Chemotherapy has historically played a vital role in cancer treatment, significantly improving survival rates for millions of patients.

However, the pharmaceutical sector is now highlighting the potential of a novel class of targeted therapies that could ultimately substitute traditional chemotherapy, which can come with severe side effects. Antibody-drug conjugates (ADCs) have made significant advancements in recent times, with pharmaceutical giants like AstraZeneca, Daiichi Sankyo, Pfizer, and Merck investing heavily in this area, signaling both a shift in treatment paradigms and a potential lucrative opportunity.

Many drugmakers have committed billions to the development of ADCs, designed to administer concentrated chemotherapy directly to cancer cells while protecting healthy cells. This stands in contrast to conventional chemotherapy, which indiscriminately targets both malignant and healthy cells.

Despite the promise of ADCs, experts caution that broad replacement of chemotherapy may still be years away. Some oncologists believe that further refinement of these therapies is necessary. “While we’ve seen some successes, the initial expectations that ADCs would eliminate the need for chemotherapy are largely unmet at this point,” remarked Dr. John Heymach, chair of thoracic and head and neck medical oncology at MD Anderson Cancer Center, in an interview with Finance Newso. “There’s clearly room for improvement,” he emphasized.

Nevertheless, certain companies are optimistic about the potential for ADCs to substitute chemotherapy in targeted applications. Other manufacturers are working on ADCs that could be administered prior to chemotherapy, while learning from past experiences. “We are pioneering a precision-focused approach that positions ADCs to replace traditional chemotherapy,” stated David Fredrickson, executive vice president of AstraZeneca‘s oncology division.

He referenced promising data presented at the 2025 American Society of Clinical Oncology annual meeting in Chicago, where numerous firms showcased encouraging results related to both existing and experimental ADCs, potentially paving the way for new benchmarks in cancer treatment.

Since the introduction of the first ADC in 2000, the field has witnessed substantial growth. Currently, over a dozen ADCs have gained approval in the United States, with some emerging as preferred treatment options for specific types of cancer. Hundreds more are under development as major pharmaceutical firms engage in large transactions, exemplified by Pfizer‘s $43 billion acquisition of Seagen in 2023.

The excitement around ADCs is well-founded, as projections anticipate these targeted therapies could capture $31 billion of the anticipated $375 billion global cancer market by 2028, as per the drug market research firm Evaluate.

However, significant challenges remain. Some ADCs have been found to inadvertently release their cytotoxic payload into the bloodstream too early, impacting healthy cells and leading to unwanted side effects. Health experts have advised that manufacturers must also focus on identifying appropriate cancer-associated proteins to effectively target and develop new payloads.

To address these issues, the pharmaceutical industry is advancing next-generation ADCs and combination treatment strategies. Some newer ADC therapies, including a fresh offering from AbbVie, are designed to target novel proteins and utilize advanced linker technologies that better manage the timing and location of the toxic payload release.

“The path has not been easy. We’ve yet to optimize everything perfectly. Still, the field is rapidly evolving and showing improvements annually,” explained Dr. Jeffrey Infante, global head of early clinical development, translational research, and oncology at Johnson & Johnson, which is currently advancing several experimental ADCs.

Significant Advances in ADCs

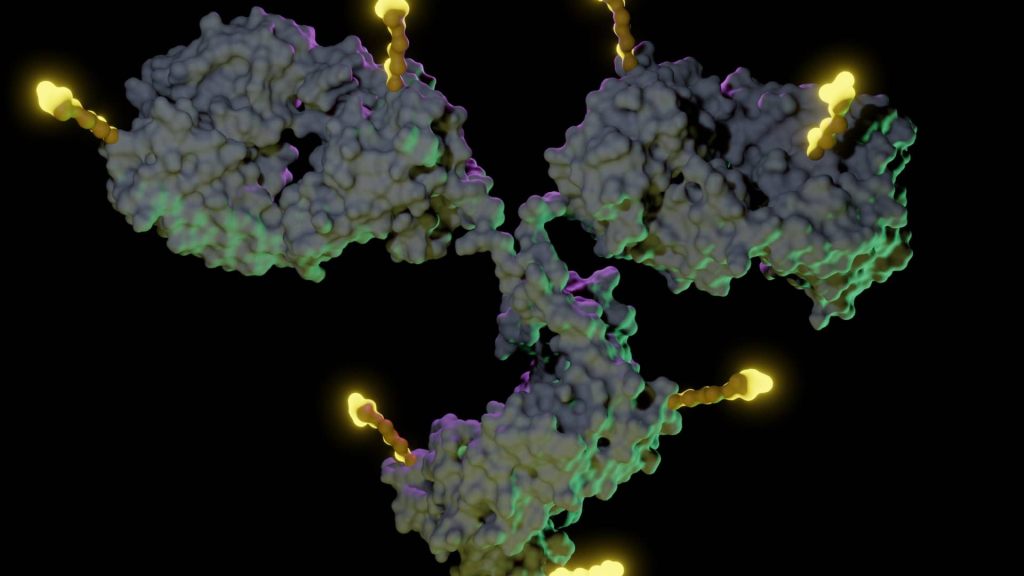

Most ADCs are composed of three key elements: an antibody that targets a specific protein abundant on cancer cells’ surfaces, a chemotherapy payload, and a linker that connects the two components. The antibody directs the ADC toward the cancer cell, where the linker releases the chemotherapy agent to eradicate the cancer from within.

Innovations with newer ADCs, particularly Enhertu created by AstraZeneca and Daiichi Sankyo, incorporate enhancements to this design and are nearing standards for treatment in various cancers.

Enhertu allows for a higher dose of chemotherapy compared to earlier ADCs and employs a sophisticated linker engineered to release the drug solely within tumor environments. The therapy also exhibits the ability to eliminate adjacent cancer cells with lower HER-2 levels, marking a pivotal advance in oncology.

Currently approved in the U.S. for specific breast, lung, and gastric cancers, Enhertu is projected to generate over $3.7 billion in sales for the companies in 2024. New data shared at ASCO may further broaden the application of Enhertu and revolutionize breast cancer treatment for the first time in a decade.

In a late-stage trial, Enhertu successfully stalled the progression of a common breast cancer variety for over a year when administered as an initial treatment compared to a traditional chemotherapy regimen. The trial examined the combination of Enhertu and another agent called pertuzumab for patients diagnosed with HER-2-positive metastatic breast cancer, with AstraZeneca and Daiichi Sankyo seeking regulatory approval for this application.

“We are increasingly administering this drug earlier in treatment, and the benefits are becoming significantly more pronounced,” stated Ken Keller, CEO of Daiichi Sankyo and head of its oncology operations. “Our aim is to position it in earlier-stage contexts where the goal is to cure.”

Keller’s comments underline the promising potential of the drug, suggesting that it could replace chemotherapy. The companies are also expected to release data concerning a subset of trial patients who received Enhertu monotherapy.

MD Anderson’s Heymach indicated that the results represent a “clear and significant advancement” that should become more common, allowing ADCs to serve as the primary treatment for patients.

Other ADCs are making noteworthy progress as well.

Pfizer’s Adcetris, acquired from Seagen, has been approved as a first-line treatment in combination with chemotherapy for certain lymphomas and reported sales of nearly $1.1 billion in 2024.

Padcev, a product of Pfizer and Astellas Pharma, received approval to be used alongside Merck’s Keytruda as a first-line treatment for bladder cancer, accruing $1.69 billion in revenues last year. Keytruda, a leading immune checkpoint inhibitor, is designed to enhance the immune system’s ability to recognize and attack cancer cells by blocking the PD-1 protein.

Gilead‘s Trodelvy, which generated $1.3 billion in 2024, was also highlighted at ASCO.

Trodelvy demonstrated a 35% reduction in disease progression risk when combined with Keytruda for patients suffering from an aggressive form of breast cancer in a late-stage trial. The study focused on advanced triple-negative breast cancer patients whose tumors exhibit PD-L1 expression.

“These studies highlight that substituting chemotherapy with an ADC can lead to improved efficacy and safety,” stated Dr. Dietmar Berger, Gilead’s chief medical officer.

Berger hinted at preliminary indications that this combination may extend patient survival, though the data remains nascent. Gilead is also investigating Trodelvy as a first-line treatment for another breast cancer type and non-small cell lung cancer.

Challenges in Drug Development

The ASCO results were a positive turn for Gilead following recent challenges faced by Trodelvy.

In October, Gilead withdrew Trodelvy from the U.S. bladder cancer treatment market after disappointing trial outcomes. Additionally, in January 2024, Trodelvy failed a phase three trial for non-small cell lung cancer.

Berger remarked on the complexity of ADC development, emphasizing that efficacy can vary significantly based on cancer type, leading to disparate patient outcomes. “It’s crucial to glean insights from various studies to identify specific populations that might benefit,” he noted, emphasizing that progress in developing treatments isn’t a straightforward process.

British pharmaceutical company GSK is also learning from its past failures. The company withdrew its blood cancer ADC, Blenrep, from global markets in 2022 after it failed effectiveness verification in a study.

Nevertheless, Blenrep has recently received reapproval in the U.K., with a U.S. decision anticipated on July 23.

GSK Chief Commercial Officer Luke Miels noted that the company had to “start from scratch” to revitalize Blenrep, which involved recruiting a team with deeper expertise in ADCs and reconsidering dosing strategies.

Following revisions and with successful results from two pivotal trials in previously treated blood cancer patients, Blenrep successfully demonstrated efficacy when combined with other therapies. This marks a departure from its initial singular usage.

GSK also presented data at ASCO indicating that Blenrep’s primary adverse effect—blurred vision in about one in three patients—can be managed with adjusted dosing strategies. The company anticipates that Blenrep could achieve peak annual sales of up to £3 billion ($3.97 billion) and is also researching its application as a first-line treatment to potentially increase that revenue outlook, Miels stated.

Meanwhile, Merck and Daiichi Sankyo are encountering a new challenge regarding an ADC they are co-developing.

In May, they withdrew their U.S. application for an ADC targeting HER-3 after it failed to demonstrate improved overall survival in a late-stage lung cancer trial.

Despite meeting the primary objective regarding tumor progression delay compared to chemotherapy, the decision was made to scrap the application. This drug is one of three ADCs that Merck is partnering on with Daiichi Sankyo as they prepare for the expiration of Keytruda’s patent.

Marjorie Green, head of global clinical development in oncology at Merck, stated that the companies are reflecting on both positive and negative learnings from their trials and remain fully committed to enhancing the drug, with plans for testing in late-stage breast cancer settings.

Innovation in ADC Development

For instance, AbbVie is making strides by developing ADCs that target new cancer-causing proteins. In May, the company earned U.S. approval for the first ADC aimed at a protein called c-Met, prevalent in non-small cell lung cancer and linked to poorer survival outcomes.

AbbVie also reported encouraging trial results for next-generation products believed to potentially dominate the c-Met ADC market, according to Pedro Valencia, the company’s vice president of oncology asset strategy leadership. He attributed this achievement to years of refining the ADC platform.

Additionally, AbbVie shared data on an ADC targeting SEZ6, a protein overexpressed in neuroendocrine tumors, such as small-cell lung cancer, but absent in healthy tissues. This ADC has shown response rates exceeding two to three times those of traditional chemotherapy in affected patients.

Meanwhile, Bristol Myers Squibb is developing a bispecific ADC, as explained by Chief Medical Officer Samit Hirawat. These designs zero in on two different cancer cell proteins or protein fragments to enhance precision and efficacy.

In collaboration with Chinese firm SystImmune, Bristol Myers Squibb is advancing a drug that targets both EGFR and HER-3, common markers in multiple cancer types. Hirawat noted that this ADC carries a higher chemotherapy payload than older variations and employs a linker that seems to help mitigate a frequent side effect seen in comparable treatments known as interstitial lung disease, which causes lung scarring. A phase three trial is currently in progress within the realm of triple-negative breast cancer, alongside plans for further late-stage studies.

The company is also investigating non-chemotherapy payloads to boost efficacy and safety, including protein degraders designed to eliminate cancer-causing proteins instead of merely obstructing them.

Eli Lilly is similarly pursuing ADCs that incorporate non-chemotherapy payloads. President of Lilly Oncology Jake Van Naarden stated that these new types of payloads could provide solutions for patients who relapse from existing ADCs, effectively shrinking their “newly developing cancers” in a sustainable manner.

Dr. Jennifer Suga, co-chair of Kaiser Permanente’s National Lung Cancer Program, noted that developing alternative payloads becomes crucial as cancer cells may develop “resistances” to those employed in currently available ADCs.

Eli Lilly is also leveraging linker technology acquired from Mablink in 2023 to enhance the retention of its ADCs in the body, facilitating better access to tumors.

At ASCO, Eli Lilly revealed the initial human data on an ADC utilizing this linker technology, aimed at folate receptor alpha, a protein frequently found in ovarian cancer. AbbVie’s approved ADC, Elahere, also targets this receptor. However, Eli Lilly aims for its agent to exhibit fewer side effects, according to Van Naarden. In preliminary trials, the company reported no eye-related adverse effects typically associated with other ADCs.

“Looking ahead to a couple of years, based on our laboratory findings, we anticipate a surge in diversity and innovation derived from the knowledge accumulated in the field,” asserted David Hyman, Eli Lilly’s chief medical officer.

Johnson & Johnson is eager to differentiate itself by concentrating its ADC efforts on prostate cancer, a domain where it possesses extensive expertise. The lead ADC the company acquired from Ambrx targets PSMA, a protein frequently found in prostate tumors. As of now, there are no other ADCs targeting this protein. Infante stated that the ADC features a “very stable” linker platform that can be paired with an existing diagnostic tool, facilitating the identification of suitable patients.

Advancements Through Combinations

While chemotherapy is unlikely to be entirely phased out, it may continue to provide significant advantages as a later treatment option in specific instances, according to MD Anderson’s Heymach. However, he and industry leaders foresee an increasing adoption of ADCs for the initial treatment of solid tumors—those that manifest as masses in organs like the lungs, breasts, or ovaries—over the next decade.

Heymach also underscored the potential of “more effective combinations” of ADCs and other therapeutic agents will likely help secure a wider acceptance of ADCs in treating a broader array of cancers.

Pfizer considers immune checkpoint inhibitors, such as Keytruda, to be particularly promising complements for their ADCs, stated Chief Scientific Officer Chris Boshoff.

Pfizer’s ADCs, developed using the vedotin platform, aim to do more than just eliminate tumor cells; they also induce immunogenic cell death—a mechanism that alerts the immune system to recognize and eradicate similar cancer cells.

This process facilitates checkpoint inhibitors in executing their role more effectively, releasing the “brakes” on the immune system and enabling a robust attack against cancer. The combination creates a synergistic effect: ADCs destroy cancer cells while signaling the immune system, while the checkpoint inhibitors amplify this immune response.

“When we merge these treatments, we observe enhanced response rates, prolonged progression-free survival, and in studies conducted thus far, an uptick in overall survival,” Boshoff stated, elaborating on measures of treatment success.

At ASCO, Pfizer shared preliminary yet promising data on two vedotin-based ADCs combined with Keytruda, including one targeting integrin B6, a protein typically found in lung cancers, and another aimed at PD-L1. Boshoff indicated that these findings support the initiation of late-stage trials this year for these combinations in certain cancer types.

In a similar vein, Pfizer is exploring a combination ADC strategy with a drug acquired through a licensing agreement with the Chinese company 3SBio. This bispecific antibody drug targets both PD-L1 and VEGF.

BioNTech is adopting a comparable combination strategy with its bispecific antibody drug that, like Pfizer’s, targets both proteins. Bristol Myers Squibb disclosed in June that it would invest $1.5 billion in upfront payments to co-develop this innovative product.

In April, BioNTech released its inaugural early data supporting this combination strategy, although it will have to validate each of its four ADCs through independent trials, cautioned Chief Commercial Officer Annemarie Hanekamp. The company is hopeful that ADCs will eventually replace conventional chemotherapy while also expecting the bispecific antibody drug to outperform existing immunotherapies that target only PD-1, such as Keytruda and Bristol Myers Squibb’s Opdivo.

“This will enable us to merge these two approaches effectively, which is truly exhilarating,” Hanekamp remarked, noting the ongoing combination trials set to evaluate this innovative approach.

Meanwhile, at Johnson & Johnson, Infante mentioned plans for the first trial evaluating an ADC in conjunction with one of its T-cell engagers, a type of immunotherapy that directs immune cells toward cancer cells. Preparations for enrolling patients in this combination study are already underway.