The recent legislative package passed by House Republicans highlights a significant divide between high-income earners and lower-income households.

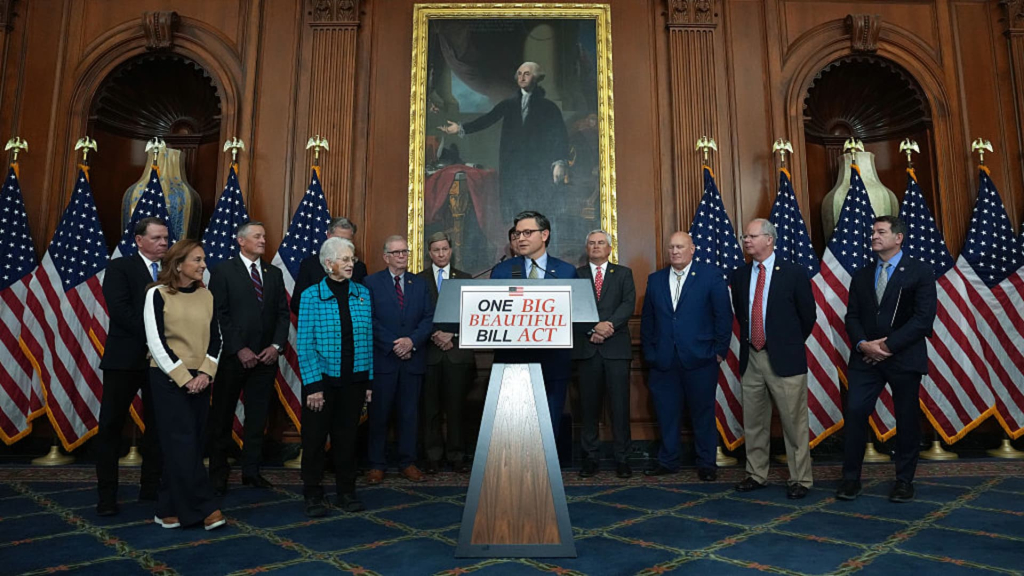

The “One Big Beautiful Bill Act,” as the comprehensive financial plan is called, primarily benefits the wealthiest Americans through a series of tax reductions aimed at business owners, investors, and homeowners, particularly those in high-tax regions, analysts have noted.

The proposed tax and spending bill is now headed to the Senate, where it is likely to undergo further scrutiny and potential revisions.

‘It skews pretty heavily toward the wealthy’

The nonpartisan Congressional Budget Office (CBO) has projected that households in the lowest income decile could see their earnings decline by 2% in 2027 and by 4% by 2033 as a direct result of the proposed changes.

In stark contrast, the top 10% of earners are anticipated to experience an income increase, with a 4% rise by 2027 and a 2% rise by 2033, the CBO reports.

A preliminary analysis from the Yale Budget Lab echoed these findings, highlighting a similar trend.

Households in the bottom 20% of income, earning less than $14,000 per year, are projected to see an average decrease of approximately $800 in annual income by 2027. By contrast, the top 20% of earners, who make over $128,000 a year, are expected to see an average income increase of $9,700, with the top 1% gaining an average of $63,000.

Both the CBO and Yale’s analyses do not account for late modifications made to the House bill, including stricter work requirements for Medicaid eligibility.

“It skews pretty heavily toward the wealthy,” remarked Ernie Tedeschi, director of economics at the Yale Budget Lab and former chief economist at the White House Council of Economic Advisers under the Biden administration.

Economists also argued that the legislation exacerbates the already regressive nature of tariffs instituted during the Trump administration.

“If you factor in the hikes in tariffs from the previous administration, the effects would be even more detrimental to lower- and working-class families,” Tedeschi added.

Most bill tax cuts go to top-earning households

Experts identify multiple factors contributing to the House bill’s tilt toward the wealthy.

This includes substantial tax benefits associated with business income, state and local taxation, and estate taxes, which predominantly favor higher-income earners. For instance, the bottom 80% of earners are expected to receive no benefits from the House’s proposal to raise the SALT cap from $10,000 to $40,000, according to the Tax Foundation.

More from Personal Finance:

Tax bill includes $1,000 baby bonus in ‘Trump Accounts’

House bill boosts maximum child tax credit to $2,500

Food stamps face ‘biggest cut in the program’s history’

The bill also retains a lower maximum tax rate of 37%, originally established by the Tax Cuts and Jobs Act of 2017, which was due to expire at the year’s end.

Additionally, it maintains a tax advantage for investors seeking to defer taxes on capital gains by investing in “opportunity zones,” a provision from Trump’s 2017 tax legislation designed to motivate investment in low-income areas designated by state governors. Wealthy individuals largely benefit from such tax incentives, as capital gains are “highly concentrated” among affluent taxpayers, according to research from the Tax Policy Center.

Ultimately, 60% of the tax cuts resulting from the bill would accrue to the top 20% of households, with over a third benefitting those with incomes of $460,000 or more, the Tax Policy Center reported.

The variation among income groups is notably stark, according to their analysis.

Why many low earners are worse off

Nonetheless, the Tax Policy Center’s analysis indicates that more than 80% of households would receive a tax cut in 2026 should the bill pass.

Low-income individuals will benefit from an increased standard deduction, enhanced child tax credits, as well as tax deductions related to tips and auto loan interest, experts have pointed out.

However, the actual value of these benefits may be misleading; for instance, approximately one-third of tipped workers do not pay federal income taxes, thus would not benefit from the proposed deduction on tips, as it is structured as a tax deduction rather than a direct credit, Tedeschi noted.

Simultaneously, low-income households, which are more reliant on federal safety net programs, would face reductions in Medicaid and SNAP funding, as well as benefits related to student loans and Affordable Care Act premiums, observed Kent Smetters, an economist and faculty director at the Penn Wharton Budget Model.

For instance, the House bill introduces work requirements for Medicaid and SNAP beneficiaries. Overall federal expenditures on these programs are projected to decrease by approximately $700 billion and $267 billion, respectively, by 2034, according to CBO forecasts.

“If you are low income and do not rely on SNAP, Medicaid, or ACA premium support, you may find yourself slightly better off,” Smetters stated.

Some high earners would pay more in tax

It may be unsurprising that the majority of tax advantages benefit wealthier households, given the structure of the U.S. tax system.

The top 10% of households are responsible for approximately 70% of federal tax contributions, and these households are expected to receive about 65% of the total benefits from the new legislation, per a recent analysis from Penn Wharton.

A portion of high-income earners — specifically 17% of the top 1% of households making $1.1 million or more annually — may actually encounter increased tax obligations, according to the Tax Policy Center.

This is primarily due to limitations on the extent to which certain pass-through businesses can deduct state and local taxes, along with a cap on all deductions applicable to households in the highest tax brackets, as explained by Howard Gleckman, a senior fellow at the Tax Policy Center.