Cryptocurrency markets experienced a significant downturn on what has been termed “Black Monday,” with total liquidations surging past $1.36 billion within a single day.

The decline in the crypto sector coincided with falling global stock markets following the announcement of President Trump’s new ‘Liberation Day’ tariffs.

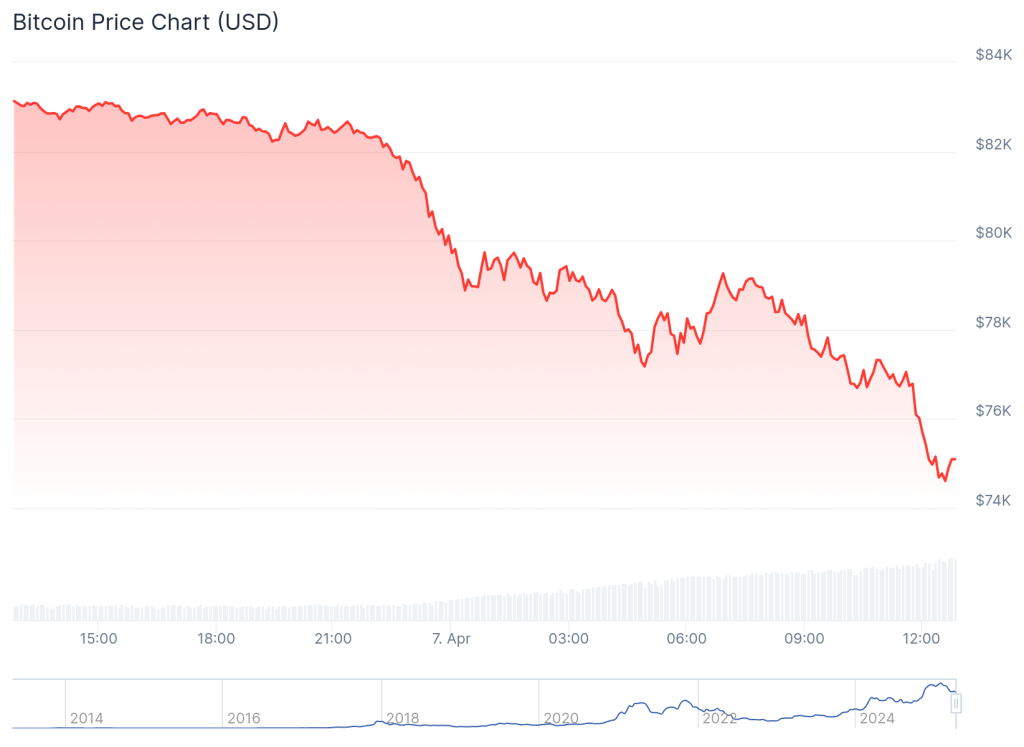

Bitcoin (BTC) was at the forefront of the crash, plummeting to nearly $75,000 and triggering widespread forced liquidations throughout the market. Currently, the entire cryptocurrency sector has dropped close to 13% over the past 24 hours.

Data from CoinGlass reveals that futures traders holding long positions were hit particularly hard by this market chaos. A staggering $1.2 billion in long bets were lost, with Bitcoin longs alone incurring more than $392 million in losses.

Source: Coingecko

ETH, SOL, and XRP Traders Face Nearly $730M in Liquidations Amid Market Crash

Traders of Ether (ETH) saw losses nearing $328 million, while popular altcoins, such as Solana (SOL) and XRP, contributed almost $400 million collectively, with each experiencing about $60 million in liquidations.

ETH saw a sharp decline of 20%, settling at $1,449, while other significant altcoins, including SOL, XRP, and Dogecoin (DOGE), also fell by as much as 20% over the past day.

BNB recorded a near 10% drop, and mid-cap as well as low-cap tokens could not escape the selloff, experiencing declines ranging from 10% to 20%, according to CoinGecko.

Remarkably, nearly 86% of all futures traders had bet on a price increase, hoping for short-term market relief.

However, the abrupt drop in prices pressured exchanges to liquidate leveraged positions en masse, as traders were unable to satisfy margin calls.

Such massive liquidations often indicate severe market tension. Forced selling in a downturn can exacerbate price drops, although it may also create opportunities for a rebound once excessive leverage is cleared out.

Crypto Crash Reflects U.S. Stock Futures Decline

The cryptocurrency decline was not isolated; U.S. stock futures also fell dramatically on Sunday night, escalating fears of a broader market crash.

S&P 500 futures dipped 5.98%, Nasdaq 100 futures fell 6.2%, and Dow futures dropped 5.5%, signaling a tumultuous start to the trading week.

This sharp decline comes amid mounting macroeconomic uncertainty, escalating trade tensions, and investor anxiety surrounding President Trump’s extensive tariff measures.

Finance Newso’s Jim Cramer drew parallels to the 1987 market crash in a Saturday post, cautioning that a “Black Monday” could significantly impact the administration’s historical footprint.

Surprised we can't get a short cover rally in case President Trump realizes that a Black Monday may not burnish a legacy

— Jim Cramer (@jimcramer) April 4, 2025

Asian markets reflected similar turmoil. The Nikkei 225 in Japan fell by 8.9%, while Taiwan’s Taiex index plunged nearly 10%, activating circuit breakers on leading companies like TSMC and Foxconn.

In response to the volatility, authorities swiftly moved to temporarily ban short-selling.

On the retail front, investors withdrew an unprecedented $1.5 billion from equities in just 2.5 hours on Friday, highlighting the intense fear prevailing in the markets.

Continued institutional sell-offs have marked March 2025 as one of the most significant withdrawal periods in recent history.

Data indicates that U.S. stock markets have suffered an astounding $11 trillion loss since February 19, with declines accelerating on April 4 due to increased concerns over President Trump’s extensive tariff initiatives.

The single-day market loss reached $3.25 trillion—surpassing the total valuation of the global cryptocurrency market, which was estimated to be $2.68 trillion at the time.

Among major tech companies referred to as the “Magnificent 7,” Tesla led the decline with a 10.42% drop, while Nvidia and Apple also experienced significant losses of 7.36% and 7.29%, respectively.

The recent turmoil underscores the interconnectedness of global markets and the profound impact of economic announcements on investor sentiment.