Key Takeaways:

The market is witnessing a renewed focus on structural challenges and the rise of Layer 2 (L2) solutions, prompting discussions about Ethereum’s future. Investors are re-evaluating their perspectives as emphasis shifts toward refining protocols and asset tokenization. This landscape opens up broader technical debates regarding the evolving role of Ethereum in the cryptocurrency market.

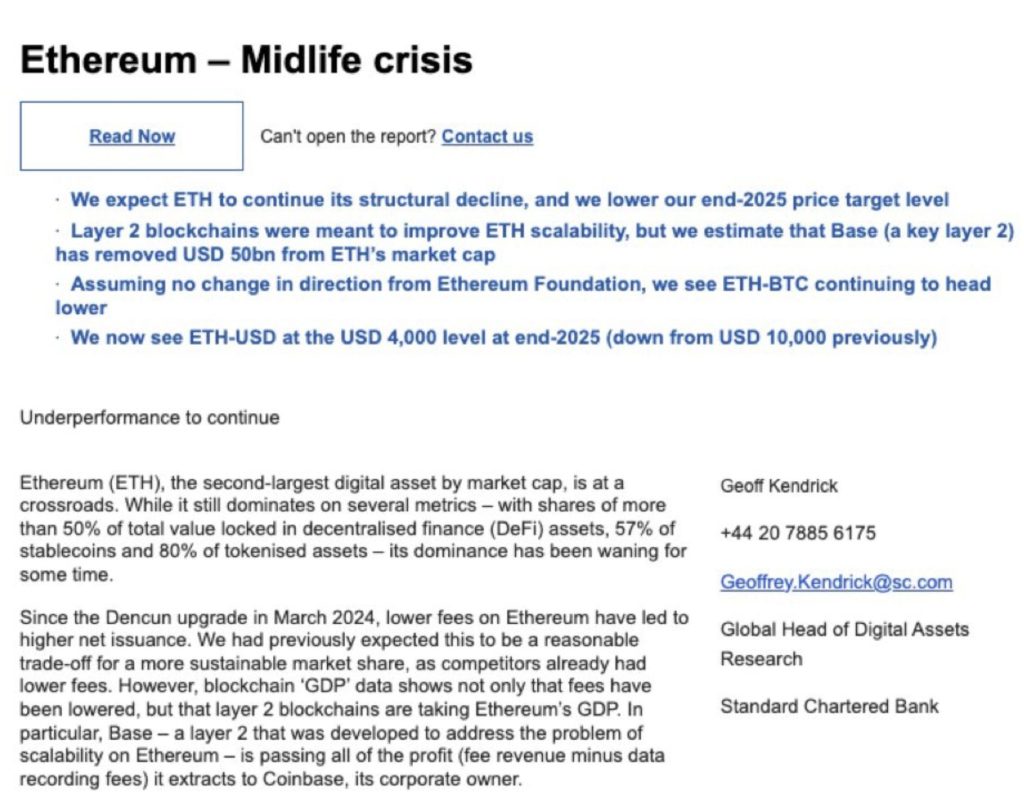

Standard Chartered has revised its price forecast for Ethereum (ETH) at the end of 2025, slashing it from $10,000 to $4,000. This significant downgrade reflects concerns over structural weaknesses and increasing competition within the cryptocurrency space.

JUST IN: Standard Chartered Bank cuts $ETH year-end price target by 60% from $10,000 to $4,000.

— Watcher.Guru (@WatcherGuru) March 17, 2025

The bank’s latest research highlights several factors hindering Ethereum’s long-term prospects, such as the rising influence of Layer 2 solutions and a diminishing market share when compared to Bitcoin.

Ethereum Faces Pressure from Layer 2 Solutions

According to the report, Ethereum’s recent struggles can be largely attributed to the rapid growth of Layer 2 solutions, like Coinbase’s Base. While these solutions were developed to enhance Ethereum’s scalability, their popularity has inadvertently reduced demand for ETH itself.

Instead of bolstering ETH prices, the proliferation of L2 networks has contributed to a $50 billion reduction in Ethereum’s market capitalization. Standard Chartered anticipates that this trend will persist, further eroding Ethereum’s influence in the market.

Ethereum’s ETH/BTC Ratio Projected to Fall Further

The institution additionally points out Ethereum’s waning status in comparison to Bitcoin. The projected ETH/BTC ratio is expected to decrease to 0.015 by the end of 2027, indicating that Ethereum may continue to lag behind Bitcoin, which solidifies Bitcoin’s place as the leading cryptocurrency.

While concerns about Ethereum’s positioning against Bitcoin are mounting, there remains a possibility for stabilization in one area.

Tokenizing Real-World Assets (RWAs) Could Stabilize Ethereum

Despite its structural difficulties, Ethereum could sustain its dominant 80% share of blockchain security if the tokenization of real-world assets (RWA) gains traction. However, Standard Chartered posits that the Ethereum Foundation will need to adopt proactive measures to counteract the diminishing demand.

One strategy mentioned in the report is the implementation of taxes on Layer 2 solutions to redirect some value back to Ethereum’s main chain, although this approach is deemed improbable.

Buterin Suggests Layer 1 Gas Scaling to Strengthen Ethereum

While Standard Chartered addresses broader macroeconomic variables, Ethereum co-founder Vitalik Buterin has been suggesting technical adjustments to augment the network. In a blog post from February, he argued for an increase in Layer 1 gas fees by approximately tenfold, which could boost the network’s long-term value, even as Layer 2 solutions expand.

Buterin identifies numerous use cases requiring enhanced Layer 1 capacity, including improved censorship resistance for L2s, more efficient cross-L2 transactions, and streamlined ERC-20 token issuance. He emphasizes that expanding the Layer 1 gas capacity within the next one to two years could bolster Ethereum’s performance, security, and cost-effectiveness, thereby reinforcing its position amid escalating competition.

Rethinking Ethereum’s Trajectory

The revised projections for Ethereum necessitate a reassessment of the factors that contribute to value in digital assets. Structural and technological changes are steering discussions toward a more intricate understanding of the cryptocurrency landscape.

This evolving narrative invites investors to scrutinize established assumptions and explore alternative viewpoints, promoting more agile strategies in an unpredictable environment. The shifting dialogue encourages each participant in the market to engage thoughtfully and enrich their investment approaches.

Frequently Asked Questions (FAQs)

How might upcoming regulatory shifts affect Ethereum’s prospects?

Changing legal frameworks can alter Ethereum’s appeal by shifting investor risk profiles and cost dynamics. Tightened guidelines may necessitate network upgrades and alter long-term adoption trends, ultimately impacting the market outlook.

What role does community-driven development play in Ethereum’s future?

An active developer community drives protocol improvements that enhance efficiency and security. Collaborations among developers can lead to the introduction of innovative features, strengthening the network and encouraging diverse user participation.

How might global economic trends influence Ethereum’s valuation?

Global economic fluctuations, including inflation and interest rate adjustments, can shape crypto investments. These changes may affect market risk profiles and liquidity, thus influencing Ethereum’s overall valuation.

The post Standard Chartered Lowers Ethereum Price Target to $4K, Cites Long-Term Structural Decline appeared first on Cryptonews.