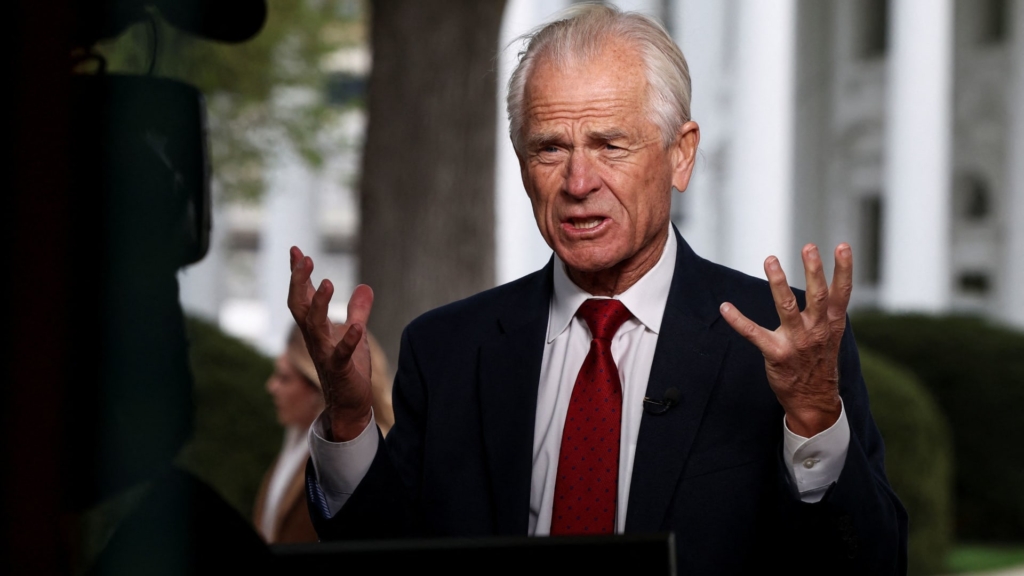

Peter Navarro, a senior trade advisor to President Donald Trump, urged Americans to consider investing in stocks during an interview on Friday, following a significant decline in the market attributed to concerns over a slowdown linked to trade tariffs—a situation Navarro dismissed as “no big deal.”

Navarro expressed optimism about the market rebounding due to Trump’s anticipated tax reforms and potential trade agreements with nations looking to avoid the tariffs the President has proposed. He stated, “Let me just say, ninety deals in ninety days, biggest, broadest tax cut in American history should be driving the tape,” during an appearance on Finance Newso Business. “That’s what’s going to be a bullish market.”

Encouraging investors to hold on to their stocks, he remarked, “If you’re not long, you’re going to get left behind.”

Navarro’s sentiments align with those expressed by Trump and other officials who have remained optimistic about the stock market despite its recent volatility and fluctuations. “This team is just the best in history,” Navarro asserted about the current economic advisors. “America should trust in Trump. The market should trust in Trump and not get these weak knees, because this is going to be bullish.”

As of Friday, the S&P 500 index was reported at 12.5% lower than its value on January 20, the day Trump resumed his presidency. However, Navarro emphasized that individuals experiencing declines in their stock holdings should focus on the fact that these are merely paper losses, insisting, “If you don’t sell, you don’t lose.”

Additionally, Navarro directed criticism toward JPMorgan Chase CEO Jamie Dimon, saying, “While he’s wringing his hands about all this, his firm made out like bandits trading on the volatility.” He cautioned small investors not to be rattled by the major financial firms. “The small investor needs to just sit tight, not panic, and don’t let these big firms shake you out,” he added. “I’d rather have mom and pop have a solid portfolio than Jamie Dimon have another billion dollars.”

Following a positive earnings report from JPMorgan Chase on Friday, Dimon remarked on the current economic landscape, acknowledging significant challenges due to geopolitical factors and ongoing inflation, while also citing potential benefits from tax reform and deregulation.

On Thursday, the stock market experienced a notable drop, with the S&P 500 falling 3.46% and the Dow Jones Industrial Average dropping 1,000 points, or 2.5%. This decline followed a substantial market increase spurred by news of Trump’s decision to delay higher tariffs for 90 days on countries other than China.

Just before announcing the tariff pause, Trump had encouraged investors, stating, “BE COOL! THIS IS A GREAT TIME TO BUY!!!” on social media, despite the preceding four days of market declines with concerns of tariffs possibly leading to a recession.

The downward trend in the markets came after analysts pointed out the expected high tariff rates resulting from Trump’s new tariffs on Chinese imports. Navarro argued that a pullback following such a market surge was typical, adding, “You had the highest rise in stock market history yesterday. Of course, there’s gonna be a little pullback. The question is: What spin are you gonna put on it?”

Previously, during a Sunday interview on Finance Newso News, Navarro had advised against panic-selling, declaring that the current strategy should be to remain invested. “You can’t lose money unless you sell and right now the smart strategy is not to panic, just stay in because we are going to have the biggest boom in the stock market we’ve ever seen,” he stated confidently, predicting that the Dow would exceed 50,000 by the end of Trump’s term.

— Finance Newso’s Kevin Breuninger contributed to this story.