Engaging in market investments is a journey that benefits from an early start. The earlier you dive in, the more fruitful your financial future can be.

Reflecting on the past century, it appears to be a straightforward choice. Since the late 1970s, the trajectory of the S&P 500, despite occasional downturns, has been largely upward. Investors aged between 18 and 81 today are fortunate to experience this trend.

Modern investors are carving out new paths:

A new investment mentality

A fresh sense of assurance

LABOR SECRETARY SAYS TRUMP’S ‘GOLDEN AGE’ STARTING TO BENEFIT YOU

In light of recent market fluctuations, rather than being paralyzed by emotional reactions, now is an opportune moment to delve into investments during this bear market.

There is a pressing need to be proactive and seize available opportunities. This is more than a simple strategy of buying at dips; long-term investors should actively build their positions at this time, and everyone is encouraged to adopt a long-term outlook.

It is wise to allocate a segment of your portfolio to trading while holding core positions that could have a substantial impact on your finances. Fortunately, numerous investment opportunities, both new and established, are available at attractive prices.

The goal is not just to weather the periodic fluctuations and bear markets but to thrive through them.

This is more than buying the dip. Long-term investors should be building positions right now and everyone should be a long-term investor.

A time-honored adage emphasizes that success stems more from time spent in the market rather than trying to navigate its timing. This holds particularly true for passive investors, but significant rewards await those who are genuinely ready to seize the opportunities presented.

The stock market now constitutes 170% of disposable income for American households, with the top 10% owning a staggering 87% of all stocks. Ironically, this elite group is likely hoping that current market turbulence dissuades you from holding onto your portfolio, paving the way for them to manage your investments while you prioritize corporate interests over those of everyday Americans.

Ordinary citizens have come to recognize that the stock market is a path to wealth. The American lifestyle has increasingly revolved around the financialization of the economy, shifting the focus from investing in people to enabling money to generate more money.

Since 1854, the United States has weathered 35 recessions, each time emerging to spur a boom that propelled the nation beyond its British counterparts. The Second Industrial Revolution catalyzed urban development and increased disposable income, marking the dawn of what became known as the American Century.

In recent years, what is particularly noteworthy is:

CLICK HERE TO READ MORE ON Finance Newso BUSINESS

Fewer and shorter recessions have marked the economic landscape. The system has become adept at rapid recovery, and with each economic rebound, the stock market tends to follow suit.

The current market climate necessitates a dual approach when facing downturns; consider the following options:

- Stay invested while maintaining a passive investment strategy.

- Remain in the market and capitalize on declining prices by buying the dip.

Your intelligence is apparent, but it is crucial to distinguish between theoretical knowledge and practical experience. I find humor in online portrayals of older individuals enjoying life to the fullest, having acquired their lavish properties for a mere fraction of today’s costs.

Despite the prevailing sentiment, baby boomers are still acquiring homes at a higher rate than millennials and Gen Z, who often feel they have little hope of achieving the American Dream. I empathize with the frustrations of today’s young adults.

If given the opportunity, many would wish to travel back in time and purchase property at more favorable prices. H.G. Wells’s “The Time Machine,” published in 1895, illustrates the profound ability to traverse time—an idea reflected in various film adaptations, including a notable version from the 1960s.

Imagine if such a journey were possible in reality, enabling you to accumulate wealth alongside boomers. In a similar vein, you can use strategic investment in the stock market as a means to build lasting wealth.

When observing long-term market trends, the pullbacks can appear daunting, but they should be viewed as opportunities to acquire exceptional stocks at prices poised to potentially reshape your financial future.

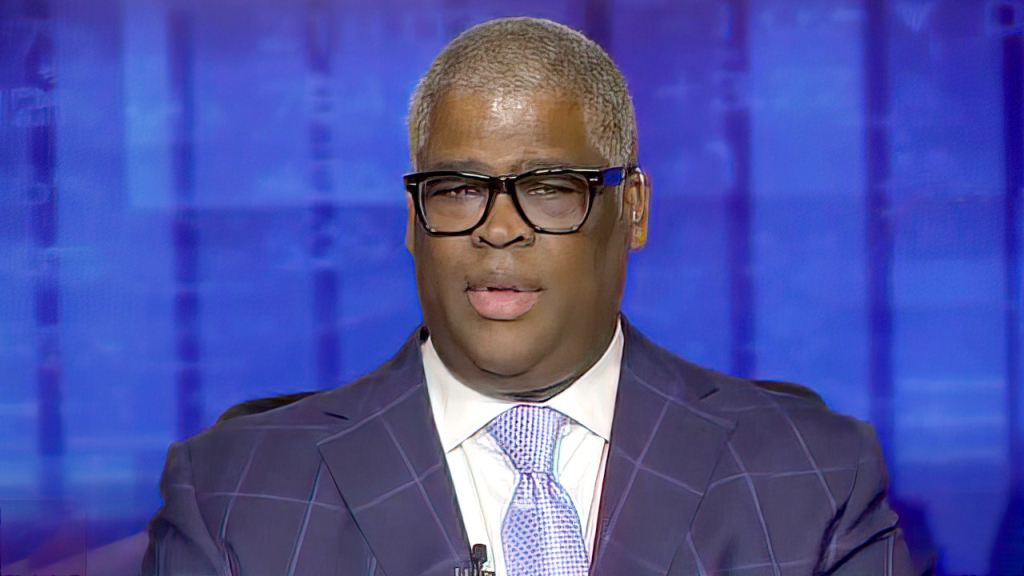

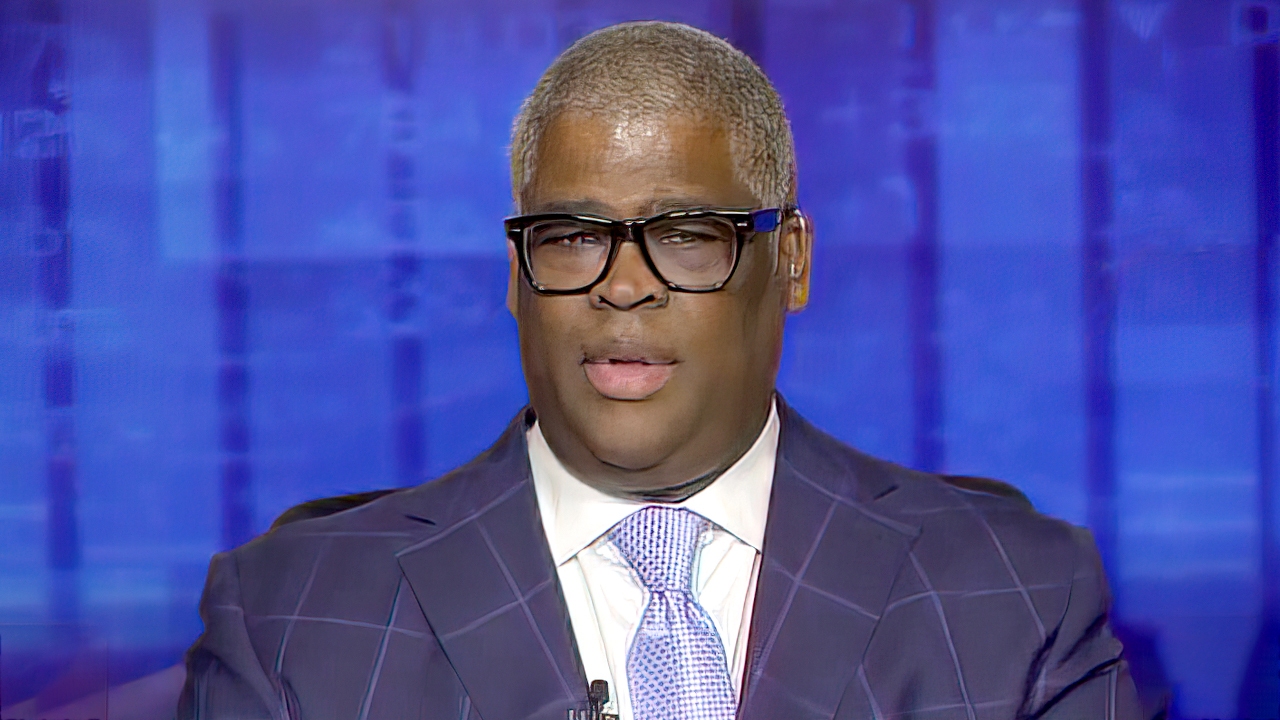

CLICK HERE FOR MORE FROM CHARLES PAYNE