Key Takeaways:

Bitcoin accumulation is a crucial element of Tether’s broader asset management strategy.

Consistent purchases demonstrate a commitment to maintaining a robust long-term portfolio balance.

Increasing regulatory scrutiny prompts a review of reserve structures.

Diversifying beyond cryptocurrency enhances its overall financial strategy.

On March 31, 2025, Tether significantly augmented its Bitcoin holdings by purchasing 8,888 BTC for $735 million, reinforcing its ongoing strategy of quarterly acquisition and reserve diversification.

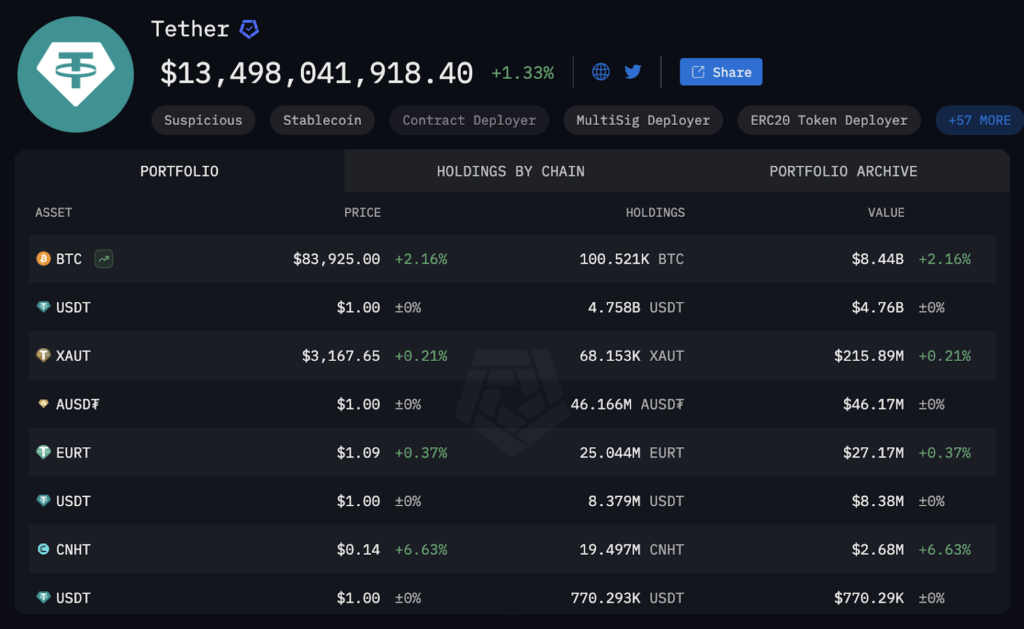

Following this transaction, Tether’s Bitcoin reserves surged to 100,521 BTC, which translates to a value of approximately $8.44 billion, positioning the firm among the largest corporate Bitcoin holders in the market.

Tether’s Bitcoin Holdings Reflect Long-Term Strategy

As reported by Arkham Intelligence, the issuer of USDT transferred the newly acquired Bitcoin from a Bitfinex address to its main wallet on April 1.

BREAKING: TETHER BUYS 8,888 BITCOIN IN MASSIVE BUY-THE-DIP MOVE. Tether just added 8,888 BTC to its reserves, doubling down on Bitcoin during the market pullback. While others panic, Tether stacks.

— The Wolf Of All Streets (@scottmelker) April 1, 2025

In addition to its Bitcoin assets, Tether’s holdings include $4.75 billion in USDT, $215.89 million in XAUT, $46.17 million in AUSDF, and $27.17 million in EURT across various wallets.

Tether Bitcoin holdings are valued at $8.44 billion. | Source: Arkham Intelligence

This strategic acquisition aligns with Tether’s established trend of accumulating Bitcoin quarterly, wrapping up its reserve consolidation at the end of each reporting period.

Beginning in September 2022, Tether made its initial moves into Bitcoin, publicly announcing in May 2023 its commitment to invest 15% of its quarterly net profits into additional BTC purchases.

This long-term diversification strategy has led Tether to continue expanding its Bitcoin position. Currently, the value of Tether’s Bitcoin holdings has produced roughly $3.86 billion in unrealized gains, showcasing a beneficial approach even amid market fluctuations.

While Tether experienced gains, the broader cryptocurrency sector encountered challenges in early 2025. Bitcoin’s value saw a nearly 12% drop in the first quarter, marking its poorest Q1 performance since 2018.

Analysts have linked this decline to macroeconomic uncertainties, including newly imposed U.S. tariffs on Mexico and Canada, as well as shifting investor sentiment.

At present, Bitcoin trades around $84,000, down 23% from its peak of $109,114, which occurred when Donald Trump resumed the presidency as the 47th U.S. President.

Tether Responds to JP Morgan’s Reserve Concerns

Tether’s recent Bitcoin acquisition has raised eyebrows as JP Morgan expressed concerns about the company’s capability to sustain adequate reserves.

In mid-February, JP Morgan analysts warned that forthcoming regulations could compel Tether to diminish its Bitcoin exposure.

Presently, the U.S. Congress is evaluating two proposed stablecoin bills: the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act in the House and the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act in the Senate.

Both proposals seek to strengthen reserve requirements, ensuring that stablecoins are fully backed by highly liquid assets, such as U.S. Treasuries.

JP Morgan estimated that 66% of Tether’s existing reserves align with the standards set by the STABLE Act, while 83% could comply with the GENIUS Act.

In response to these concerns, Tether CEO Paolo Ardoino dismissed the JP Morgan report, suggesting that traditional banks display frustration due to their lack of Bitcoin exposure.

JP Morgan analysts are salty because they don’t own Bitcoin.

— Paolo Ardoino  (@paoloardoino) February 13, 2025

(@paoloardoino) February 13, 2025

Tether’s Q4 2024 attestation revealed over $7 billion in reserves and reported $13 billion in annual profits, following the recent Bitcoin buy.

Tether Expands Investment Portfolio Beyond Bitcoin

Tether’s recent ventures into Bitcoin, alongside sports, media, and AI investments, demonstrate the company’s diverse investment strategy.

In February, Tether acquired a majority stake in Juventus FC, a prominent Serie A football club based in Turin.

Subsequently, in March, the company allocated €10 million ($10.8 million) to the Italian media firm Be Water.

Tether is also exploring the possibility of securing a controlling interest in Adecoagro, an agribusiness based in South America.

In the tech industry, Tether is actively developing AI tools, including AI Translate, a voice assistant, and a Bitcoin wallet assistant.

Following these initiatives, the company announced its investment in Zengo Wallet, a self-custodial cryptocurrency wallet recognized for its security and user-friendliness.

Tether Announces Strategic Investment in Zengo Wallet to Advance Global Stablecoin Adoption.

— Tether (@Tether_to) February 11, 2025

As Tether continues to evolve, its strategy of diversifying across various sectors indicates a sustained commitment to fortifying its financial foundation through broader exposure beyond digital assets.

Frequently Asked Questions (FAQs)

How does Tether’s Bitcoin accumulation reshape market dynamics?

A substantial Bitcoin reserve can centralize the supply of digital assets, influencing trading patterns and price trends. This consolidation could lead to noticeable shifts in market behavior and exchange liquidity.

What long-term benefits does Tether aim for with routine Bitcoin acquisitions?

Regular purchases of Bitcoin serve to blend asset growth with risk management, mitigating volatility and adapting to regulatory changes. This strategy seeks to establish a stable portfolio over time and reflects a prudent, long-range approach to asset management.

What role do Tether’s non-crypto investments play in its overall strategy?

Expanding into industries such as sports, media, and technology diversifies Tether’s revenue streams. This combination of digital and traditional assets may help reduce risks and balance the overall financial portfolio.

The post Tether Quietly Becomes One of Bitcoin’s Largest Whales With $8.44B in Holdings appeared first on Cryptonews.