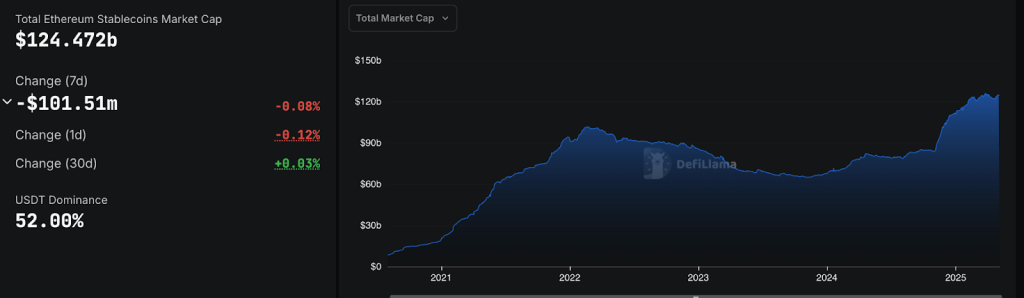

In January 2018, when Ethereum first breached the $1,400 threshold, the total stablecoin market capitalization associated with the network was a modest $124,500. Fast forward to May 6, 2025, and that figure has ballooned to an astonishing $124.5 billion, according to data from DeFiLlama, representing a staggering one-million-fold increase.

Source: DeFiLlama

This unprecedented growth is closely linked to Ethereum’s status as the leading layer for digital dollar liquidity. Tether (USDT) dominates this landscape, claiming 52% of the market and representing $64.7 billion of the overall stablecoin total. Following USDT is USD Coin (USDC) with $37 billion, and Ethena’s USDe at $4.5 billion. Other significant players include Sky Dollar’s USDs ($3.8 billion), DAI ($3.6 billion), and a variety of offerings including BlackRock’s BUIDL, Ethena’s USDtb, FDUSD, USDO, and PayPal’s PYUSD.

Despite experiencing a slight decline of 0.08% or approximately $100 million in the past week, the stablecoin ecosystem remains robust. Ethereum itself is currently trading at $1,804, reflecting a 10.9% increase over the last two weeks, with a market cap of $216 billion and daily trading volume hitting $9.2 billion.

Source: Finance Newso

This surge in stablecoin activity coincides with Ethereum’s preparation for a significant upgrade this month, which will include EIP-7251. This enhancement will dramatically increase the maximum staking capacity from 32 ETH to 2,048 ETH, with implications for validator operations, decentralization, and overall efficiency on-chain.

Stablecoin Market Matures: Institutions, Regulations, and Adoption Fuel Growth

The global stablecoin market is nearing a staggering $240 billion, approaching an all-time high. The last week of April alone witnessed a notable addition of over $5 billion in new supply, with year-over-year growth telling an even more compelling story.

The #stablecoin market nears $240B all-time high with $5B weekly surge, as Citigroup forecasts $2T by 2030 amid global crypto payment adoption.#Stablecoins #CryptoGrowth https://t.co/NhG8kYtwlK

The #stablecoin market nears $240B all-time high with $5B weekly surge, as Citigroup forecasts $2T by 2030 amid global crypto payment adoption.#Stablecoins #CryptoGrowth https://t.co/NhG8kYtwlK

— Finance Newso.com (@Finance Newso) April 29, 2025

Active stablecoin wallets experienced remarkable growth, surging from 19.6 million in February 2024 to 30 million by February 2025, marking a 53% increase. In parallel, the total supply of stablecoins has escalated from $138 billion to $225 billion during the same timeframe.

Tether remains a key player, holding over 61% of the global market share. However, the increasing availability of alternatives like USDC, USDe, and DAI signals a maturation of the ecosystem.

The convergence of institutional interest, technological advancements, and proactive regulatory frameworks is reshaping the landscape significantly. Citi anticipates stablecoins could exceed $2 trillion in market capitalization by 2030, with more optimistic projections suggesting numbers could reach up to $3.7 trillion.

Citigroup has projected a rise in stablecoin market, forecasting its total market cap to soar from $240 billion to $2 trillion by 2030. #Stablecoin #Citigroup https://t.co/tGNT3XfNC0

Citigroup has projected a rise in stablecoin market, forecasting its total market cap to soar from $240 billion to $2 trillion by 2030. #Stablecoin #Citigroup https://t.co/tGNT3XfNC0

— Finance Newso.com (@Finance Newso) April 25, 2025

In a surprising turn, Mastercard has emerged as a major advocate for stablecoins, recently launching a framework enabling 150 million merchants to accept digital dollars through a comprehensive “360-degree” strategy.

Mastercard announced its partnership with payments processor Nuvei, Circle and Paxos to enable a seamless stablecoin payment ecosystem. #Mastercard #Stablecoin #OKXCard https://t.co/VyzaH9fRyY

Mastercard announced its partnership with payments processor Nuvei, Circle and Paxos to enable a seamless stablecoin payment ecosystem. #Mastercard #Stablecoin #OKXCard https://t.co/VyzaH9fRyY

— Finance Newso.com (@Finance Newso) April 29, 2025

By collaborating with payment processors such as Nuvei and stablecoin issuers including Circle and Paxos, Mastercard has established the necessary infrastructure to facilitate wallets, card issuance, on-chain remittances, and instant settlements for merchants.

Another payments powerhouse, Stripe, is also preparing to introduce its own USD-backed stablecoin aimed at enhancing its payment capabilities beyond the North American and European markets.

Ethereum’s Hidden Triumph: Powering Trillions Amid Market Lulls

Though recent price trends have painted a sobering picture for Ethereum—with reports indicating a 45% decline in Q1 2025—the underlying metrics reveal a more nuanced narrative.

In fact, Bitwise’s Q1 report referred to this period as “The Best Worst Quarter in Crypto’s History.” During this timeframe, stablecoins facilitated a record-breaking $27.6 trillion in on-chain settlements, eclipsing Visa’s annual settlement volume of $12 trillion. Notably, Ethereum is the main settlement layer driving much of this activity.

Stablecoins settle $27.6 trillion in Q1 2025, doubling Visa’s annual volume, as Ethereum’s infrastructure dominates global digital payments, even amid price turbulence. #Stablecoins #Ethereum https://t.co/LVFclqLGPX

Stablecoins settle $27.6 trillion in Q1 2025, doubling Visa’s annual volume, as Ethereum’s infrastructure dominates global digital payments, even amid price turbulence. #Stablecoins #Ethereum https://t.co/LVFclqLGPX

— Finance Newso.com (@Finance Newso) April 18, 2025

As the network scales, resources have shifted to Layer 2 solutions like Base, Arbitrum, and Optimism, which offer significantly lower transaction fees and accommodate a substantial amount of transaction volume originally processed by the Ethereum mainnet. With median fees at just $0.66, Ethereum remains competitive, complemented by its unparalleled developer engagement as it continues to lead in average developer count across the industry.

The first quarter of 2025 also brought noteworthy alignments with political and institutional forces favoring cryptocurrency. With the election of a pro-crypto U.S. president, digital assets were positioned as a national strategic priority. Executive orders have initiated a Strategic Bitcoin Reserve and rolled back previous restrictions, allowing banks to custody crypto assets and dismissing lawsuits from the SEC.

@coinbase has uncovered @FDICgov documents revealing efforts to halt crypto banking activities, exposing a systematic push against the industry. #Coinbase #FDIC https://t.co/Wr6DByXffC

@coinbase has uncovered @FDICgov documents revealing efforts to halt crypto banking activities, exposing a systematic push against the industry. #Coinbase #FDIC https://t.co/Wr6DByXffC

— Finance Newso.com (@Finance Newso) January 3, 2025

Throughout this tumultuous period, Ethereum’s core strength lies beyond mere token performance. The platform continues to serve as the backbone for decentralized finance (DeFi), payments, and innovative smart contracts. While other networks, such as Solana, may have experienced short-lived spikes in revenue or user engagement, Ethereum’s foundational stability endures, as evidenced by Uniswap’s revenue reaching $1.03 billion and increased rollup adoption.

The expansion of the stablecoin market has positioned Ethereum at the forefront of a significant financial revolution. Once merely a platform for initial coin offerings (ICOs), it now plays a pivotal role in enabling trillions in global settlement values.

The post Ethereum Stablecoin Market Explodes 1M-Fold to $124B – What’s Driving It? appeared first on Finance Newso.