The recent policy shifts by US President Donald Trump have significantly affected the crypto mining sector, including major Bitcoin miners, pushing many operations into unprofitable territory.

Trump’s introduction of global tariffs has set off a chain reaction across various industries, with crypto mining being notably impacted. The announcement of these tariffs prompted a widespread market sell-off, leading to a decline in Bitcoin’s hashprice.

Bitcoin’s hashprice, an indicator of mining profitability, has recently dropped below $40/PH/s, a threshold not seen since September 2024, according to the latest Miner Weekly report from BlocksBridge Consulting.

After some backlash, Trump reversed course, announcing a temporary 90-day suspension of the global tariffs. This move spurred a slight market recovery, but Bitcoin’s hashprice stabilized just above $42/PH/s.

Source: Miner Weekly

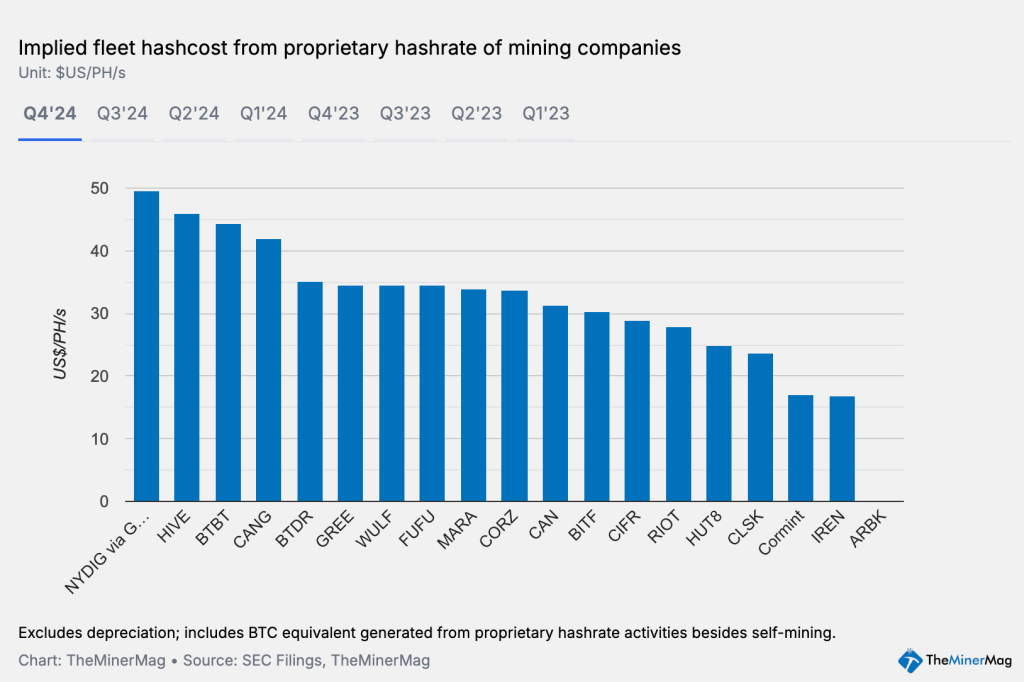

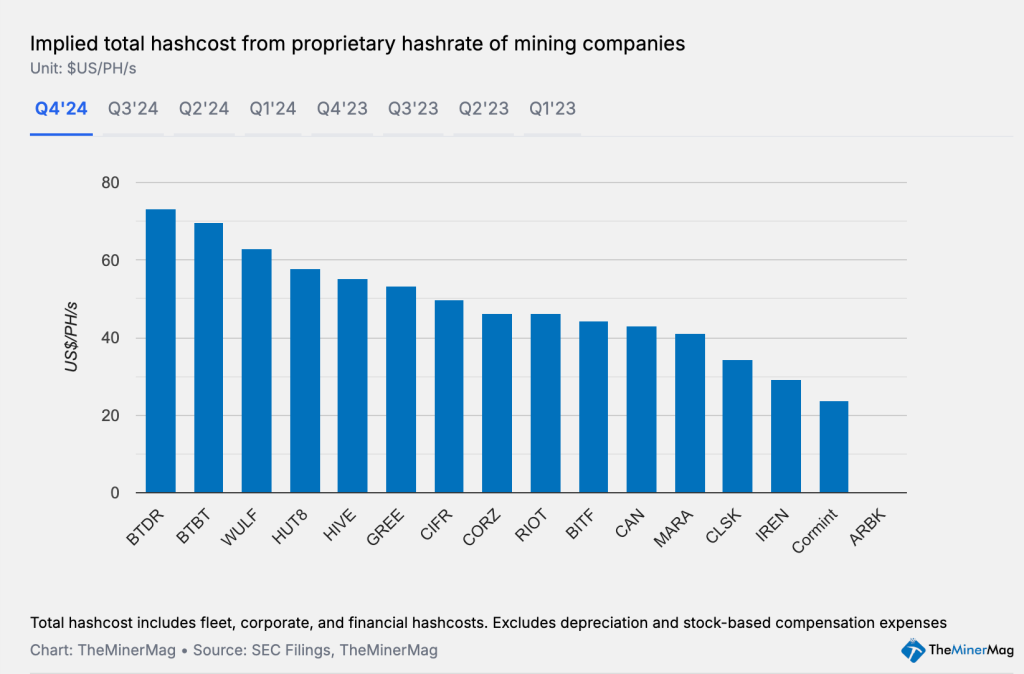

Moreover, TheMinerMag’s examination of Q4 earnings highlights that the $40/PH/s threshold is crucial for many public mining firms to maintain gross margin breakeven. This assessment considers the fleet hashcost—the direct costs associated with mining operations, excluding corporate expenses and financial liabilities, as noted in the report.

With hashprices hovering around breakeven levels, the situation is dire; additional costs beyond the fleet hashcost, including corporate overhead and interest obligations, are driving nearly all these companies into the negative regarding their mining operations.

Source: Miner Weekly

Source: Miner Weekly

Interestingly, Trump’s family is also venturing into the crypto mining industry. Recently, energy infrastructure firm Hut 8 Corp. announced the launch of American Bitcoin Corp., an industrial-scale Bitcoin mining operation in collaboration with Trump’s sons, Eric and Donald Jr.

Many Miners Facing Shutdowns

The report emphasized that conditions are particularly grim for operators utilizing S19 Pro-class machines, which represent half of the network’s hashrate, according to Coin Metrics.

These miners are already on the brink of profitability following the Bitcoin halving in April 2024. Experts predict that without a significant increase in hashprice, many will likely experience accelerated shutdowns or redeployments in the coming weeks.

#Trump says he’s pro-Bitcoin… but his #tariffs are squeezing U.S. #Bitcoin miners hard — and not in the way you’d expect. The latest issue of #MinerWeekly breaks it down. Read + subscribe FREE  https://t.co/BTlsalqzcg#bitcoinmining #Nasdaq $CLSK $MARA $RIOT

https://t.co/BTlsalqzcg#bitcoinmining #Nasdaq $CLSK $MARA $RIOT

— BlocksBridge Consulting (@BlocksBridge_) April 10, 2025

Moreover, while Bitcoin’s hashprice previously touched $40/PH/s in mid-September 2024, when BTC was valued around $64,000, current conditions find BTC trading at approximately $80,000, yet miners are facing worse circumstances than before.

The report identifies two primary factors contributing to this situation. First, the 7-day average hashrate of Bitcoin has surged significantly, which has diluted mining revenues. Second, as the hashrate rises, transaction fees have plummeted, with monthly block transaction fees hitting record lows this year.

Concerning Bitcoin’s price, it has fluctuated around the $80,000 mark over the past few days. At the time of reporting, BTC is priced at $82,586, reflecting a 2% increase within 24 hours, alongside a minor decline of less than 1% over the past week and under 2% in the past month.

Over the last year, Bitcoin’s price has risen by 18%. After reaching an all-time high of $108,786 in January 2025, it has since fallen by 24%.

The post Trump’s Global Tariffs Impact Even Large Bitcoin Miners appeared first on Cryptonews.