Key Points:

As digital assets increasingly integrate into corporate treasury management, firms may need to revisit their risk assessments and accounting models. The incorporation of Bitcoin is expected to transform corporate governance and investor reporting by demanding higher levels of transparency. This strategic shift may also affect market sentiment and reshape how credit and valuation metrics are applied to digital assets.

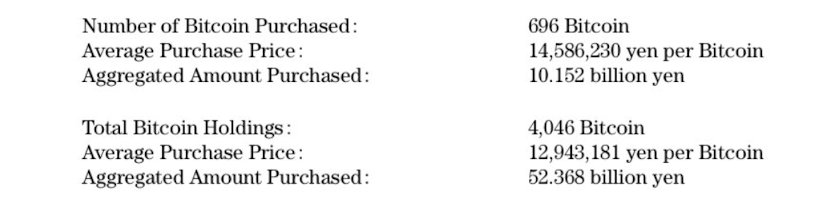

On Tuesday, Metaplanet Inc., headquartered in Tokyo, revealed it had purchased an additional 696 Bitcoin, funded by revenues from cash-secured put options it had previously sold. This latest acquisition raises Metaplanet’s total Bitcoin holdings to 4,046 BTC.

*Metaplanet Purchases Additional 696 $BTC* pic.twitter.com/ppnm8ZNH5X

— Metaplanet Inc. (@Metaplanet_JP) April 1, 2025

The Bitcoin acquisition was executed via the company’s Bitcoin Income Generation segment. The average purchase price for this latest batch was ¥12,943,181 (around $86,700) per Bitcoin, amounting to a total investment of ¥52.368 billion.

Additionally, on Monday, Metaplanet announced the issuance of ¥2 billion (approximately $13.3 million) in zero-interest bonds, with the funds specifically allocated for Bitcoin purchases. This initiative received approval at a board meeting held on March 31 and aligns with the company’s overall strategy to anchor its treasury in Bitcoin.

Metaplanet’s Bitcoin Income Strategy in Q1 2025

Throughout the first quarter of FY2025, Metaplanet continued its established strategy of trading cash-secured Bitcoin put options. The firm reported operating revenues of ¥770.35 million from these options, translating to approximately 50.26 BTC in premiums.

This approach resulted in the acquisition of 645.74 BTC through options, contributing to a total increase of 696 BTC in its holdings for the quarter. By deploying ¥9.386 billion in collateral, Metaplanet was able to secure more Bitcoin than it could have through direct market purchases.

The nominal book cost per Bitcoin was set at ¥14,586,230, but factoring in premiums allowed for a reduced effective cost of ¥13,479,404 per BTC. This strategy enabled Metaplanet to acquire Bitcoin at prices that were below market rates during the quarter.

Bitcoin Yield as a Treasury Metric

Metaplanet has adopted BTC Yield as a key performance metric to assess the growth of its total Bitcoin holdings in relation to fully diluted shares outstanding. This measure aids the company in evaluating the impact of its acquisition strategy on shareholder value.

By expanding its Bitcoin exposure and enhancing capital efficiency, Metaplanet has reinforced its commitment to managing a corporate treasury focused on Bitcoin. Between July and September 2024, the company posted a BTC Yield of 41.7%. This figure surged to 309.8% in the fourth quarter of 2024 and reached 95.6% in Q1 2025, indicating a sustained increase in Bitcoin reserves.

Metaplanet’s Strategic Outlook

Metaplanet has been steadily repositioning itself as a company aligned with Bitcoin, taking cues from MicroStrategy’s strategy in the U.S. The company began its Bitcoin acquisition journey in April 2024 and has publicly announced a goal of accumulating a reserve of 10,000 BTC by the end of 2025.

Japan’s @Metaplanet_JP plans to scale its Bitcoin holdings to 10,000 BTC this year, using advanced capital market strategies to accelerate its crypto growth.#Metaplanet #BitcoinTreasury https://t.co/8CzfEGItV1

Japan’s @Metaplanet_JP plans to scale its Bitcoin holdings to 10,000 BTC this year, using advanced capital market strategies to accelerate its crypto growth.#Metaplanet #BitcoinTreasury https://t.co/8CzfEGItV1

— Cryptonews.com (@cryptonews) January 6, 2025

The firm views Bitcoin as a hedge against ongoing economic challenges in Japan, including currency instability and increasing national debt. By anchoring its balance sheet in Bitcoin, Metaplanet has strategically positioned itself for sustained exposure to decentralized assets, moving away from reliance on fiat stability.