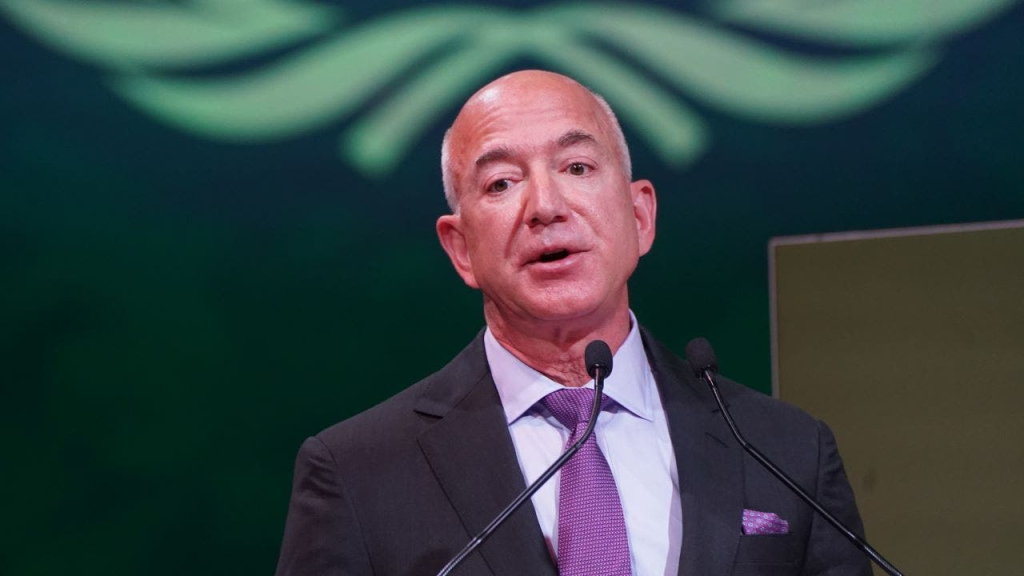

Jeff Bezos has announced plans to sell up to 25 million shares of Amazon, as detailed in a recent filing with the Securities and Exchange Commission (SEC).

In a quarterly report submitted to the SEC, Amazon disclosed that its founder implemented a trading strategy last month, designed to comply with Rule 10b5-1(c). This approach allows him to divest a significant portion of his holdings.

The shares in question were valued at more than $4.7 billion as of Friday morning.

This trading plan allows Bezos, who has been at the helm of Amazon for over 30 years and is currently its executive chair, to sell the shares gradually, with the process expected to conclude by May 29, 2026, contingent upon specific conditions outlined in the report.

AMAZON TAKES FIRST STEP TOWARD SATELLITE INTERNET SERVICE WITH SUCCESSFUL LAUNCH

Another SEC filing revealed that Bezos directly owned over 909.4 million Amazon shares as of March 3.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMZN | AMAZON.COM INC. | 190.20 | +5.78 | +3.13% |

This is not the first instance in which Bezos has utilized trading plans to sell portions of his Amazon shares.

JEFF BEZOS-BACKED AUTOMAKER UNVEILS AFFORDABLE EV PICKUP TRUCK

In a previous plan, he sold 50 million shares across several transactions in February 2024, raising more than $8.5 billion in the process.

A substantial portion of Bezos’s twelve-figure net worth is derived from his Amazon holdings.

As reported by Forbes, Bezos’s net worth stood at $205.4 billion as of Friday morning, placing him as the world’s second-richest individual, trailing only Tesla CEO Elon Musk.

In addition to his role at Amazon, Bezos owns The Washington Post and founded Blue Origin.

VENICE TO PLAY HOST TO BEZOS, SANCHEZ WEDDING, CITY SAYS