Investors currently find themselves navigating a tumultuous landscape as the U.S. stock market experiences significant fluctuations spurred by aggressive selling activity. This volatility coincides with President Trump’s steadfast implementation of a broad tariff strategy targeting numerous trading partners.

Bear Markets & Correction Territory

The S&P 500 index momentarily dipped into bear market territory on Monday, following the Nasdaq Composite, which officially fell 20% from its recent peaks last Friday. Meanwhile, the Dow Jones Industrial Average remained just short of entering this same state by the end of Monday’s trading session.

Adding to the anxiety, the CBOE Volatility Index (VIX), which serves as a gauge of market turbulence, soared to its highest point in five years, reaching a level of 46.

Don’t Panic

While many investors are understandably concerned about the impact on their portfolios, retirement accounts, and 401(k)s, experts advise against making hasty decisions in a market downturn. Ken Fisher, founder of Fisher Investments, which manages $295 billion in assets, cautioned against selling during moments of panic during a recent interview on Varney & Co.

Panic Selling Will Cost You

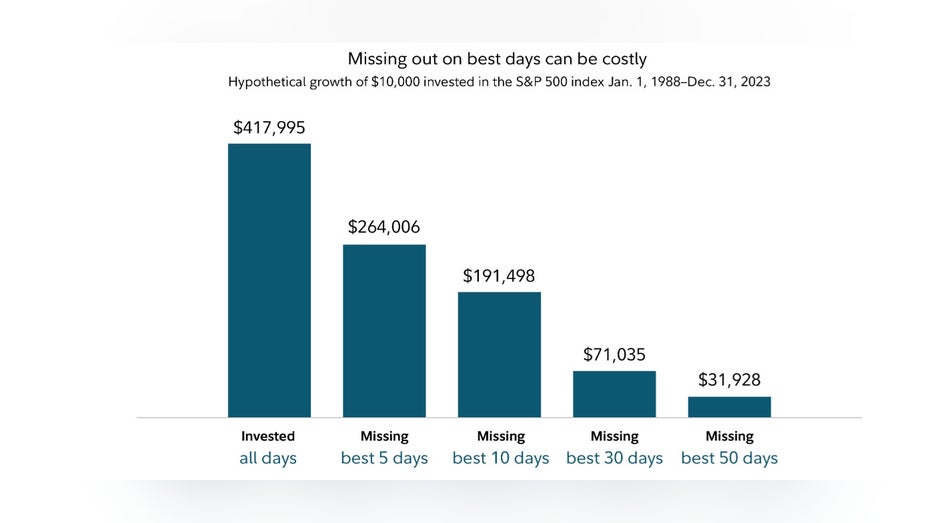

Research from Fidelity, shared with Finance Newso Business, warns that those who engage in panic selling risk losing out on potential market rebounds. For instance, an investment of $10,000 in the S&P 500 from January 1, 1988, through December 31, 2023, would result in missed gains surpassing $264,000 by not participating during just the five best trading days.

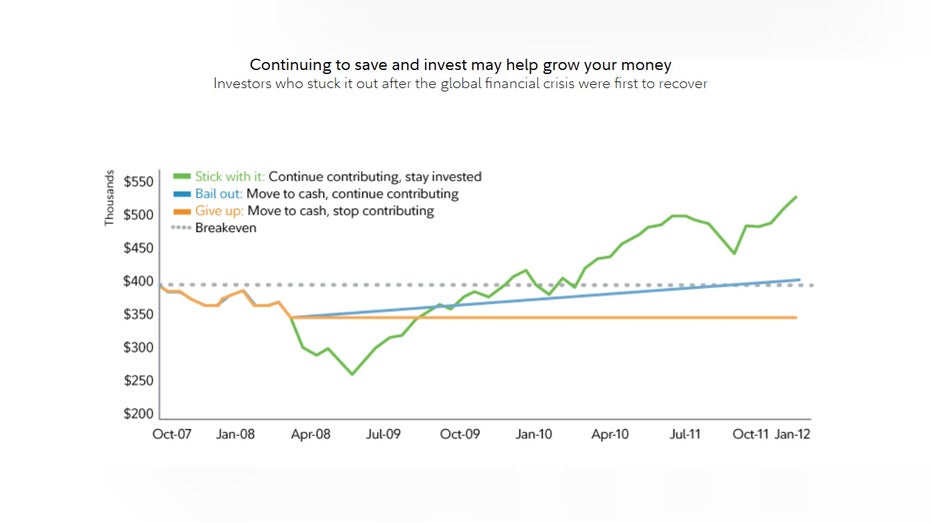

Additionally, Fidelity emphasizes that “Historically, every severe downturn has eventually given way to subsequent growth.” The firm provided insights into hypothetical choices made during the Global Financial Crisis from 2007 to 2012, based on a portfolio balanced with 70% stocks and 30% bonds, starting with an initial balance of $400,000 and receiving workplace contributions of $15,000 annually.

“It took 52 months for investments to recover to pre-crisis highs,” Fidelity noted. Investors who maintained their positions saw their account values increase by approximately $500,000, while those who shifted to cash and halted contributions experienced declines to around $350,000.

“We are witnessing target price reductions and lowered earnings forecasts across the board. However, I believe that during times of fear like these, it’s an opportune moment to buy, as the risks are likely diminished while the potential for upside is significant,” remarked Jim Paulsen, former Chief Investment Strategist at Wells Fargo.

State of Play?

Nevertheless, the effects of the tariff policy are still unfolding, leaving uncertainty regarding the timeline and outcomes. Financial institutions such as Goldman Sachs and JPMorgan have increased their projections for a possible U.S. recession, with JPMorgan CEO Jamie Dimon issuing a cautionary note on Monday.

FED CHAIR POWELL SAYS TARIFFS LIKELY TO CAUSE INFLATION TO RISE, COULD BE PERSISTENT

In his annual letter to shareholders, Powell noted, “In the short term, we are likely to encounter inflationary pressures, not just on imported goods but also on domestic prices, with rising input costs and increased demand for domestic products. The effect of these tariffs on various products will depend on their substitutability and price sensitivity. While the potential for a recession due to the tariffs remains to be seen, growth is likely to slow.”

READ MORE FROM Finance Newso BUSINESS

Last week, Federal Reserve Chairman Jerome Powell reiterated similar concerns during his remarks.