BEIJING — As China tightens its control over the global supply of essential minerals, Western nations are actively seeking to diminish their reliance on Chinese rare earth elements.

This effort includes identifying alternative sources for these minerals, investing in technology aimed at reducing dependence, and recycling materials from obsolete products.

“A modern vehicle cannot be manufactured without rare earths,” stated consulting firm AlixPartners, highlighting China’s dominance in the supply chain of these critical minerals.

In September 2024, the U.S. Department of Defense allocated $4.2 million to Rare Earth Salts, a startup focused on extracting oxides from domestically recycled products, particularly fluorescent light bulbs. Additionally, Japan’s Toyota is investing in technological advancements to decrease the use of rare earth materials.

As per the U.S. Geological Survey, China accounted for 69% of global rare earth mine production in 2024, controlling nearly half of the world’s reserves.

According to analysts at AlixPartners, a typical battery-operated electric vehicle incorporates around 550 grams (1.21 pounds) of components containing rare earths, in stark contrast to gasoline-powered cars, which utilize only 140 grams (about 5 ounces) of these materials.

Soon, the first generation of electric vehicles will require recycling, creating an opportunity for Western control of materials previously sourced from China.Christopher EcclestonePrincipal and mining strategist at Hallgarten & Company

Battery-powered and hybrid vehicles now represent over half of new car sales in China, while in the United States, gasoline vehicles remain predominant.

Christopher Ecclestone, a principal and mining strategist at Hallgarten & Company, commented on the U.S. market: “With the gradual slowdown in electric vehicle adoption and delayed mandates on transitioning from internal combustion engines to electric vehicles, the urgency to replace Chinese-sourced materials in EVs is diminishing.”

He added, “In the near future, the first generation of electric vehicles will be turned in for recycling, providing a new source of material no longer reliant on China.”

According to Cox Automotive, only 7.5% of new vehicle sales in the U.S. during the first quarter were electric, a slight increase compared to the previous year. The report also noted that about two-thirds of EVs sold were assembled domestically, although manufacturers still rely on imports for essential components.

“The ongoing trade war with China, the preeminent supplier of EV battery materials, will further distort the market dynamics,” the report emphasized.

Rare torque

In a standard single-motor electric vehicle, approximately 1.7 kilograms (3.74 pounds) of components include around 550 grams (1.2 pounds) of rare earths. Likewise, hybrid electric vehicles utilizing lithium-ion batteries consume about 510 grams of rare earths.

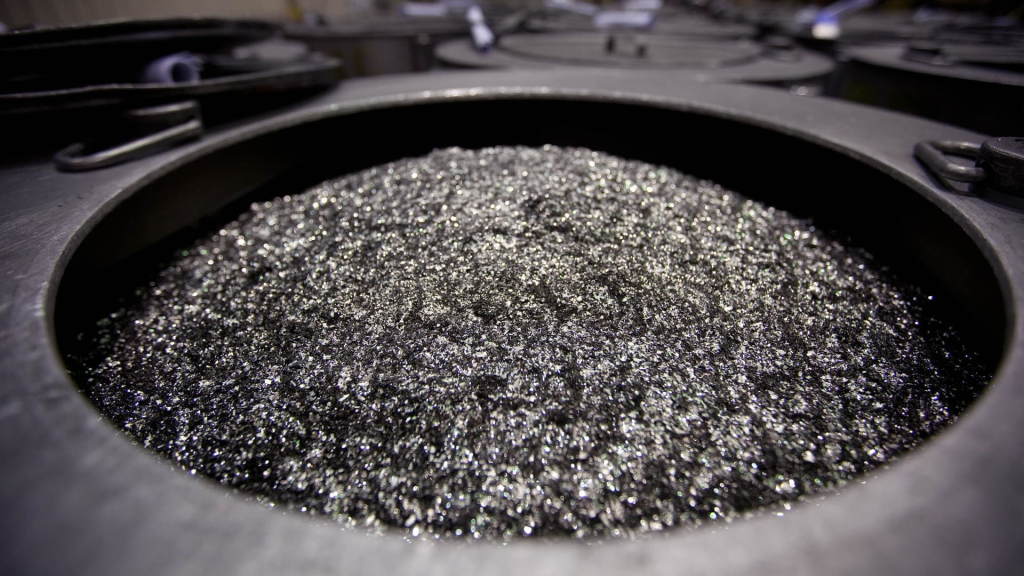

In April, China imposed export controls on seven rare earth minerals, including terbium, with an average of 9 grams used in a single-motor electric vehicle, as per AlixPartners data.

The other six minerals listed were not significantly used in automotive applications. However, additional controls also came into effect in December on cerium, which comprises roughly 50 grams used in an electric vehicle. Such restrictions require Chinese firms to obtain government clearance for overseas sales of these minerals. Following a recent U.S.-China trade truce, Caixin reported that three major Chinese rare earth magnet companies had regained export licenses to North America and Europe.

This dependency on Chinese sources raises concerns, as there are few alternatives outside China for sourcing rare earths. Establishing new mines and processing plants can take substantial time and expertise.

“Presently, China controls over 90% of the refined supply for the four rare earth elements used in creating permanent magnets for electric vehicle motors,” stated the International Energy Agency, referring to neodymium, praseodymium, dysprosium, and terbium.

For hybrid vehicles using nickel metal hydride batteries, the amount of rare earth elements can rise to 4.45 kilograms (nearly 10 pounds), primarily due to the use of 3.5 kilograms of lanthanum.

“It’s estimated that about 70% of the over 200 kilograms of minerals in an electric vehicle are sourced from China, varying by vehicle and manufacturer, making a precise estimate challenging,” noted Henry Sanderson, an associate fellow at The Royal United Services Institute for Defence and Security.

Power projection

Nonetheless, the recycling process presents limitations, remaining challenging, energy-intensive, and time-consuming. Furthermore, even with slower adoption rates in the U.S., these minerals are increasingly utilized in defense applications.

For instance, the F-35 fighter jet reportedly contains more than 900 pounds of rare earth materials, according to the Center for Strategic and International Studies based in Washington, D.C.

China’s recent restrictions also encompass a broader array of metals beyond those announced in April.

In recent years, China has tightened its grip over a wider range of metals classified as critical minerals. In the summer of 2023, the country announced restrictions on gallium and germanium, both essential in semiconductor manufacturing. Approximately a year later, new restrictions on antimony, crucial for strengthening various metals and critical in the production of bullets and nuclear weapons, were also implemented.

The State Council of China, the country’s leading executive authority, unveiled a comprehensive policy in October aimed at enhancing export controls for minerals that may have dual-use applications in military and civilian sectors.

Among the unexpected restrictions was that on tungsten, acknowledged as a critical mineral by the U.S. but not categorized as a rare earth. This exceptionally durable metal is vital for various applications, including weapons, cutting tools, semiconductors, and electric vehicle batteries.

China produced approximately 80% of the global tungsten supply in 2024, while the U.S. relied on China for 27% of its tungsten imports, according to the U.S. Geological Survey.

Typically, about 2 kilograms of tungsten are utilized in each electric vehicle battery, as highlighted by Michael Dornhofer, founder of metals consulting firm Independent Supply Business Partner. He noted that due to its long lifecycle, this tungsten cannot be reintroduced into the recycling chain for at least seven years and may not even be reusable at its low usage levels.

“Fifty percent of the world’s tungsten is consumed within China, allowing them to continue business as usual,” said Lewis Black, CEO of Almonty, a tungsten mining company, in a recent interview. He predicted that the reopening of a tungsten mine in South Korea later this year would enhance the non-Chinese supply available to meet the defense demands of the U.S., Europe, and South Korea .

However, he cautioned that for industries such as automotive, medical, and aerospace, the supply situation remains insufficient.