In 2024, early-stage investments in Bitcoin-native startups experienced a remarkable uptick, marking a significant shift in a sector that was once considered niche, as highlighted in a recent research report by Trammell Venture Partners (TVP).

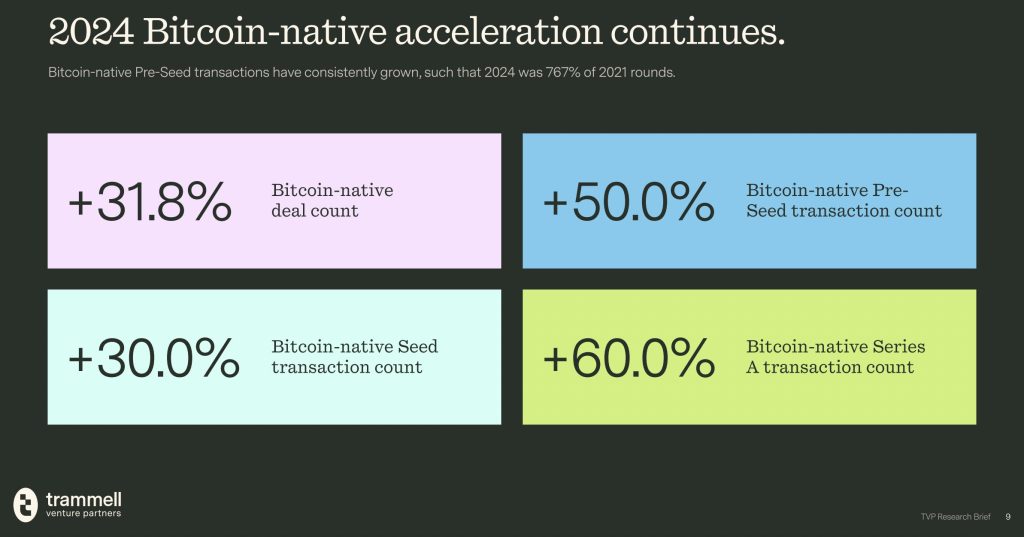

Despite an overall decline of 22.1% in total capital raised this year, the number of deals involving Bitcoin startups surged nearly 32%, with pre-seed investments seeing a notable 50% increase.

The report characterizes “Bitcoin-native” companies as businesses that are intrinsically connected to Bitcoin as both a monetary asset and a protocol stack, focusing on products that leverage Bitcoin’s growth and capabilities.

These startups differentiate themselves from broader crypto initiatives, which typically operate across various blockchain technologies, by dedicating their efforts entirely to the Bitcoin ecosystem.

Steady Growth in Bitcoin Startups Across All Early Stages

In 2024, the volume of Bitcoin-native pre-seed deals was over seven times higher than in 2021, signaling a significant increase in new ventures and concepts.

Furthermore, seed and Series A deal volumes posted impressive year-over-year growths of 30% and 60%, respectively.

Image Source: Trammell Venture Partners

Although the overall capital raised in the market may have seen a decline, the increase in the number of deals and the formation of new companies indicate a growing trust in Bitcoin-native startups. TVP points to four consecutive years of growth as evidence that these startups may soon capture a larger portion of crypto venture funding.

Institutional Investors Fuel Bitcoin Ecosystem Growth

This positive trajectory is bolstered by an expanding roster of institutional investors. Notable firms such as Founders Fund, Ribbit Capital, Y Combinator, and Valor Equity Partners have actively engaged in funding Bitcoin startup rounds in 2024, reflecting a mounting confidence in business models derived from Bitcoin’s foundational layers.

While Bitcoin commands over half of the total value in the cryptocurrency market, it only received 2.3% of venture capital funding in 2024, according to the report. Researchers interpret this discrepancy as a chance to recalibrate, particularly as the Bitcoin ecosystem evolves beyond simple mining and asset retention.

With their straightforward business models, targeted focus, and increasing investor enthusiasm, Bitcoin-native startups are quietly redefining the landscape of crypto innovation.

The post Early-Stage Deals for Bitcoin Startups Jumped in 2024, Defying Broader Market Trends appeared first on Cryptonews.