels—to Trump’s second inauguration. Collectively, these seven leading tech companies experienced a staggering loss of approximately $1.8 trillion in market capitalization over the past two trading sessions.

With investors increasingly wary due to the anticipated fallout of broad tariff hikes on the U.S. and global economy, the repercussions have cascaded into the initial public offering market. Recent delays from online lender Klarna and ticketing platform StubHub on their respective IPOs come amid heightened market volatility, shortly after submitting filings to the Securities and Exchange Commission. Reports indicate that fintech startup Chime has also postponed its listing.

— Ari Levy

Cramer’s week ahead: It all depends on Trump

This coming week, Finance Newso’s Jim Cramer indicated that the earnings reports could provide insights into how executives are contending with the repercussions of Trump’s tariff policies.

The earnings season will kick off with major bank reports, as investors eagerly anticipate additional inflation data. Regardless of the numbers, Cramer stated that the market’s trajectory will hinge largely on Trump’s forthcoming actions. He noted that the recent tariff-induced market plunge might recover if Trump offers concessions to trading partners, although it risks deepening as it did during the 1987 Black Monday crash.

“If President Trump remains steadfast without taking steps to address the damage witnessed over the past few days, I don’t foresee any constructive momentum,” Cramer commented.

Even if earnings exceed expectations, a negative shift in economic outlook due to the tariffs has already impacted stock valuations, which may persist into the upcoming week, he added. “Our only real hope is that the president devises a strategy that can transform this bear market into a bull,” Cramer concluded.

— Russell Leung

Trump golfs in Florida amid the tariff fallout

As financial markets struggle following his recent tariff announcements, President Trump was spotted golfing at his club in Jupiter, Florida. He traveled to his home state the day after implementing his “reciprocal tariffs.”

On Thursday evening, he participated in a fundraising dinner for a super PAC supporting his agenda. Following that, he was seen at Trump International Golf Club before attending a charity dinner for the MAGA Inc. super PAC.

On Saturday, he continues to play golf, now participating in the senior club championships at his course. The White House reported his advancement to the Championship Round following a victory in his second-round matchup.

Democrats reacted sharply against Trump’s golfing amidst escalating concerns over the economic fallout of his policies, using social media to criticize his priorities. “While fears of recession rise and the stock market tumbles, Donald Trump is golfing,” tweeted Democratic Rep. Jason Crow from Colorado.

— Erin Doherty

National Association of Wine Retailers says tariffs will cause layoffs and business closings

The National Association of Wine Retailers has issued a warning regarding the significant impact that tariffs will have on the wine industry, predicting substantial revenue drops, layoffs, and business closures as a direct consequence of the trade policies.

In a statement, the association asserted, “We have every reason to believe that the recently enacted tariffs on wines imported from other countries, as well as tariffs on other goods, will result in a significant contraction of the wine market in the United States.”

They expressed skepticism towards the notion that consumers would simply shift their purchasing habits to favor domestic wines, emphasizing the nuance of consumer preferences in the wine market. “It is a fundamental misunderstanding of wine drinkers and the wine marketplace to believe that wine is a fungible product,” they noted, adding that when a consumer opts for a specific variety, they often don’t seek substitutes based on price or availability.

— Yun Li

Musk wants zero tariffs between the U.S. and Europe

Elon Musk expressed his desire for a “zero-tariff” arrangement between the United States and Europe, aiming to create what he described as “a free trade zone.” According to Bloomberg, Musk conveyed this sentiment to Italian Deputy Prime Minister Matteo Salvini during a virtual event this past Saturday.

“Both Europe and the United States should ideally move to a zero-tariff situation,” Musk stated. In response, Salvini expressed gratitude for Musk’s participation.

— Annika Kim Constantino

Economists take issue with Trump’s tariff formula

Several economists have critiqued President Trump’s tariff formula, suggesting it is based on a miscalculation that leads to inflated tariff rates imposed on various countries.

The formula, as outlined by the Office of the United States Trade Representative, calculates the reciprocal tariff plan as the trade deficit with the U.S. divided by exports and then halved. Critics argue that this methodology assumes a far lower elasticity of import prices concerning tariffs than is accurate. The American Enterprise Institute’s senior fellows Kevin Corinth and Stan Veuger argue that a more realistic elasticity figure should approach 1.0 rather than the 0.25 currently used.

They state that if the formula were adjusted to this standard, no tariffs would exceed 14 percent, with the majority hovering around the baseline of 10 percent established by the administration. For example, the country experiencing its highest tariff rate, Lesotho, has been assigned a steep 50 percent, a rate they argue should actually be reduced to 13.2 percent if recalculated.

— Erin Doherty

Tech, finance leaders reportedly visiting Trump to ‘talk common sense’ on tariffs

A coalition of influential leaders from the technology and finance sectors is reportedly heading to Trump’s Mar-a-Lago resort in Palm Beach, Florida, to engage in discussions aimed at addressing concerns over his expansive tariff approach. The information comes from veteran tech journalist Kara Swisher, who noted that the significant donations made by these leaders during Trump’s inauguration are now translating into extensive financial losses due to the tariffs.

Swisher remarked that the losses of “billions and soon trillions” are leading these leaders to rethink their positions. She also hinted at the involvement of Tesla CEO Elon Musk in the discussions.

In the wake of the sweeping tariffs, global markets have been severely shaken, resulting in substantial losses of wealth for major CEOs, including a $30.9 billion drop for Musk, $23.49 billion for Amazon’s Jeff Bezos, and $27.34 billion for Meta’s Mark Zuckerberg, as reported by Bloomberg.

The tariffs are heavily affecting technology stocks, largely due to the industry’s heavy reliance on manufacturing and IT services from nations such as China, India, and Taiwan.

— Annika Kim Constantino

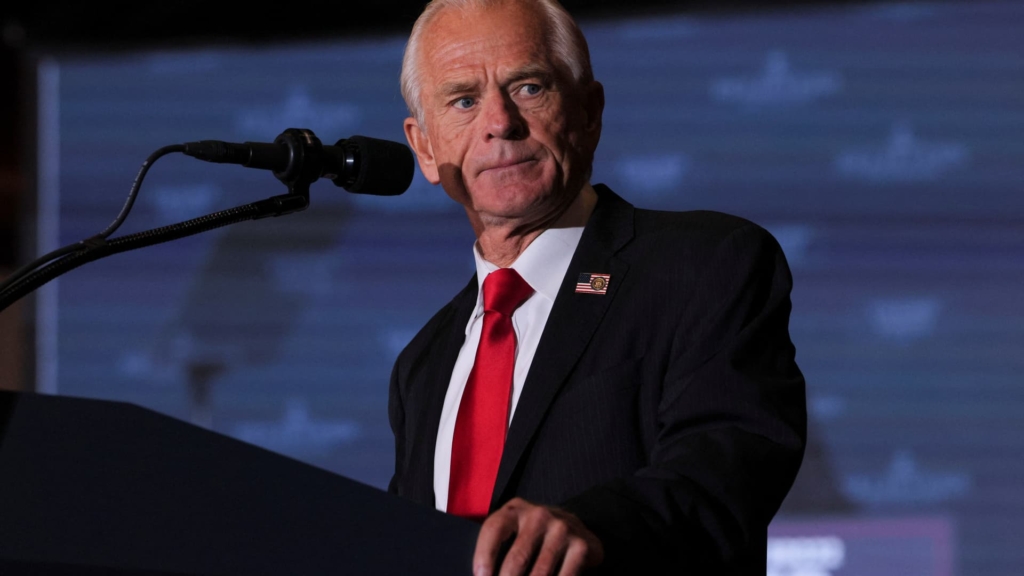

Musk takes aim at Navarro

Elon Musk has publicly criticized Peter Navarro, the prominent trade advisor to President Trump, who continues to defend the tariffs. Musk expressed skepticism regarding Navarro’s economic theories, suggesting that a Ph.D. from Harvard is not an asset in crafting effective policies.

In a response to Navarro’s optimistic predictions for market recovery, Musk stated, “The market will find a bottom. It will be soon, and from there, we’re going to have a bullish boom, and the Dow is going to hit 50,000 during Trump’s term,” a sentiment he shared during a CNN appearance. Musk also remarked that Navarro hasn’t accomplished much of value in his tenure.

As a significant figure in the early Trump administration, Musk’s influence has been noteworthy, but there are indications he may step back from his role in the coming months, as noted in NBC News reports.

— Erin Doherty

Jaguar Land Rover to pause shipments to the U.S. in April as it develops post-tariff plans

Jaguar Land Rover, a prominent British automotive manufacturer, announced that it will pause shipments to the U.S. in April to address the implications of a new 25% import tax imposed by the Trump Administration.

The automaker confirmed that the halt is necessary as they develop new business strategies in light of the changing trade landscape. “The USA is an important market for JLR’s luxury brands,” the company stated, noting that they are taking short-term measures while formulating more sustainable plans.

This comes during a challenging period for the U.K. automotive industry, which is already grappling with declining demand at home and the transition to electric vehicles. Following the latest announcements, Mike Hawes, CEO of the U.K.’s Society of Motor Manufacturers and Traders, emphasized the urgent need for accelerated trade discussions to protect jobs and advance economic growth on both sides of the Atlantic.

In 2023, UK car production fell 13.9% to 779,584 vehicles, with over 77% destined for the export market.

— Reuters

Trade advisor Peter Navarro downplays market turmoil triggered by tariffs

Peter Navarro, a top trade advisor for President Trump, has downplayed the significant market sell-off that occurred following Trump’s tariffs announcements, promising that the market will soon recover.

Navarro asserted, “The market will find a bottom. It will be soon, and from there, we’re going to have a bullish boom, and the Dow is going to hit 50,000 during Trump’s term.” He expressed optimism that the S&P 500 will rebound broadly, anticipating increases in wages and profits across the board.

The Dow Jones Industrial Average recently plunged by 2,231.07 points—marking the largest single-day drop since June 2020—after a previous decline of 1,679 points the day before. It is the first time in history that the index has lost over 1,500 points in two consecutive days. The S&P 500 lost over 10% in those two days, plummeting over 17% from its recent peak.

— Yun Li

Trump claims China has been ‘hit much harder’ in tariff war

During a recent statement, President Trump asserted that China has borne a significantly heavier burden amid the ongoing trade war, claiming, “They have been treated unsustainably badly by many nations.” In a post on Truth Social, he emphasized that the U.S. was no longer willing to accept being the “whipping post.”

Trump lauded his newly implemented tariffs, asserting that they will revitalize American jobs and businesses at an unprecedented rate. He boasted about “more than FIVE TRILLION DOLLARS OF INVESTMENT” and described the current period as an “economic revolution” that will lead to historic outcomes. “HANG TOUGH, it won’t be easy, but the end result will be historic. We will MAKE AMERICA GREAT AGAIN!!!” he proclaimed.

— Annika Kim Constantino

Eli Lilly CEO says tariffs could ultimately harm drug research and development

David Ricks, CEO of Eli Lilly, has raised concerns that the newly imposed tariffs could ultimately hinder drug research and development within the pharmaceutical field. Though Trump’s tariff measures currently exempt pharmaceutical imports to the U.S., the industry anticipates that drug-specific tariffs may be introduced soon, causing apprehension among pharmaceutical leaders.

As Ricks indicated in a recent interview with BBC, companies might have to absorb the cost of the tariffs, which would likely result in budget cuts in areas such as employment and research. “Typically, that will be in reduction of staff or research and development, and I predict R&D will come first. That’s a disappointing outcome,” he added.

Despite having invested $50 billion in enhancing U.S. production capabilities, Eli Lilly remains reliant on foreign manufacturing, particularly in Ireland, where they are building a new $800 million facility. Ricks described the tariffs as a pivotal moment in the history of U.S. economic policy, suggesting it may be difficult for the country to revert to previous approaches.

— Annika Kim Constantino

Automakers seek ‘opportunity in the chaos’ of Trump’s tariffs

In light of the new tariffs, some automakers see potential advantages amid the turbulence. Ford and Stellantis are introducing employee pricing measures, while Hyundai Motor has announced it will maintain stable prices for at least two months to mitigate consumer anxiety.

Automakers interpret these strategies as opportunities to accelerate sales during this uncertain economic period prompted by the tariffs. Ford stated in a morning announcement, “We understand that these are uncertain times for many Americans. Whether it’s navigating the complexities of a changing economy or simply needing a reliable vehicle for your family, we want to help.”

— Michael Wayland

China says ‘market has spoken’ after Trump’s tariff chaos

In response to Trump’s recently enacted tariffs, China’s Foreign Ministry stated, “the market has spoken,” urging the U.S. to defuse the escalating trade war through equitable negotiations. The Chinese statement framed the trade and tariff struggle as “unprovoked and unjustified.”

As financial markets reacted sharply, all three major U.S. stock indexes plummeted by over 5% during the latest trading sessions.

— Sam Meredith

S&P 500′s 10% 2-day collapse is among the deepest in history

The U.S. stock market is grappling with one of the most severe two-day sell-offs in its history, following President Trump’s introduction of significant tariffs against numerous trading partners. This volatility has left the market in a precarious position, tightly coiled for a potential near-term recovery yet struggling to fully account for the broader implications of the policies now in place.

Bespoke Investment Group has encapsulated the market’s unsettling climate, where investor sentiment is heavily influenced not just by economic conditions but also by the unpredictable maneuvers of the President, who wields executive power to declare “emergency” tariffs, reminiscent of long-standing anti-trade sentiments.

— Michael Santoli

— Michael Santoli

Netanyahu to talk tariffs with Trump on Monday, officials say

Israeli Prime Minister Benjamin Netanyahu is slated to visit the White House on Monday to discuss the recent tariff implementations with President Trump, according to three Israeli officials and a White House representative.

This potential meeting with a foreign leader could signify the first of its kind aimed at negotiating tariff adjustments. Although Netanyahu’s office has yet to confirm the details, the meeting is expected to cover additional topics such as Iran and Israel’s conflict with Palestinian militants in Gaza. The discussion was confirmed by Axios.

Trump’s latest tariff agenda includes the implementation of a 17% tax on unspecified Israeli goods entering the U.S., affecting exports in sectors like machinery and medical equipment. The U.S. stands as Israel’s strongest ally and its largest trading partner.

An Israeli finance ministry official remarked that the latest tariffs could influence Israel’s export sector significantly, particularly in machinery and medical products.

— Reuters

How Trump’s tariffs rollout turned into stock market mayhem

Prior to Wednesday’s announcements, the expectation surrounding Trump’s tariffs was that they would pose a challenge to the markets but would remain manageable. However, the reality that has unfolded is characterized by significant economic and geopolitical turmoil.

This recent upheaval commenced with Trump’s press conference in the Rose Garden when he unveiled a series of 10% tariffs on every U.S. trading partner, effective immediately, alongside tailored rates for 60 additional nations to be applied within a week. Almost instantly, the effective U.S. tariff rate skyrocketed from 2.5% to over 20%.

In retaliation, China implemented a sweeping 34% tariff on all U.S. goods, and EU leaders are also considering countermeasures. Stock markets reacted sharply, resulting in intense sell-offs, thrusting the Nasdaq Composite into bear market territory.

— Jeff Cox

— Jeff Cox

Read Finance Newso’s earlier tariffs coverage

The introduction of President Trump’s tariffs set off a wave of reactions across global markets, leaving investors unsettled and economists pondering the ramifications. Click here to see Finance Newso’s earlier reports on the matter.

— Terri Cullen