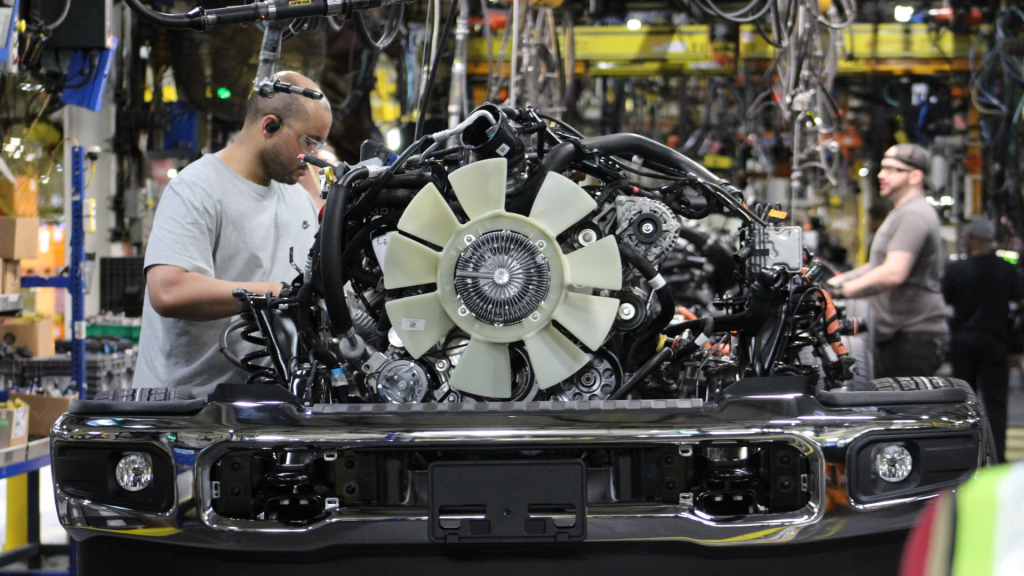

LOUISVILLE, Ky. — A 2025 Ford Expedition SUV featuring bronze exterior trim emerges from the assembly line at Ford Motor‘s Kentucky Truck Plant. Though assembled entirely by American workers, the vehicle is not entirely “Made in the USA.”

According to the window sticker, more than 58% of the Expedition’s primary components were manufactured abroad, with 22% sourced from Mexico, including the key Ford-engineered, 3.5-liter twin-turbocharged V-6 Ecoboost engine.

This popular large SUV exemplifies the complexities of the global automotive supply chain, highlighting how even products manufactured by iconic American companies like Ford heavily depend on international resources.

The expansive Kentucky assembly facility, employing over 9,000 workers to produce the Expedition, F-Series pickup trucks, and Lincoln Navigator SUVs, is the kind of plant that former President Donald Trump urged automakers to build on U.S. soil, leveraging aggressive tariffs as a catalyst for local production.

Following the imposition of a 25% tariff on imported vehicles and automotive components, automakers have rushed to emphasize their U.S. investments and efforts to localize their supply chains. However, experts warn that while such an approach would create jobs and boost the economy, fully sourcing auto parts domestically is far from practical.

“Even with the tariffs, some parts remain cheaper to manufacture abroad rather than in the USA at scale,” explained Martin French, a veteran supplier executive and partner at Berylls Strategy Advisors USA.

Moreover, essential processing and production facilities for materials like steel, aluminum, and semiconductor chips, as well as raw materials such as platinum and palladium, are scarce in the U.S. Without substantial investment in new plants or mines, experts indicate that building such infrastructure could take a decade or more.

The higher costs associated with manufacturing a 100% U.S.-made vehicle could dissuade many consumers from entering the market for new vehicles, potentially resulting in decreased demand and lower production rates.

“We could shift all production to the U.S., but if every Ford is $50,000, we won’t be competitive as a company,” Ford CEO Jim Farley remarked during a recent appearance on Finance Newso’s “Squawk Box.” “This challenge is something every automaker will face, even those most identified as American.”

Farley noted that 15% to 20% of standardized vehicle parts are challenging, if not impossible, to source from within the U.S. This includes components such as small fasteners, complex wiring harnesses, and approximately $5,000 worth of semiconductors per vehicle, which are predominantly acquired from Asia.

According to S&P Global Mobility, a typical vehicle comprises roughly 20,000 parts, which can originate from anywhere between 50 to 120 countries.

As an illustration, the Ford F-150, which shares a platform and specific components with the Expedition, is exclusively assembled in the U.S. but consists of around 2,700 main billable parts, excluding numerous smaller items, as reported by Caresoft, an engineering benchmarking consulting firm.

The Trump administration might alleviate the financial burden of American-made vehicles through tax incentives or consumer credits, similar to the former $7,500 electric vehicle incentive that Trump aimed to abolish.

Nevertheless, the complexities and costs associated with crafting a 100% American-made vehicle extend beyond initial impressions. Additionally, tracking U.S. content is cumbersome since automakers are required to report a combined percentage of Canadian and U.S. content, rather than solely U.S. contributions.

The material expenses alone, without considering manufacturing investments, would significantly hike a vehicle’s price, thwarting profits for automakers and compelling price hikes for consumers, according to several automotive analysts and executives speaking to Finance Newso.

These sources, who preferred anonymity, estimated that each incremental approach toward 100% U.S. and Canadian parts would add thousands of dollars to production costs.

100% U.S.-made vehicle

Mark Wakefield, a partner and head of the global automotive market at consulting firm AlixPartners, stated that while nothing is beyond reach over time, the investment required for U.S. and Canadian sourcing would result in exponentially rising costs closer to achieving a 100% “Made in the USA” vehicle.

“The expenses escalate drastically as you approach 100%,” Wakefield explained. “Getting above 90% can become very costly, while striving for 95% involves complexities that require significant time and effort [to accomplish].”

To attain that final 5% to 10%, Wakefield insisted that it could be “extremely pricey” and potentially require a decade or more to establish sourcing for raw materials and re-establish production for some components.

“I don’t see it being feasible to exceed around 95% on average with current conditions, largely due to the need for extensive and time-consuming infrastructure development,” he commented. “Establishing processing and raw material facilities demands considerable financial resources and can take years to bring online.”

Two auto supplier executives disclosed to Finance Newso that striving for a fully U.S.-made vehicle is “unrealistic,” if not impossible, to do profitability at this juncture. Another automaker executive estimated that the typical cost increase for a U.S.-assembled full-size pickup could soar by at least $7,000 if more components were sourced from the U.S. and Canada.

General assessments indicated that a $5,000 increment would be required to elevate a vehicle’s U.S./Canadian parts content from below 70% to 75%, an additional $5,000 to $10,000 to achieve 90%, and several thousand more to surpass that threshold.

Currently, the average transaction price for a new vehicle in the U.S. is approximately $48,000, according to Cox Automotive. If a vehicle’s components total around $30,000, the added costs could lead companies to incur an extra $10,000 to $20,000.

Cars.com identifies the U.S. as the most expensive nation for vehicle production. The average price for a new car assembled in the U.S. is over $53,200, compared to about $40,700 in Mexico, $46,148 in Canada, and roughly $51,000 in China.

A hypothetical new automaker, which we will call U.S. Motors, might spend billions to build new factories and create an entirely domestic supply chain, but the resulting vehicle is likely to be low-volume and prohibitively expensive, according to expert insights.

Taking Ferrari as an example, every vehicle produced by the renowned manufacturer originates from Italy, leveraging as many local components as feasible.

However, even Ferrari’s high-priced sports cars incorporate parts and materials from non-Italian suppliers, such as airbags, brakes, tires, and batteries.

“If you were to operate at low volumes and innovate uniquely with the vehicle, it might be possible to create vehicles costing $300,000 to $400,000 that are entirely American,” Wakefield suggested. “Achieving this on a larger scale would demand 10 to 15 years and an investment of approximately $100 billion.”

What’s more realistic?

Reaching a target where vehicles consist of 75% U.S. and Canadian parts, with final assembly conducted in America, represents a more attainable objective that “doesn’t compel companies to undertake unfeasible practices,” according to Wakefield, indicating that certain vehicles already meet this standard.

However, achieving this benchmark on a wider scale could necessitate billions in new investments from automakers and suppliers to localize production. Some manufacturers may transition more smoothly, while others will require significant adjustments in both sourcing and production.

This reflects a shift from the 2007 model-year NHTSA data, where all top 16 vehicles boasting 90% or higher U.S. and Canadian content were produced by GM and Ford. At that time, the Ford Expedition ranked among the highest at 95%, prior to the global integration of the automotive supply chain following the Great Recession and before significant advancements in automotive technology necessitated new components and materials.

For decades, trends indicate a decline in U.S. and Canadian content as globalization has expanded supply chains, leading to an uptick in sourcing from Mexican manufacturers.

Many imported luxury vehicles, particularly from German brands and Toyota’s Lexus line, feature minimal U.S.-sourced content, often recording none or just 1%, according to federal statistics.

The percentages reported under the American Automobile Labeling Act of 1992 derive from a “carline” basis rather than individual vehicle assessments and can be rounded to the nearest 5%. Manufacturers are tasked with calculating and reporting these percentages to the government.

However, a high proportion of North American parts does not necessarily confirm that the vehicles are manufactured in the U.S. For instance, the 2024 Toyota RAV4 is said to possess 70% U.S. and Canadian parts while being constructed in Canada.

“It’s entirely possible to have a vehicle manufactured in the U.S. that utilizes only 1% American parts,” explained Patrick Masterson, a leading researcher for Cars.com’s “American-Made Index.”

Cars.com’s annual American-Made Index evaluates vehicle assembly, parts content, and additional factors. This year, no vehicles from Ford or General Motors made the top ten, with two Teslas, two Hondas, and a Volkswagen taking the top five positions.

The index considered over 400 vehicles from the model year 2024 for assessment based on criteria including assembly location, parts content, engine origin, transmission source, and U.S. manufacturing workforce composition.

The recent model of the 2025 Ford Expedition is anticipated to achieve a better score than its predecessor, which ranked 78th, reflecting an uptick in domestic component content.

Masterson remarked that there has been notable growth in interest for the “American-Made Index” this year, partially driven by Trump’s tariff policies and a rising sense of nationalism among consumers.

“The traffic surrounding the ‘American-Made Index’ has surged this year. … There’s significant concern over this topic now more than ever,” Masterson stated, adding, “Achieving a 100% U.S.-made vehicle would be exceptionally difficult.”