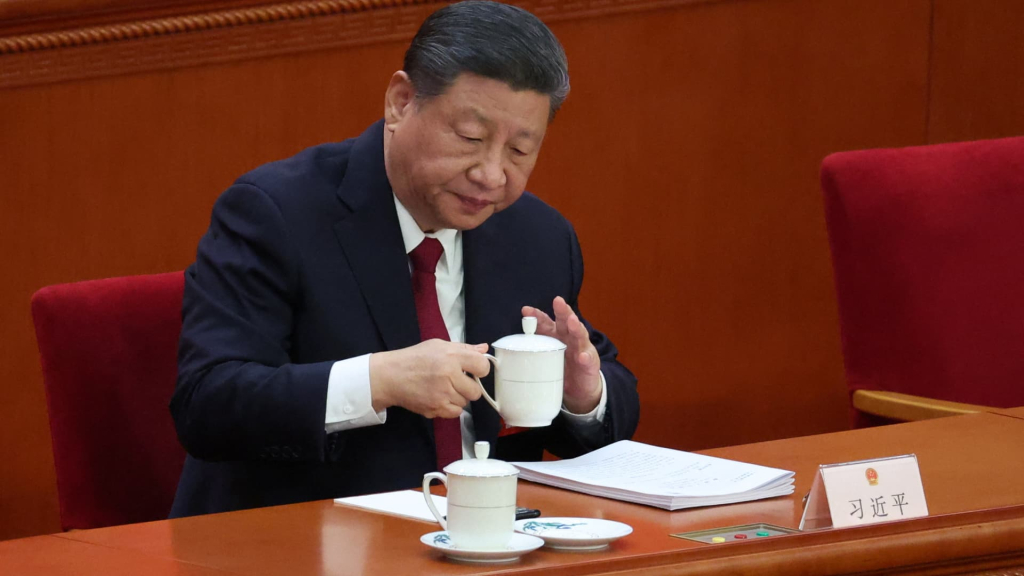

BEIJING — In response to rising pressure from external factors, China is poised to implement targeted support measures aimed at assisting struggling businesses, according to a statement from a meeting led by President Xi Jinping on Friday.

This Politburo session — comprised of senior officials from China’s ruling party — takes place amidst heightened tensions between the United States and China, which have seen the imposition of reciprocal tariffs exceeding 100% this month. Major financial institutions on Wall Street have subsequently revised their projections for China’s GDP this year, even as the nation continues to pursue its ambitious growth target of “around 5%” established earlier in March.

The authorities have emphasized the need for “multiple measures to assist businesses in difficulty,” including financial aid, as noted in a Chinese-language report translated by Finance Newso.

Moreover, the Politburo advocated for a “timely reduction” in interest rates and the reserve requirement ratio, which dictates the liquidity that banks must maintain.

According to Zong Liang, chief researcher at the Bank of China, while policymakers are maintaining their earlier approach, there is an openness to implement measures that are more specifically targeted. He anticipates that China will engage in further assessments of particular businesses affected by tariffs to tailor its support accordingly.

In a significant policy shift, China raised its deficit target to 4% of GDP in March. Finance Minister Lan Fo’an signaled that the country has some flexibility in its fiscal policy.

Following the recent deterioration of trade relations with the U.S., numerous Chinese local governments and leading enterprises have moved to facilitate the redirection of exports to bolster domestic sales.

The statement from the Politburo underscored the intention to elevate the income of middle and lower-income demographics while stimulating consumption in services. Additionally, there were calls for advancements in technology, particularly in the realm of artificial intelligence.

Zhiwei Zhang, president and chief economist at Pinpoint Asset Management, commented on the press release, indicating that the government appears prepared to introduce new policies to counteract the economic ramifications of external shocks.

“However, it seems that Beijing is not hurrying to initiate a significant stimulus package at this time,” he added. “It requires careful monitoring and evaluation to determine the optimal timing and magnitude of any response to trade shocks.”

Policy coordination

Following the release of the meeting’s statement, the CSI 300 index experienced a brief dip, while Hong Kong’s Hang Seng Index scaled back some of its earlier gains.

The Politburo, consisting of senior members of the Communist Party, typically outlines broad policy guidelines during their meetings.

During this latest session, existing policies set forth by the State Council, which is the highest executive authority in China, were reaffirmed, indicating a strong commitment to coordinated policy efforts, according to Bruce Pang, an adjunct associate professor at CUHK Business School.

“While these measures may not include many surprises or groundbreaking strategies, they equip policymakers with essential tools to address external uncertainties,” Pang noted, also mentioning the expectation of an upcoming private sector law to enhance the business environment.

The National People’s Congress, China’s legislative body, is scheduled to convene from Sunday to Wednesday, where it will assess new legislation aimed at supporting the private sector.