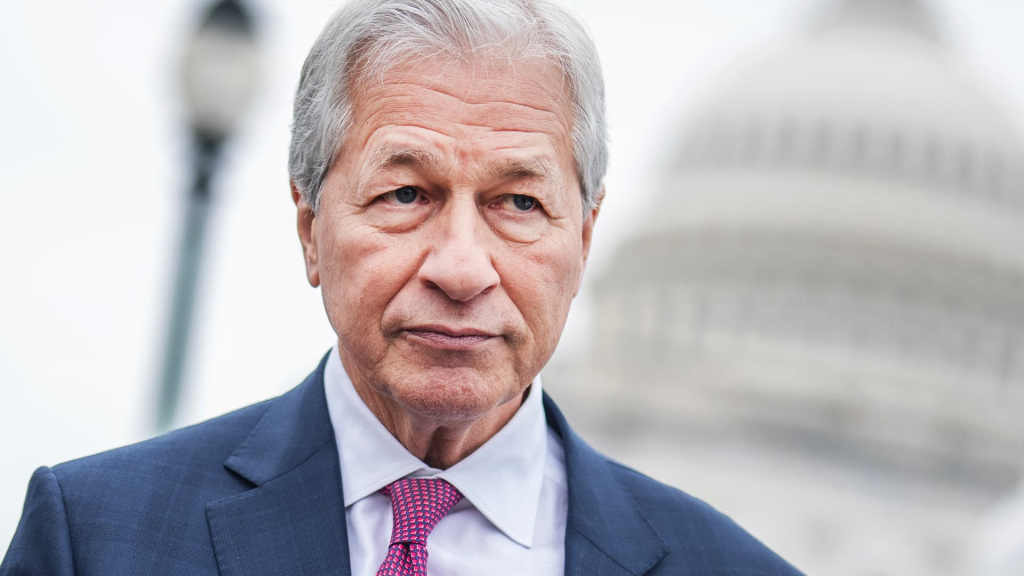

Jamie Dimon emphasized his lack of enthusiasm for stablecoins, yet acknowledged that he cannot afford to ignore the trend.

This sentiment came during an earnings conference call when Dimon was questioned about JPMorgan Chase’s explorations in this payment technology, underscoring the stance of the nation’s premier bank.

Stablecoins are cryptocurrencies designed to retain a consistent value, typically pegged to established currencies like the U.S. dollar. Last month, JPMorgan revealed plans to introduce a more tailored stablecoin limited to its clients, distinguishing it from a fully-fledged stablecoin that would be widely accepted.

“We’re going to be involved in both JPMorgan deposit coin and stablecoins to understand it, to be good at it,” he stated. “I think they’re real, but I don’t know why you’d want to [use a] stablecoin as opposed to just payment.”

At 69, Dimon stands as one of the leading critics of certain cryptocurrencies, including bitcoin. However, given that JPMorgan facilitates almost $10 trillion in daily global payments, exploring stablecoins seems prudent amid a shifting regulatory landscape.

Dimon cautioned that neglecting this area could allow fintech companies to gain competitive ground as they aim to integrate aspects of the regulated banking system, stating, “You know, these guys are very smart. They’re trying to figure out a way to create bank accounts, to get into payment systems and rewards programs, and we have to be cognizant of that. And the way to be cognizant is to be involved.”

Bank of America CEO Brian Moynihan has also indicated intentions for his company to engage with stablecoins.

One avenue for traditional banks could involve collaboration through Early Warning Services, similar to how they united to launch Zelle, an instant peer-to-peer payment service, to counter the influence of fintech platforms like PayPal and Square’s Cash App.

When pressed about the potential for collaboration among banks, Dimon refrained from providing a definitive response. “That’s a great question, and we’ll leave it remaining as a question,” he remarked. “You can assume we’re thinking about all that.”