In a significant legislative move, Senate Republicans have passed a robust tax reform package led by President Trump, emphasizing tax cuts as its focal point.

The bill introduces an array of new tax breaks, including deductions for auto loans, tips, overtime pay, and special provisions for senior citizens. These tax benefits come in the form of deductions that lower taxable income.

Experts note that the amount saved through these deductions is contingent upon an individual’s tax bracket. High-income households typically derive greater benefits from deductions than lower-income earners. According to Carl Davis, research director at the Institute on Taxation and Economic Policy, “The most modest-income workers can’t use a tax deduction at all.”

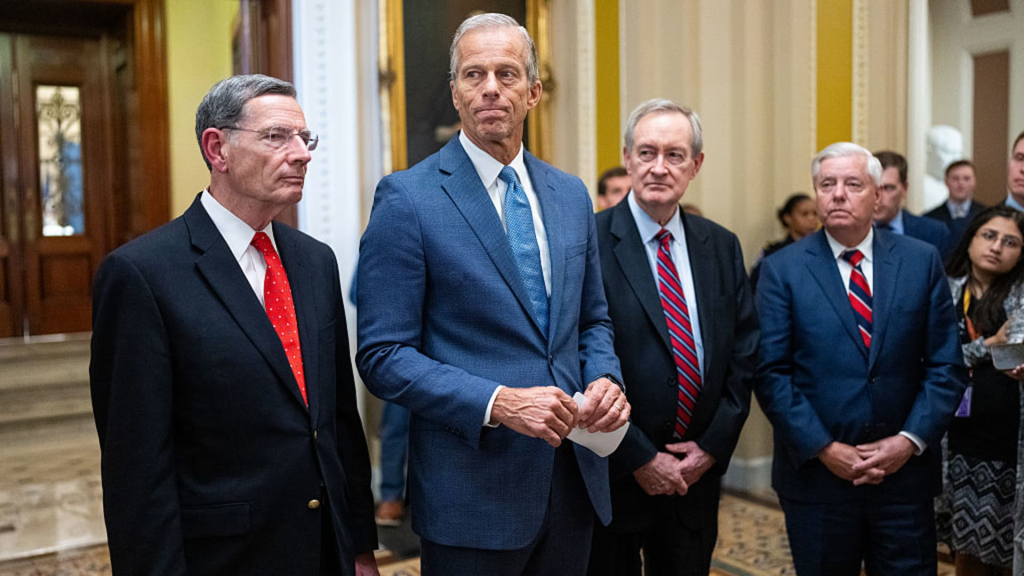

The legislation was approved by a slim margin in the Senate and is now set to move to the House, where its future remains uncertain.

Insights on the Tax Deductions within the Comprehensive Bill

The Republican-sponsored bill, initially termed the One Big Beautiful Bill Act, is projected to deliver over $4 trillion in net tax reductions, as reported by the Committee for a Responsible Federal Budget.

The proposed tax deductions include:

- Car loan interest: Up to $10,000 of annual interest on new car loans can be deducted from taxable income.

- Tips: Employees can deduct as much as $25,000 in tips annually from their taxable income.

- Overtime pay: Up to $12,500 of annual overtime income can be deducted, with married couples filing jointly able to deduct up to $25,000.

- Senior ‘bonus’ deduction: Individuals aged 65 and older may deduct up to $6,000 from their taxable income.

If the bill is enacted in its current form, these deductions would be available temporarily from 2025 through 2028, and they would have various limitations, including income ceilings.

Challenges for Lower-Income Earners Regarding Tax Deductions

Tax deductions function by decreasing the amount of income subject to taxation, which is reflected as taxable income on line 15 of the Form 1040 tax return.

While the proposed deductions appear generous, several factors may limit their effectiveness for lower-income individuals, according to tax experts.

1. The Necessity of Taxable Income

Garrett Watson, director of policy analysis at the Tax Foundation, explains that eligible households must have taxable income in order to benefit from any deductions. He adds that many low-income earners already receive significant benefits from the standard deduction.

The standard deduction for 2025 is set at approximately $15,000 for individuals and $30,000 for married couples filing jointly. The forthcoming bill increases this to $15,750 for individual filers and $31,500 for joint filers.

To gain benefits from the new deductions, a household’s taxable income must surpass these thresholds. In 2022, 37% of tipped workers had incomes so low that they were exempt from federal income tax, as highlighted in a Yale University analysis.

Thus, a substantial portion of tipped employees may not realize any advantage from the proposed tip deductions.

2. Impact of Tax Brackets on Value

The effectiveness of tax deductions is also influenced by an individual’s tax bracket. There are seven federal income tax brackets ranging from 10% to 37%. Typically, higher-income households fall within higher tax brackets, thus maximizing their benefits from taxable income reductions.

According to Davis, “If you’re in a somewhat higher bracket, every dollar you get to deduct is worth more because that dollar would have been taxed at a higher rate.” For example, a household in the 22% tax bracket that deducts $1 in tipped income would see a tax advantage of 22 cents, while a household in the 10% bracket would only gain 10 cents on the same deduction.

3. Limitations on Deductions

In addition to the aforementioned factors, various limitations may prevent households from maximizing certain deductions.

For instance, to achieve the maximum $10,000 deduction on car loans, a borrower would need to have a car loan that totals around $112,000 or more. However, only approximately 1% of new car loans reach this amount, as per data from Cox Automotive.

In contrast, average new car buyers are expected to deduct about $3,000 in interest during the first year of their loan, resulting in a tax benefit of about $500 or less.

Above-the-Line Tax Deductions

There are two aspects of the proposed tax breaks that aim to provide more equitable benefits to low- and middle-income households.

First, all deductions are classified as "above-the-line," allowing households to claim them regardless of whether they opt for the standard deduction or itemize their deductions.

Typically, high-income taxpayers are more inclined to itemize their deductions, which necessitates detailing individual eligible deductions on their tax returns.

Taxpayers choose to itemize when the sum of their individual deductions exceeds the standard deduction. Certain deductions, like those for state and local income tax (SALT) or mortgage interest, are only available to those who itemize.

Additionally, the new deductions incorporate income limits to prevent the highest-income households from benefiting. For instance, the value of the overtime deduction decreases for individuals making over $150,000 income ($300,000 for married couples filing jointly), while the senior "bonus" deduction begins to decrease once income exceeds $75,000 ($150,000 for married couples filing jointly).

The Role of Tax Credits

Tax credits present another avenue for households to reduce their tax liabilities.

Unlike deductions, tax credits lower tax bills on a dollar-for-dollar basis. For example, claiming a $1,000 credit directly reduces your tax liability by $1,000, and this value remains constant across tax brackets.

According to the Congressional Budget Office, tax credits disproportionately benefit lower- and middle-income households. They are categorized as either "refundable" or "nonrefundable":

- Refundable: This type of credit can lower a tax bill below zero, resulting in a tax refund. For instance, if someone owes $500 in taxes and qualifies for a $600 refundable credit, they would receive a $100 refund.

- Nonrefundable: This type can reduce a tax bill to zero, but not further; individuals with lower incomes may not benefit fully from nonrefundable credits.

The most significant credits, in terms of total government expenditure, include the child tax credit, the earned income tax credit, and the premium tax credit for healthcare, as noted by the CBO.

The current Senate legislation proposes to permanently increase the maximum child tax credit to $2,200 starting in 2025, indexing this figure to inflation beginning in 2026. This credit is partially refundable, enabling low earners to claim up to $1,700 as a tax refund.

However, approximately 17 million children currently miss out on the full $2,000 child tax credit because their families earn too little to qualify, according to the Center on Budget and Policy Priorities.