Following weeks of negotiations over the details of a significant legislative package dubbed the “one big, beautiful bill,” the proposal is nearing a crucial vote in the Senate, with lawmakers eager to finalize it before the Independence Day holiday. Their objective is to deliver the measure to President Donald Trump by early July.

However, uncertainty lingers regarding the House’s acceptance of the Senate’s version of the bill, which was only completed shortly before midnight on Friday. Last-minute revisions resulted in both triumphs and setbacks for various lawmakers, businesses, and interest groups, emphasizing the intense negotiations that led to the crafting of the 940-page document.

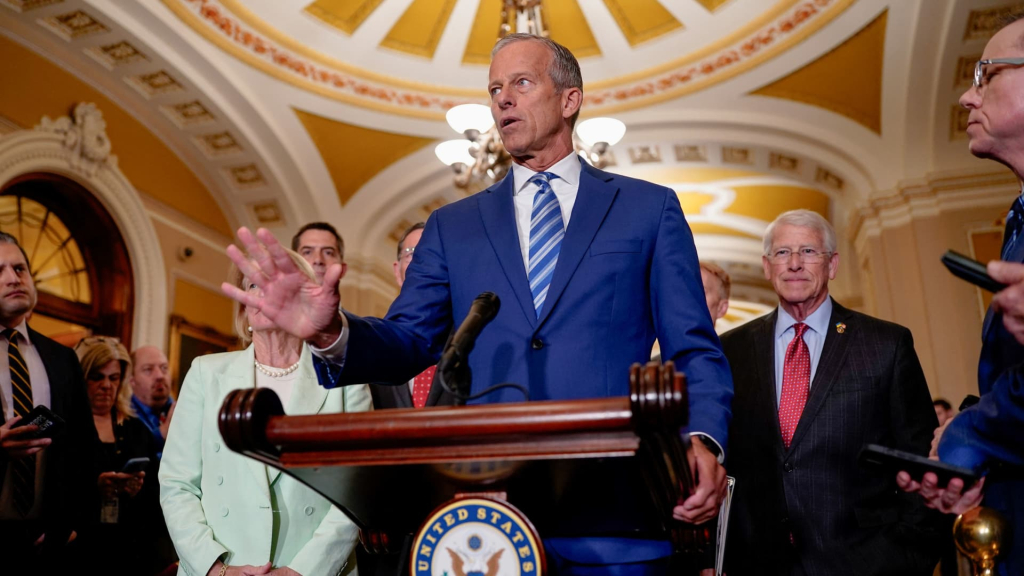

A primary concern for fiscal conservatives is the proposed $5 trillion increase in the debt ceiling, a figure that continues to provoke dissent among some Senate Republicans. This has raised doubts about Senate Majority Leader John Thune’s capability to unite his party.

Thune expressed his intention to bring the bill to a procedural vote as early as Saturday afternoon, while acknowledging potential difficulties in securing enough votes. This situation highlights the precariousness of the Republicans’ slim majority.

Key features of the Senate’s expansive bill have emerged, detailing who would benefit from the proposed changes:

Codifying Trump’s campaign agendas

Should it pass, the Senate bill would solidify several of Trump’s campaign commitments by extending his 2017 tax cuts. These extensions would include provisions for lower income-tax brackets, increased standard deductions, a larger child tax credit, and other related measures.

The bill introduces new tax relief initiatives as well, encompassing tax breaks for tipping income, overtime pay, auto loans, and additional deductions for seniors aimed at offsetting Social Security income tax burdens.

Importantly, many of the new tax benefits would be temporary, lasting only from 2025 to 2028, potentially affecting taxpayers during the 2026 filing season.

Earlier estimates indicated that a previous Senate proposal would cut household taxes by an average of approximately $2,600 in 2026, a figure slightly lower than the House version, according to the Tax Policy Center. However, the benefits from both proposals are expected to disproportionately favor higher-income families.

Removing the ‘revenge tax’

This week, Republicans and the Treasury Department agreed to eliminate the controversial “revenge tax” provision, known as Section 899, much to the relief of Wall Street investors concerned that it could diminish the U.S.’s investment allure.

This tax was designed as a punitive measure against countries perceived to have “discriminatory” tax policies against the American economy.

Treasury Secretary Scott Bessent announced plans to establish a “joint understanding among G7 nations to protect American interests,” motivating Congress to discard this provision from the tax legislation.

Legal experts from Holland & Knight remarked in a note that considerable anxiety had been voiced by Wall Street and other stakeholders regarding the implications of Section 899 on foreign investment in the U.S., highlighting its complexity, potential scope, and compliance hurdles, as reported by CNN.

Adjusting the ‘SALT’ deduction

Included in the Senate’s text is a preliminary agreement with House Republicans regarding the limit placed on the federal deduction for state and local taxes (SALT). This limit, establishing a cap of $10,000, originated from Trump’s 2017 tax reforms and has been contentious among legislators from blue states.

The current proposal suggests raising this cap to $40,000 beginning in 2025, tapering off after incomes exceed $500,000. Both amounts would incrementally increase by 1% annually through 2029, reverting to $10,000 in 2030.

In a concession for industry interests, the bill maintains a SALT cap workaround for pass-through entities, enabling owners to bypass the $10,000 cap. In contrast, the House’s version proposed eliminating this strategy for specific white-collar professionals.

Chye-Ching Huang, executive director of the Tax Law Center at NYU, criticized this provision via social media, highlighting the inconsistency in tax policy that benefits high-income taxpayers while neglecting loopholes that allow the wealthiest to evade the limit completely.

Medicaid changes

The proposed legislation faces significant debate regarding reductions to Medicaid, a critical health insurance program for low-income and disabled individuals impacting over 70 million Americans.

Although some proposed cuts were rejected by the Senate parliamentarian, others—including work requirements of 80 hours a month—were retained, raising concerns that these would jeopardize health coverage for millions, according to the Congressional Budget Office.

Negotiated provisions

In the final hours of negotiation, certain lawmakers and industry stakeholders secured advantageous provisions aimed at benefiting their constituents, reflecting the intense bargaining seen at the eleventh hour.

One notable provision would increase the deductible for whale-hunting-related costs to $50,000, an increase from $10,000, highlighting the influence of Alaska Republican Senators Lisa Murkowski and Dan Sullivan, as reported by Politico.

Conversely, the Senate bill proposes the removal of the $7,500 tax credit for electric vehicle purchases and leases, accelerating the timeline of this change compared to earlier drafts, impacting both manufacturers and consumers alike.