Recent developments regarding a proposed House tax and spending bill indicate significant changes to the health insurance landscape in the United States. If passed in its current form, the legislation threatens to remove millions of Americans from health insurance programs. This includes substantial cuts to Medicaid and the Affordable Care Act (ACA) as part of an initiative to finance President Donald Trump’s priorities, including nearly $4 trillion in tax reductions.

The Congressional Budget Office (CBO), an impartial arbiter of budgetary impact, estimates that approximately 11 million individuals would lose health insurance under the provisions outlined in the House proposal. Additionally, another 4 million are expected to become uninsured when existing Obamacare subsidies expire, as the bill does not include an extension for these benefits.

The potential increase in the uninsured population is attributed to policies that would introduce new barriers to access, escalate insurance costs, and eliminate benefits for specific groups, including certain legal immigrants.

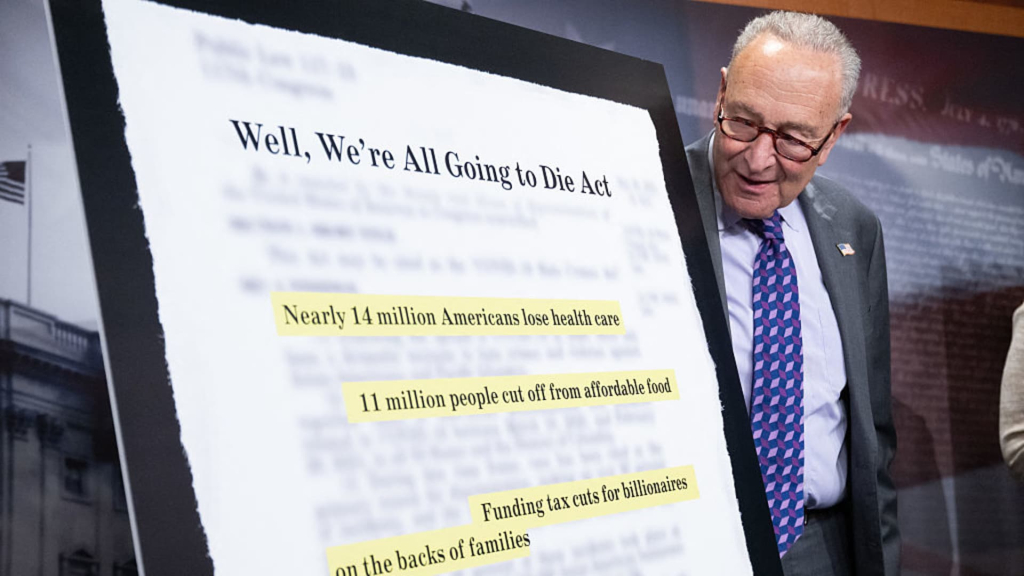

Titled the “One Big Beautiful Bill Act,” this legislation may undergo changes as it moves to the Senate, where healthcare cuts remain a contentious topic. A small number of Republican senators, critical to the bill’s passage, have expressed reluctance towards significant Medicaid reductions.

According to CBO projections, the bill would add $2.4 trillion to the national debt over ten years while simultaneously reducing healthcare program funding by over $900 billion during the same timeframe, as noted by the Penn Wharton Budget Model.

This proposed legislation marks a drastic pivot away from the progressive expansion of health insurance access observed over the past half-century, including through Medicare, Medicaid, and the ACA, according to Alice Burns, associate director at KFF’s program on Medicaid and the uninsured.

“We are facing the largest reduction in health insurance coverage we’ve ever seen,” Burns commented. “This raises serious questions about how individuals, healthcare providers, and states will respond.”

The following section outlines how the new bill could significantly increase the uninsured rate across various demographics.

No population ‘safe’ from proposed Medicaid cuts

Experts warn that proposed federal cuts to Medicaid funding would have widespread repercussions across various demographics.

“No population is exempt from a bill that slashes over $800 billion from Medicaid over the next decade, forcing states to make tough decisions,” explained Allison Orris, senior fellow and Medicaid policy director at the Center on Budget and Policy Priorities.

A contentious aspect of the House proposal involves new work requirements for individuals aged 19 to 64 without qualifying exemptions, which would determine Medicaid eligibility for those states that adopted Medicaid expansion under the ACA, according to Orris.

Individuals would need to prove they are working or engaging in approved activities for at least 80 hours monthly. Furthermore, states would have to check compliance for one or more consecutive months prior to coverage and conduct regular verification at least biannually for existing enrollees.

In a recent interview with NBC News on “Meet the Press,” House Speaker Mike Johnson asserted that “4.8 million people will not lose their Medicaid coverage unless they choose to,” suggesting the work requirements are manageable.

Nevertheless, the CBO has projected that these requirements would lead to approximately 5.2 million adults losing federal Medicaid coverage, leaving 4.8 million without insurance. This estimate may be conservative, as it does not account for individuals who may qualify but fail to report their work activities or proper documentation for exemptions, noted KFF’s Burns.

Overall, the CBO predicts that approximately 10.3 million individuals could lose Medicaid coverage—translating to 7.8 million people losing health insurance altogether, according to Burns’ analysis.

Proposal creates state Medicaid funding challenges

States typically rely on healthcare provider taxes to fund Medicaid, but the proposed House bill seeks to end this practice, according to Orris.

This could force states to face difficult decisions about whether to cut coverage or make reductions elsewhere in their budgets to sustain Medicaid support, she remarked.

For instance, funding for home and community-based services may be at risk as states aim to maintain mandatory benefits such as inpatient and outpatient hospital care, she added.

In addition, the bill would postpone until 2035 two eligibility reforms introduced under the Biden administration designed to simplify Medicaid enrollment and renewal processes, especially for older adults and those with disabilities, Burns mentioned.

Furthermore, states would see their federal matching rates decreased for Medicaid expenditures if they provide coverage to undocumented immigrants, according to her observations.

Affordable Care Act cuts ‘wonky’ but ‘consequential’

Currently, more than 24 million individuals rely on health insurance obtained through ACA marketplaces. This coverage is particularly vital for those without employer-sponsored health options, including self-employed individuals and low-wage workers, along with older adults who have yet to reach Medicare eligibility, as stated by researchers at the Center on Budget and Policy Priorities, a left-leaning think tank.

The proposed House legislation would significantly diminish ACA enrollment numbers—and by extension, the total insured population—through a series of intertwined modifications rather than a single sweeping change, according to Drew Altman, president and CEO of KFF, a nonpartisan health policy organization.

“Although many of these changes may seem technical and esoteric, they still carry significant implications,” Altman wrote.

Expiring ACA subsidies add to coverage costs

Enrollment in the ACA is currently at a record high, having more than doubled since 2020, primarily due to enhanced insurance subsidies initiated by Democrats in the American Rescue Plan of 2021 and extended through 2025 via the Inflation Reduction Act.

These subsidies, referred to as “premium tax credits,” serve to significantly lower consumers’ monthly insurance costs, with options available to either claim them during tax time or apply them upfront to reduce premiums.

Moreover, Congress expanded the subsidy eligibility criteria to encompass more middle-income households while lowering the maximum contribution that families are mandated to make towards premium payments.

The enhanced subsidies effectively reduced household premiums by $705 (or 44%) in 2024, lowering costs from $1,593 to $888 annually, according to KFF analyses.

The House Republican plan does not provide for the continuation of these enhanced subsidies, resulting in their expiration after this year.

The Congressional Budget Office projects that approximately 4.2 million individuals will find themselves uninsured by 2034 if the extended premium tax credits are not renewed, according to their findings.

“People may simply opt out of obtaining coverage because they cannot afford it,” cautioned John Graves, a health policy and medicine professor at Vanderbilt University.

For the remaining families holding marketplace plans, costs will become increasingly burdensome. For instance, a typical family of four earning $65,000 is predicted to see a $2,400 increase in yearly expenses if the enhanced premium tax credits are not extended, according to estimates from the Center on Budget and Policy Priorities.

Adding red tape to eligibility, enrollment

The implementation of additional provisions in the House legislation could lead to over 3 million people losing their ACA coverage, as projected by CBO estimates.

Significant amendments include widespread changes to eligibility, stated Kent Smetters, a professor of business economics and public policy at the University of Pennsylvania’s Wharton School.

For instance, the bill reduces the annual open enrollment period by roughly a month, shifting the deadline to December 15 instead of the typical January 15 in most states.

Furthermore, it eliminates the automatic re-enrollment process for health insurance, utilized by more than half of individuals renewing coverage in 2025, by instituting a mandate for all enrollees to actively secure their coverage annually, according to CBPP.

Additionally, the bill would require households to confirm their eligibility details—such as income, immigration status, health coverage status, and residence—before receiving subsidies or cost-sharing reductions, according to KFF.

Graves likens introducing additional bureaucratic hurdles to navigating a rough path with an apple cart. “The more uneven you make the road, the more apples will fall off the cart,” he explained.

Uncapping subsidy repayments

Another notable change proposed in the bill involves the elimination of repayment caps for premium subsidies.

Currently, households receive federal subsidies based on estimated annual income, which determines their total premium tax credits. If actual income exceeds their initial estimate during the tax season, they must repay any excess subsidies.

Current regulations cap repayments for several households; however, the House bill would require all recipients to pay back the total amount of any excess subsidies, regardless of their income level, according to KFF.

While this requirement might appear sensible, KFF’s Altman labels it impractical and potentially “cruel.” “Income for low-income individuals can be unpredictable, and many Marketplace enrollees work hourly, operate their own businesses, or manage multiple jobs, which complicates their ability to accurately forecast their income for the upcoming year,” he remarked.

Curtailing use by immigrants

The proposed legislation also seeks to restrict ACA marketplace insurance access for certain legal immigrant groups, experts indicate.

Beginning January 1, 2027, various lawfully present immigrants, including refugees, asylees, and those with Temporary Protected Status, would find themselves ineligible for subsidized insurance on the ACA exchanges, according to KFF.

The bill would also prevent Deferred Action for Childhood Arrivals (DACA) recipients from purchasing insurance through ACA exchanges in all states. This group, also known as “Dreamers,” is currently recognized as “lawfully present” for healthcare coverage, allowing them to enroll (and receive subsidies) in 31 states and the District of Columbia.