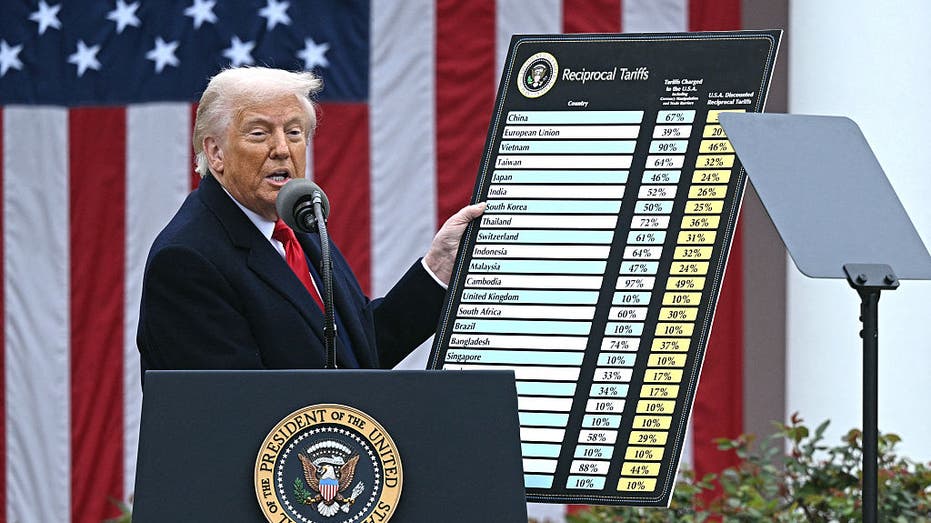

The U.S. financial markets concluded one of their most turbulent weeks since the onset of the COVID-19 pandemic, amid President Donald Trump’s aggressive tariff strategy, which has sparked retaliation from China.

By the end of the week, all three major indexes experienced gains on Friday, contributing to a positive weekly performance overall.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 40212.71 | +619.05 | +1.56% |

| SP500 | S&P 500 | 5363.36 | +95.31 | +1.81% |

| I:COMP | NASDAQ COMPOSITE INDEX | 16724.45559 | +337.14 | +2.06% |

The Dow Jones Industrial Average increased by 5% for the week, while the S&P 500 gained nearly 6% and the Nasdaq Composite saw a rise of 7%.

Despite these weekly gains, all three indexes continue to be in the negative territory for the year.

VOLUME AND VOLATILITY

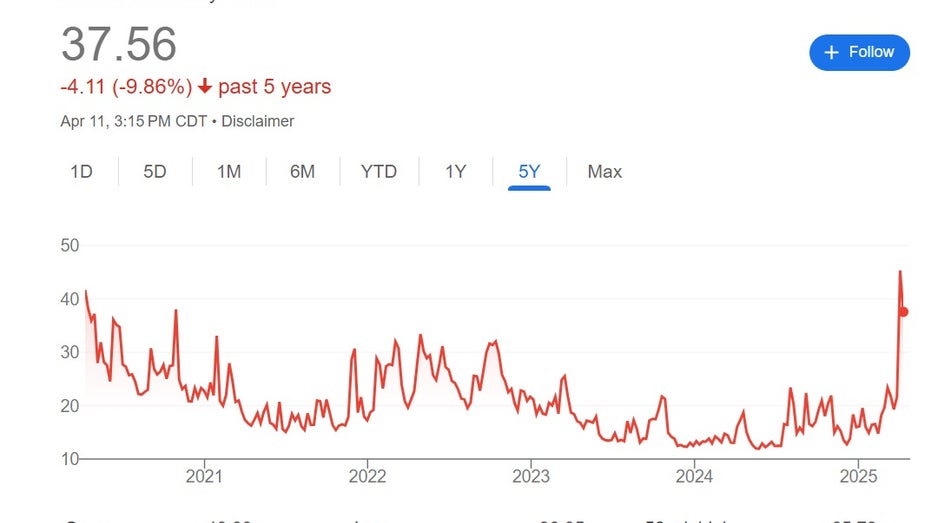

The final results came with considerable tension. The CBOE’s Volatility Index, which is often referred to as Wall Street’s fear gauge, reached a five-year high as the Dow experienced fluctuations exceeding 2,000 points on multiple occasions throughout the week.

EXPERTS ADVISE CALM AMID STOCK SELL-OFFS

The Dow experienced a dramatic increase of 2,692 points on Wednesday, marking the largest one-day point gain in history. On that day, total trading volume approached $30 trillion, the highest recorded since May 2019, according to data from Dow Jones Market Data Group. This surge occurred coincidentally on the same day Trump unexpectedly paused tariffs on selected countries.

Dow Jones Industrial Average

.

BlackRock CEO Larry Fink commented on the market’s resilience during a conference call with investors on Friday, expressing continued optimism for capital markets.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 878.97 | +21.82 | +2.55% |

“We do not see systemic risks that are independent of a pandemic,” Fink stated. “The financial system appears secure and robust, and the market’s liquidity has proven effective during volatile times. There are, of course, uncertainties in the near term.”

TARIFF DISCUSSIONS CONTINUE

Amid concerns regarding tariffs, the White House has reassured investors that negotiations are progressing under U.S. Trade Representative Jamieson Greer.

“He confirmed that over 15 offers are currently being discussed, which is quite impressive considering the time frame. We’ve also received inquiries from more than 75 countries globally,” remarked White House Press Secretary Karoline Leavitt on Friday.

BOND MARKET UPDATE: 10-Year Treasury Yield at 4.5%

In the bond market, concerns of a potential economic recession are pushing investors away. As yields rise, prices decrease; the 10-year Treasury yield hit 4.5%, the highest level since February, with a weekly increase of over 50 basis points—the largest spike in more than four decades.

Treasury Secretary Scott Bessent addressed this issue during a Wednesday interview.

“Several substantial leveraged players are experiencing losses due to their leverage positions,” he stated in an appearance on “Mornings With Maria.” “However, I believe this situation isn’t systemic. It’s an uncomfortable but standard deleveraging process within the bond market.”

BIG BANK CEOs DISCUSS TARIFFS: ‘CONSIDERABLE TURBULENCE’

Bessent was also prompted to comment on the declining U.S. dollar and recent actions by China.

“They are depreciating their currency, which ultimately harms everyone involved. When I hear concerns about the dollar losing its status as the reserve currency, it seems misguided if the Chinese plan to utilize their currency as a trading instrument. That does not bode well for its status as a reserve asset,” he remarked.

Meanwhile, the euro and the Japanese yen have appreciated by 8% compared to the U.S. dollar.

PROBABILITY OF A U.S. RECESSION INCREASES

Several Wall Street analysts are raising warnings about the possibility of a U.S. recession. JPMorgan Chase CEO Jamie Dimon shared his insights this week.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 236.13 | +9.39 | +4.14% |

“There’s a general consensus: people are saying they’ll cut back, holding off to see how things develop. That’s the kind of talk you hear during recessionary times,” Dimon conveyed during an exclusive “Mornings with Maria” interview. When asked if he foresees a recession personally, he replied, “I prefer to rely on my economists at this stage, but I believe it’s a likely scenario.”

His firm has now assigned a 60% probability of a recession occurring, while Goldman Sachs estimates a 45% chance.

CONSUMER CONFIDENCE DECLINES

A recent survey conducted by the University of Michigan revealed a drop in the Consumer Sentiment Index to 50.8 this month, down from 57 in April, marking the fourth consecutive monthly decline.

“This decrease in sentiment is widespread and affects all demographics, including age, income, education, region, and political beliefs,” noted Joanne Hsu, Director of Surveys of Consumers.

PLUMMETING CONSUMER SENTIMENT DUE TO RECESSION FEARS AND TARIFF UNCERTAINTY

“Consumer sentiment has fallen by over 30% since December 2024, driven by escalating worries about developments in the trade war throughout the year. Many consumers identify multiple warning signs indicative of a potential recession: expectations surrounding business conditions, personal finances, incomes, inflation, and labor markets have all worsened this month,” Hsu added.

INFLATION TRENDS

The consumer price index for March reflected a slight decrease of 0.1% compared to February but was still up 2.4% year-over-year, surpassing the Federal Reserve’s target of 2%.

Despite some relief in costs, prices for essential items like eggs and uncooked ground beef remain significantly high, showing increases of 60% and 10%, respectively.

GOLD AS A SAFE HAVEN

The precious metal experienced fluctuations this week but managed to rebound to an unprecedented high of $3,222.20 an ounce, marking a 7% weekly rise—the most significant since March 2020. Analysts had forecasted bullish trends for gold prior to the escalation of tariff tensions, viewing it as both an inflation hedge and a traditional safe haven asset.

GET Finance Newso BUSINESS ON THE GO BY CLICKING HERE

“While inflation and real yields have traditionally driven gold prices, recent demand from central banks has become a significant factor in the current rise of gold prices,” noted a research report from Bank of America’s Global Commodity Research team led by Francisco Blanch and Irina Shaorshadze, who predict gold price may reach $3,500.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GLD | SPDR GOLD SHARES TRUST – USD ACC | 297.93 | +5.62 | +1.92% |

BITCOIN MARKET UPDATE

Bitcoin, the largest cryptocurrency by market capitalization, saw a rise on Friday, trading just above $83,000. However, this still represents a 21% drop from its all-time high of $106,734.51, achieved in December 2024.