A new exchange-traded fund (ETF) that aims to capitalize on the burgeoning artificial intelligence sector has been launched, featuring a selection of 30 stocks recommended by Wall Street analyst Dan Ives. This ETF is poised to be a groundbreaking initiative in the financial industry.

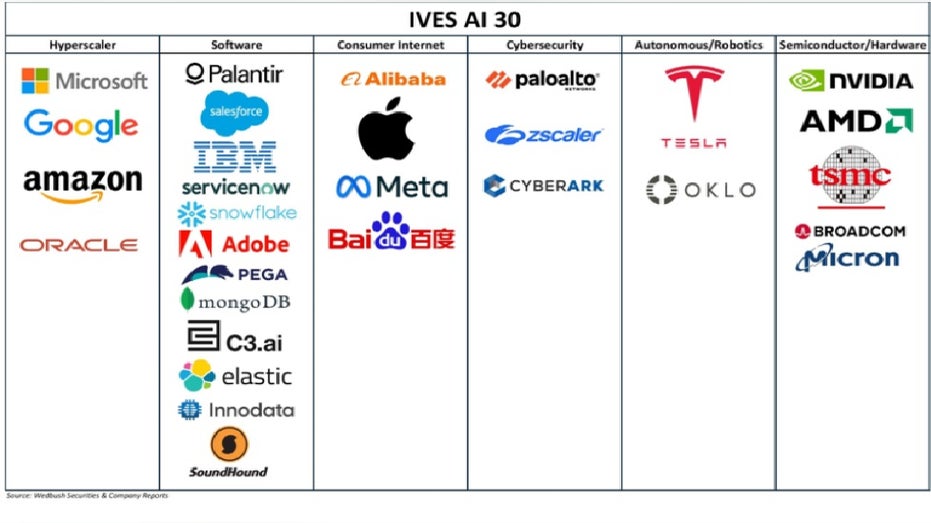

The IVES AI Revolution ETF is designed to reflect the proprietary research conducted by Ives, who serves as managing director and global head of technology research at Wedbush Securities. He emphasized the unprecedented significance of AI within the tech landscape during his 25-year career. “In 25 years covering tech, I’ve never seen a bigger theme than the AI revolution,” Ives told Finance Newso Business. “We’ve compiled 30 tech companies that encapsulate this fourth industrial revolution across semi-software, infrastructure, and autonomous sectors. That’s what gives rise to the AI Revolution ETF.”

Leading corporations like Microsoft, Palantir, Meta, Tesla, Palo Alto Networks, and Nvidia represent only a fraction of those involved in the expansive financial investments spurred by the introduction of ChatGPT in 2022, prominently driven by Nvidia’s dominance in AI chip manufacturing.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 462.97 | +1.00 | +0.22% |

| PLTR | PALANTIR TECHNOLOGIES INC. | 133.17 | +1.13 | +0.86% |

| META | META PLATFORMS INC. | 666.85 | -4.05 | -0.60% |

| TSLA | TESLA INC. | 344.27 | +1.58 | +0.46% |

| PANW | PALO ALTO NETWORKS INC. | 197.12 | +2.26 | +1.16% |

| NVDA | NVIDIA CORP. | 141.22 | +3.84 | +2.80% |

Despite the challenges posed by trade disputes between the United States and China and various tariff concerns, Ives remains steadfast in his outlook. “Tariffs are a backdrop that generates some uncertainty, but that doesn’t alter our perspective that we are witnessing a fourth industrial revolution,” he noted. “Over the next three years, $2 trillion is set to be invested. We believe we’re still at the very beginning of this AI journey, akin to the first inning of a long game. The secondary beneficiaries of technology are just beginning to embrace AI.”

The ETF will trade under the ticker symbol IVES, positioning itself against established players such as iShares, Fidelity, and First Trust, which also offer AI-focused funds, according to VettaFi. Despite this competition, Wedbush is confident that their unique approach—combining “active insight with passive structure”—will set them apart.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| IYW | ISHARES TRUST REG. SHS OF DJ US TECH.SEC.IDX | 161.70 | +2.05 | +1.28% |

| FTEC | FIDELITY COVINGTON TRUST MSCI INFORMATION TECHNOLOGY | 184.88 | +2.94 | +1.62% |

| FDN | FIRST TRUST EXCHANGE TRADED FUND DOW JONES INTERNET INDEX FD | 254.29 | +1.08 | +0.43% |

“When comparing our ETF to others, which often use arbitrary qualifiers or metrics based on external assessments of AI involvement in earnings reports, our method is different. We are deriving insights directly from our expertise,” stated Cullen Rogers, chief investment officer of Wedbush Fund Advisers. “Many existing funds are merely following the trends; we aim to define them through Dan’s insights.”

GET Finance Newso BUSINESS ON THE GO BY CLICKING HERE

This initiative marks the firm’s inaugural foray into the ETF market.