Shares of UnitedHealth Group plummeted over 15% during early trading on Thursday following a report by The Wall Street Journal that the U.S. Department of Justice (DOJ) is investigating the health insurance giant for suspected Medicare fraud.

This latest development compounds the challenges facing the company, which is already grappling with multiple government investigations, a sudden leadership shift, and a retraction of its earnings forecast amid escalating medical expenses.

Investors and analysts are expressing heightened concern, citing the scant details available on the investigation as a source of uncertainty.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| UNH | UNITEDHEALTH GROUP INC. | 257.08 | -50.88 | -16.52% |

UNITEDHEALTHCARE ANNOUNCES NEW CEO FOLLOWING BRIAN THOMPSON’S DEATH

James Harlow, senior vice president at Novare Capital Management, which holds shares in UnitedHealth, remarked, “The stock is already struggling, and this additional uncertainty will only exacerbate the situation.”

In its defense, the company stated that it has not received any notifications from the DOJ regarding the ongoing investigation.

The investigation comes on the heels of CEO Andrew Witty’s sudden exit and the withdrawal of the company’s 2025 forecast, which previously led to an 18% decrease in share prices and marked a four-year low on Tuesday.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, pointed out the ongoing turmoil, stating, “UnitedHealth Group finds itself in a seemingly endless crisis. Investors should prepare for further volatility with the DOJ investigation in play.”

UNITEDHEALTH GROUP SEEKS STABILITY FOLLOWING CEO EXIT

Should the premarket losses persist, UnitedHealth’s market capitalization could dip to approximately $280 billion—nearly half of the $530 billion valuation recorded on April 16, just before an unexpected earnings miss prompted a significant stock selloff.

The health insurance sector has come under increasing government scrutiny, following the recent filing of a lawsuit accusing several major U.S. insurers of providing kickbacks to brokers to manipulate patient enrollment in their plans.

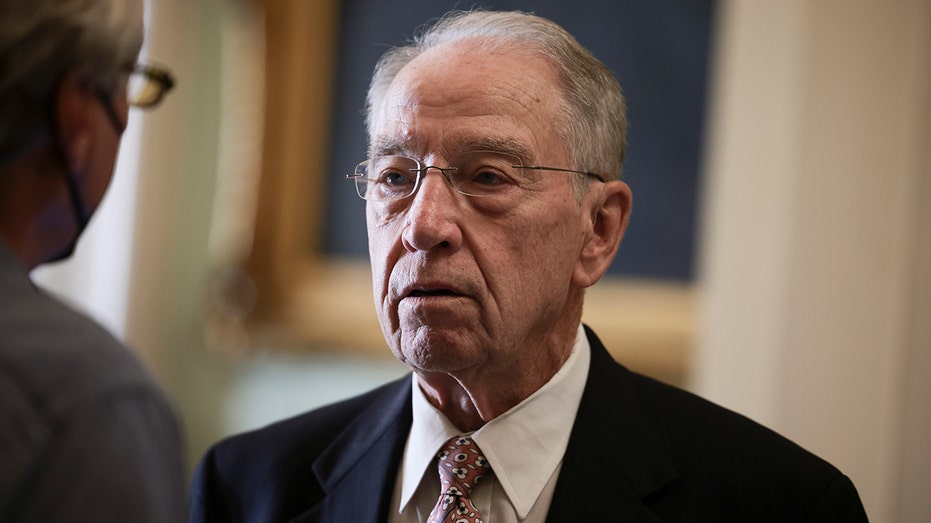

Earlier in February, The Wall Street Journal revealed an ongoing civil fraud investigation concerning UnitedHealth’s Medicare practices, prompting U.S. Senator Chuck Grassley to demand comprehensive compliance records in his inquiry into the company’s billing methodologies.

GET Finance Newso BUSINESS ON THE GO BY CLICKING HERE

Historically, UnitedHealth has thrived by capitalizing on its stronghold in the insurance market and expanding its Medicare services. However, this trajectory faced obstacles following the tragic death of a senior executive linked to public outrage over business practices.